Alex Cheong Pui Yin

12th October 2021 - 3 min read

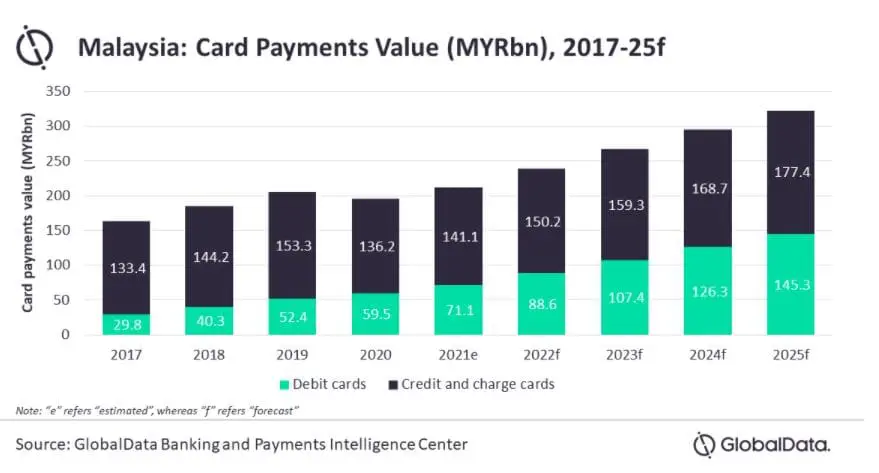

Data analytics company GlobalData said that Malaysia’s card payments market is set to rebound by 8.5% in 2021 after seeing a decline last year due to the Covid-19 pandemic.

According GlobalData’s Payment Cards Analytics report, Malaysia saw a 4.9% drop in the value of card payments back in 2020. This was attributed to the nationwide movement control order (MCO) that was implemented to combat the spread of the pandemic, which resulted in the closing of brick-and-mortar shops and reduced consumer spending.

Following the successful vaccination programme and improving economic conditions, however, card payments within the country is expected to grow again with the gradual rise in consumer spending. In fact, GlobalData estimates that the value of card payments will likely increase at a compound annual growth rate of 11.1% all the way through 2025, hitting RM322.7 billion.

“Malaysia made significant progress in the adoption of card payments in the past few years, supported by increasing banked population, rising consumer awareness of electronic payments, and increasing merchant acceptance. While the market was affected due to the Covid-19 pandemic in 2020, it is expected to rebound as consumers shift from cash to non-cash payments to avoid getting infected,” said the lead banking and payments analyst at GlobalData, Ravi Sharma.

GlobalData also noted that Malaysians had a preference for credit and charge cards due to their reward benefits, accounting for 66.5% of all card payments by value in 2021. Meanwhile, debit cards made up the remaining 33.5%.

The analytics company further shared that although there was a decline in overall card payments in 2020, debit card registered a growth of 13.6% because people were migrating from cash transactions to contactless debit card payments. Credit and charge cards, meanwhile, saw a decline of 11.2% as travel restrictions caused Malaysians to stop spending on expenses that are usually paid using these cards, including airline tickets, hotels, and restaurants.

Moving forward, GlobalData believes that the rise in contactless will be crucial in supporting card payments growth in the country. This is based on statistics provided by Bank Negara Malaysia (BNM), which indicated that contactless card transactions accounted for 50% of all card payments in 2020. This is up 33% in 2019.

“The Malaysian payments card market registered sustained growth in the last few years. Although the current Covid-19 crisis has hampered the growth trajectory, improving payment infrastructure, and rising demand for contactless and online payments will aid the payment cards market growth over the next few years,” said Sharma.

(Source: GlobalData)

Comments (0)