Pang Tun Yau

26th August 2020 - 6 min read

Over the past few weeks, banks in Malaysia have begun providing additional information on the end of the current automatic loan moratorium as well as the extended moratorium and targeted financial assistance that’s coming after.

The major banks are all treating the extended moratorium differently. Some banks offer the option of making “step up payments” to pay lower instalments and progressively pay more down the loan tenure, while others offer a moratorium extension for longer periods than what was announced by Prime Minister Tan Sri Muhyiddin Yassin.

At the same time, some banks are also including new terms and clauses into loans/financing that are restructured or rescheduled (R&R) – and here’s where you need to be alert.

Addition of interest accrued from 6-month moratorium in new loan terms

CIMB

To its credit, CIMB is one of only a handful of banks in Malaysia to offer a comprehensive FAQ available online for its borrowers to read through before deciding to apply for assistance. However, within the FAQ lies some very important conditions that borrowers must take into account before deciding to proceed with their application.

What’s particularly concerning revolves around borrowers who are on reduced salaries seeking assistance for personal loans/financing as well as auto financing (or hire purchase agreements).

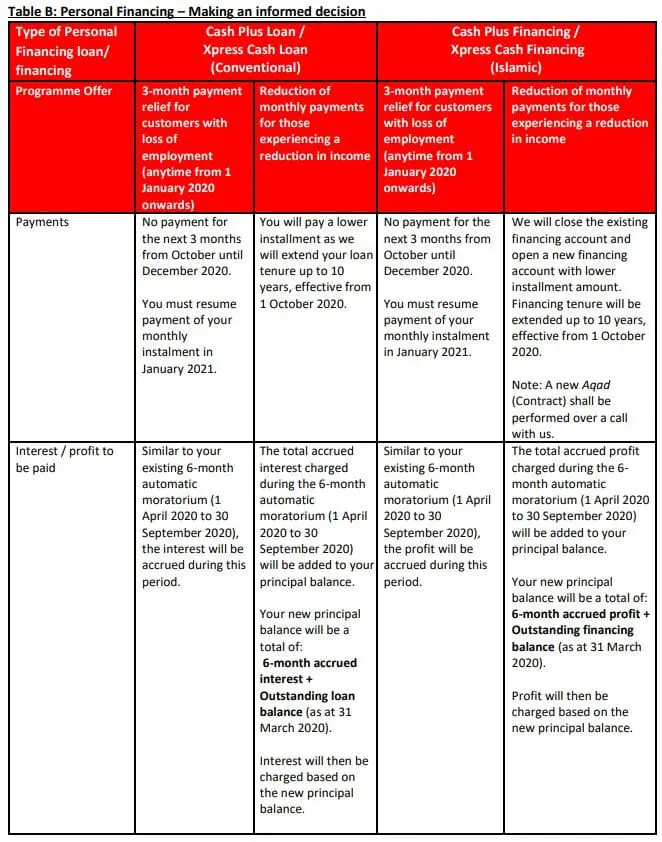

In the screenshot above, the arrangement for personal financing – both conventional (Cash Plus Loan / Xpress Cash Loan) and Islamic (Cash Plus Financing / Xpress Cash Financing) reveals that interest accrued during the 6-month automatic moratorium (1 April – 30 September) will be added into the principal balance as part of the targeted financial assistance programme. It is essentially a restructuring & rescheduling (R&R) exercise on the existing loan/financing – but the principal balance now includes the accrued interest from April till September. This means the interest accrued from 1 April till 30 September will now compound from October onwards.

Curiously, this amount is not included for borrowers who have lost their jobs – in their case, it is a three-month deferment with accrued interest during this period. There is no addition of accrued interest from the previous moratorium period.

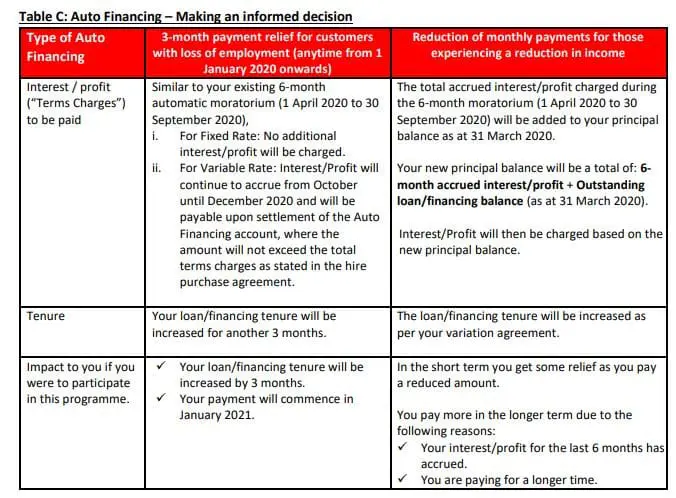

We can also see a similar pattern in auto financing or hire purchase agreements. It is explicitly stated that interest accrued during the 6-month automatic moratorium will be included into the outstanding balance if you choose to seek financial assistance. The FAQ leaves no room for misinterpretation – so this clause is indeed surprising considering that it contradicts Finance Minister Tengku Dato’ Sri Zafrul Aziz’s announcement in May that no interest will accrue for hire purchase loans during the 6-month automatic moratorium.

Hong Leong Bank

Hong Leong Bank, in its FAQ, states that interest accrued from the 6-month automatic moratorium will be added into the final instalment or full settlement amount for variable-rate hire purchase loans. However, this does not apply to its fixed-rate hire purchase loans and personal loans/financing.

Other banks

We did not find any references to additional interest accrual during the 6-month automatic moratorium (April – September 2020) for Maybank, Public Bank, and OCBC (i.e. the banks who provided comprehensive FAQs). We did notice that HSBC made an amendment to its original moratorium FAQ to allow for “capitalisation of interest” (i.e. turning interest charges into “principal balance” which can then be charged interest), while Citi also has the same clause for its borrowers taking the current moratorium. This phrase appears to be what CIMB and HLB are doing for its post-moratorium assistance.

It also means is that CIMB and HLB may not be the only banks with this unusual clause inserted into their R&R programmes as part of the post-moratorium exercise. Alliance Bank, AmBank, Bank Islam, Bank Rakyat, Maybank, RHB, Standard Chartered, and UOB are among the banks with brief FAQs and little details on their R&R programmes, so we do not know what the new terms are.

Note that during the extended moratorium from October onwards, interest will accrue for all banks on all loans, which leaves no room for confusion down the line.

Why is this happening?

For the extended moratorium and targeted financial assistance, the banks have the liberty to set their own arrangements for R&R – besides the general guideline mentioned by Prime Minister Tan Sri Muhyiddin Yassin in his announcement (3-month home loan moratorium for those who lost their jobs, and R&R for other loans for those on reduced salaries).

While it is generally understood that variable rate loans/financing (such as home loans and variable-rate car loans) will see interest accrued from April till September, some banks are using the R&R exercise on fixed-rate loans/financing (such as personal loans and hire purchase loans) as a way to include capitalisation of interest to “recoup” the interest from April – September. This is possible because R&R exercises typically involve fresh terms including revised interest rates and tenure; for R&R of Islamic products, it may even involve making a new aqad (contract).

As such, borrowers must be aware that one bank’s restructuring terms may be different from another’s. Similarly, it may also vary from borrower to borrower even within the same bank.

What should borrowers do?

The extended moratorium and targeted financial assistance is designed only to those who need it. For some borrowers, this assistance is necessary to ensure they have cash liquidity by reducing monthly commitments during this difficult period.

However, many parties across the industry have stated that the automatic loan moratorium has put a lot of stress in the industry, which in turn, also affects the banks’ ability to finance new loans. A targeted assistance with interest charges is a compromise to ensure the banks’ capability to assist borrowers.

This time around, the banks have expressly stated that borrowers consider the impact of applying for the extended moratorium or R&R as the short-term relief may result in additional costs to be paid down the line.

For borrowers, it means we should carefully check the revised loan agreement for any additional interest or charges that may be included before signing them. Similarly, if we can afford to resume our loan commitments, it is a good idea to do so.

Comments (0)