RinggitPlus

10th June 2020 - 5 min read

You’ve most probably heard of the term “credit score”. But do you know what it is exactly and just how big of a role it plays in your life?

A credit score is a number that represents the creditworthiness of an individual. Think of it as a measurement of your attractiveness to lenders – the higher your credit score, the more attractive you are to them as a potential borrower. Lenders, such as banks and other financial institutions, use credit scores to determine the probability of borrowers repaying their loans in a timely manner.

Your credit score is calculated based on an analysis of your credit history. This includes the length of your credit history, your total amount of debt, your debt repayment track record, as well as the number of new credit accounts you’ve recently opened.

How Does Your Credit Score Impact Your Life?

In a word, significantly. Whenever you want to take out a loan from the bank, or apply for a new credit card, the outcome of your application will partly depend on your credit score and credit health.

So if you’ve set your sights on buying your dream home, or if you think that it’s finally time to trade in your existing car for a new set of wheels, your credit score is an important factor in determining whether some of your life’s major goals can be fulfilled.

The Importance Of Maintaining A Good Credit Score

As mentioned, your credit score is used by banks and other lenders to partly decide if they should approve your loan. High credit scores demonstrate that you’ve been responsible with your credit behaviour, which gives potential lenders more confidence when they evaluate your loan or credit card application.

In the event that your request for credit does get approved, banks will also use your credit score to decide on your credit terms. Credit terms are the set of conditions with which a lender grants you credit – including the loan amount, credit limit, interest rate, and loan tenure. For facilities such as home loans, car loans, and personal loans, you’ll generally enjoy more favourable credit terms if you have a high credit score, which means that you’ll pay a lower interest rate throughout the tenure of the loan.

By paying less interest, you could save a significant amount of money over the course of the loan, and this is especially so for major purchases like a house or a car.

On the other hand, if you have a low credit score, even if your loan application is approved, lenders will charge you a higher interest rate to make up for the higher risk they face of you being unable to repay your loan. Therefore, you’ll end up paying more money in the long run. You may also be given a shorter loan repayment term or required to have a co-signer for any loans that you apply for.

How Can You Improve Your Credit Score?

It begins with awareness. Most of us are not aware of the current state of our credit health. However, in order to improve your credit health and raise your credit score, you’ll need to understand your credit status as well as all of the factors that affect it.

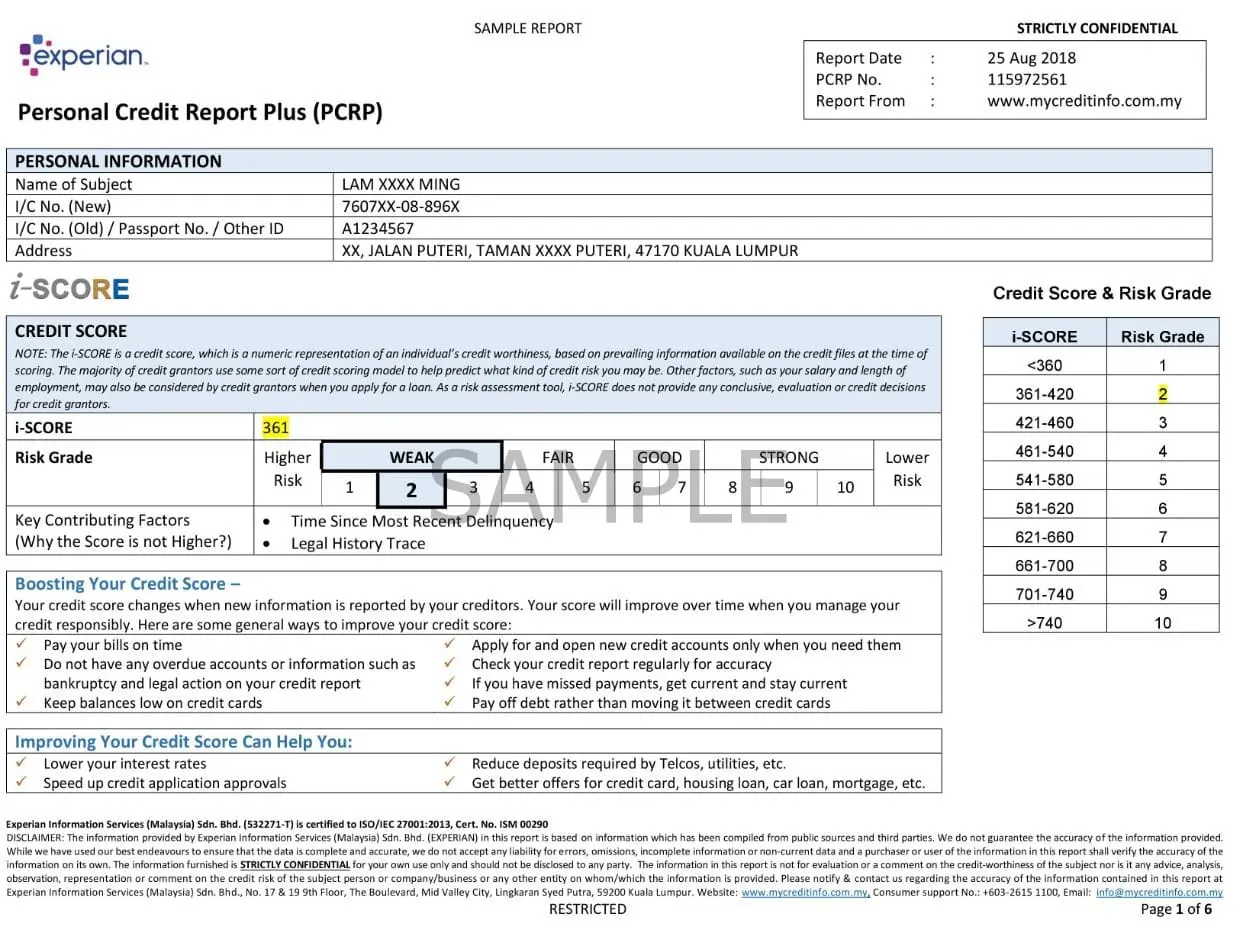

Thankfully, credit reporting agencies also provide consumers with in-depth credit reports. One such example is the Experian Personal Credit Report Plus (PCRP). Built on Experian’s extensive and leading-edge data capabilities, PCRP presents an accurate picture of your credit health at any given time and demystifies much of the ambiguity surrounding your credit status. It also offers a three-digit credit score for easy reference of your credit health – the higher the number, the better your credit health.

PCRP doesn’t just tell you your credit score either – you can find other handy information like your Skim Potongan Gaji Angkasa (SPGA) and PTPTN records, non-banking trade references as well as litigation history, among others.

More importantly, PCRP also provides detailed insight into your banking credit information. You can, for example, find out if any of your credit facilities are under special monitoring by banks or financial institutions under Special Attention Accounts.

With this powerful tool at your disposal, you’ll gain a holistic view of all aspects of your credit health, which allows you to better understand what are the key areas that you’ll need to look into as you work towards raising your credit score.

Sample Experian PCRP

For example, many are not aware that making minimum payments on your monthly credit card bills with higher card usage will not only affect your credit score, but burden you with more interest to pay. The effect is worse if you don’t repay your bank loans or credit card statements on time – this will be on record for 12 months and negatively affect your credit score, too.

The Experian PCRP will also provide you with factors that have affected your overall credit score, and some suggestions on how to improve it. A good practice is to check in on your credit health from time to time, even if you don’t have plans to buy a car or a house in the near future. This is so that when you are ready to do so, your credit score is good enough for banks to approve your application and offer favourable rates.

If you’d like to get serious about growing the numbers on your credit score, finding out more about Experian Personal Credit Report Plus is definitely one of the best ways to start.

Comments (0)