Alex Cheong Pui Yin

18th January 2024 - 3 min read

BigPay has launched a new travel insurance offering on its app called BigPay TravelEasy for individual travellers. Underwritten by Tune Protect Malaysia, it provides up to RM300,000 coverage for medical expenses, Covid-19 coverage of up to RM250,000, as well as compensation for various other travel inconveniences.

In a statement, BigPay’s parent company AirAsia said that the TravelEasy insurance will offer worldwide coverage with plans starting from RM35 for international trips, and that the offering is already live on BigPay as of today. Users can apply for it within the BigPay app itself, with the application process taking just minutes.

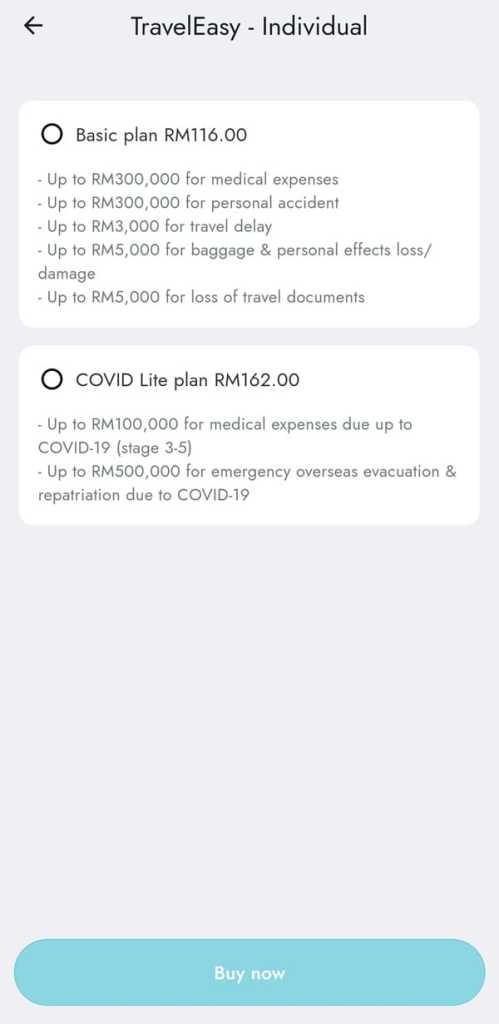

With two plans available for purchase – Basic Plan and COVID Lite Plan – you can tap into the following benefits under the TravelEasy insurance:

| Basic Plan | COVID Lite Plan |

| – Up to RM300,000 for medical expenses – Up to RM300,000 for personal accident – Up to RM3,000 for travel delay – Up to RM5,000 for baggage and personal effects loss/damage – Up to RM5,000 for loss of travel documents | – Up to RM100,000 for medical expenses due to Covid-19 (Stage 3 to 5) – up to RM500,000 for emergency overseas evacuation and repatriation due to Covid-19 |

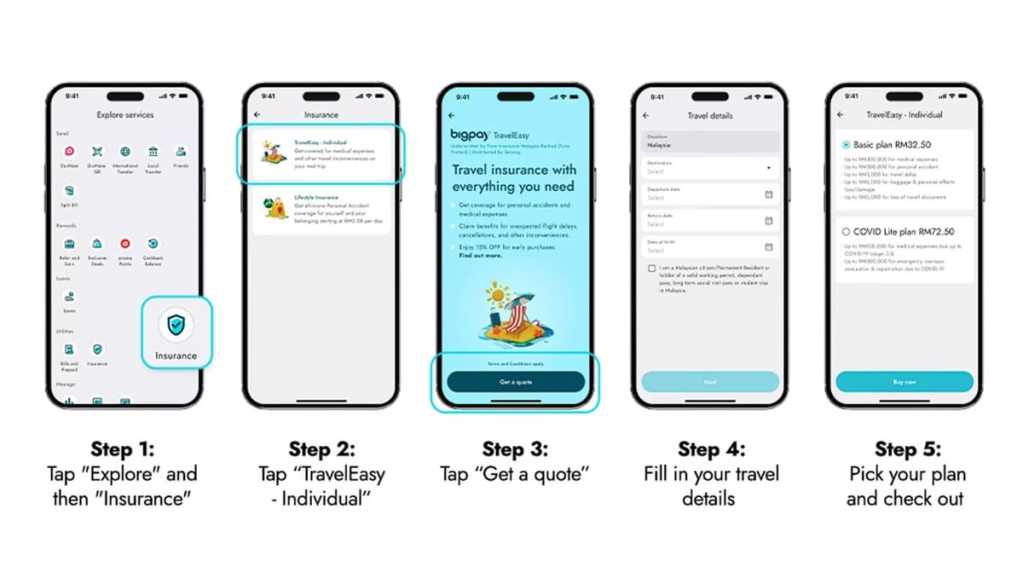

If you’re interested to check out the new feature for yourself, fire up your BigPay app and take the following steps:

- Tap on “Explore” at the bottom navigation bar.

- Tap on “Insurance” under the “Utilities” section.

- Tap on “TravelEasy – Individual”, and then “Get a quote”.

- Fill in your travel details and pick your plan.

- Make your payment, and you’re done!

For more clarification, here’s a visual guide from BigPay to help you out:

Group chief executive officer of BigPay, Zubin Rada Krishnan said that the launch of BigPay TravelEasy is aimed at making the process of getting insured easier for travellers. “We’re excited to be giving our customers the ability to conveniently, simply, and affordably insure themselves for their travels through BigPay TravelEasy, powered by Tune Protect. Buying travel insurance is often something that slips our mind – with TravelEasy, you can get it done and get protected whenever you have a few minutes to spare before you fly,” he said.

Meanwhile, the chief executive officer of Tune Protect Malaysia, Jubin Mehta shared that the collaboration with BigPay is the insurer’s attempt to deliver its services more seamlessly through its partners. “We are constantly working on widening our partner base in the lifestyle sphere to not only offer insurance propositions to our customers, but also embedding it into our partners’ offerings for their customers,” he commented.

Comments (0)