Alex Cheong Pui Yin

28th June 2021 - 3 min read

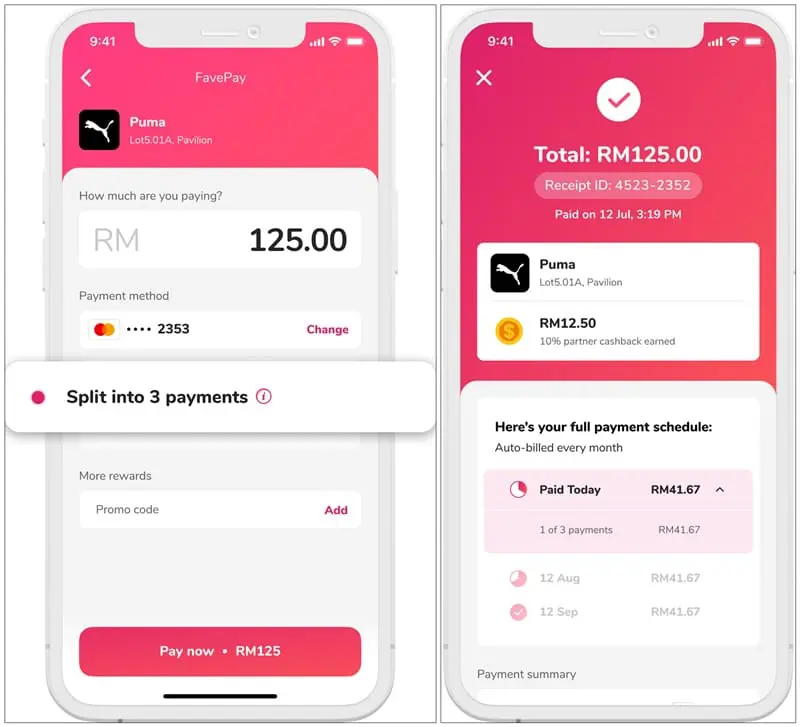

Fave has announced the launch of its new FavePay Later feature, a buy-now-pay-later (BNPL) payment option that lets users split the bill of their purchases into three instalments. Currently in its pilot phase, the feature has been rolled out to customers in Malaysia and Singapore – available on the Fave app for iPhone users starting from today, and in July 2021 for Android phone users.

With this update, Fave users will be provided with a credit balance that they can tap into for their purchases, and they can then spread out their costs across three interest-free monthly payments – provided that these are made on time. If you are late (by more than seven days), a penalty fee of 1.5% will be incurred, which is to be calculated based on the total late payable amount.

Aside from that, Fave users will also be able to earn up to 10% cashback with every offline and online purchase made via FavePay Later, to be granted upon successful payment of the first instalment. Additionally, Fave clarified that these cashback earnings can only be used to offset initial payments (the first instalment).

In a statement, Fave said that the launch of FavePay Later coincides with a time where cash-strapped consumers are seeking easier access to credit and merchants are looking for new ways to boost their sales. “As one of the leading payment apps in the region, we believe in pushing our boundaries and innovating to create better experiences. Our customers care about flexibility, convenience, and rewards. FavePay later is built with these customers in mind, and it leverages our consumers’ trust in the Fave brand,” said the chief executive officer of Fave, Joel Neoh.

Neoh also commented that it is becoming increasingly critical for merchants to work with partners that have integrated solutions, such as cashless and instalment payments as well as loyalty programmes. These partners – such as Fave – will ultimately take care of all the processing and risk for the merchants.

The new FavePay Later feature can be utilised at over 40,000 merchants – with popular brands including Pandora, Marks & Spencer, Best Denki, Puma, and GNC – and it is expected to benefit more than six million users. Fave said that it is also working on extending the feature to online commerce, and this is expected to come to fruition in the latter half of 2021.

You can find out more about Fave’s new FavePay Later feature on its FAQ page here.

Comments (0)