Alex Cheong Pui Yin

2nd March 2020 - 3 min read

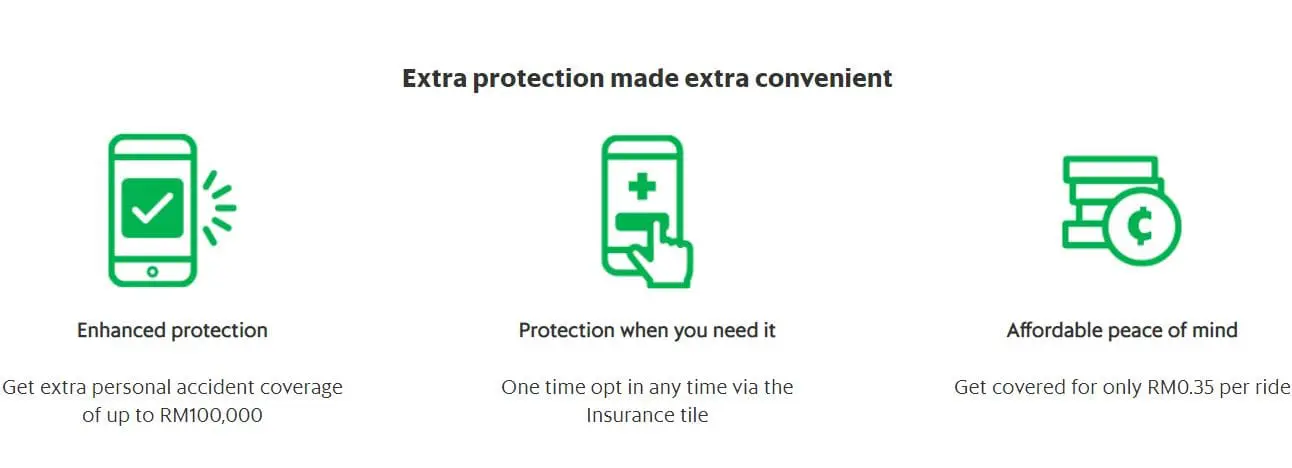

Grab Malaysia has introduced a new insurance package that GrabCar passengers can opt in for just RM0.35 per ride. Named Ride Cover, it not only provides passengers with an additional personal accident (PA) coverage during your Grab rides, but also offers compensation for late rides.

Grab Ride Cover will provide a RM100,000 personal accident (PA) coverage in the event of your death or permanent disability if you get into an accident during your Grab rides within the country. Additionally, you can get up to RM2,000 for medical expenses. The coverage also applies to any immediate family members sharing the ride.

This PA coverage is underwritten by Chubb Insurance Malaysia Berhad, and the benefits are on top of the free basic coverage already offered to all GrabCar users. The basic coverage lets you claim up to RM40,000 in the event of an accidental death or permanent disability, and up to RM2,000 for medical expenses.

In addition to the PA coverage, you will also qualify for the 100% No Delay Guarantee, which entitles you to a RM5 Grab ride voucher if your ride is delayed for more than 15 minutes after the estimated time of arrival. You will get the voucher once your journey has been completed, and it will be valid for six months. That said, you will not get the voucher if either you or the driver cancel the affected ride.

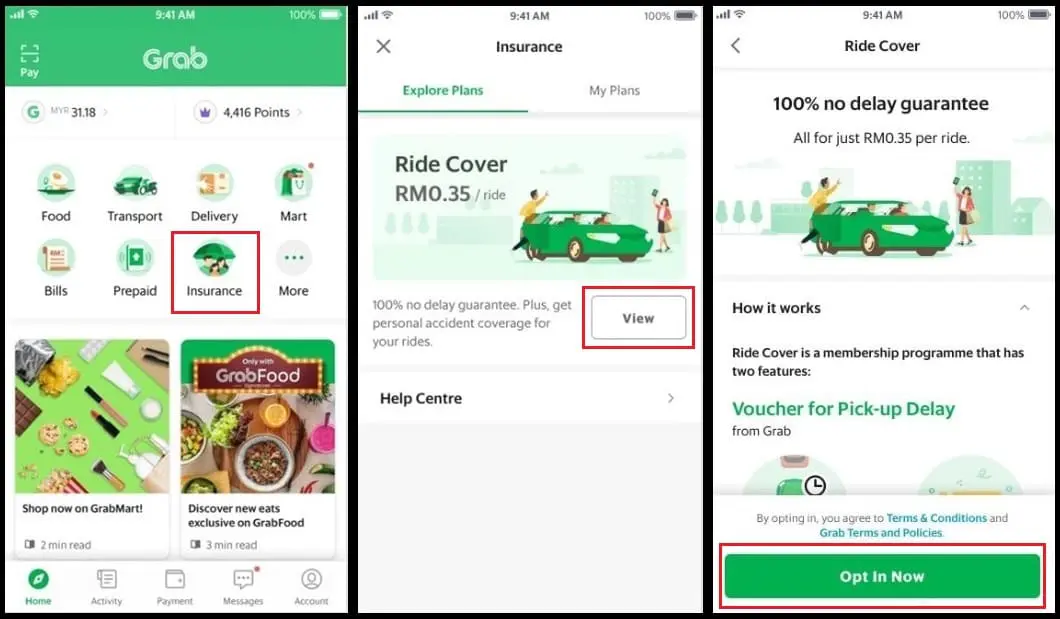

Signing up for Ride Cover is nothing more than a simple three-step process. You only need to do it once, and all your rides will be covered by Ride Cover from then on until you opt out:

- Tap on “Insurance” in the homepage of your Grab app.

- Select to “View” the Ride Cover plan.

- Tap on “Opt In Now”, followed by “Got It”, and you’re done!

Note, though, that you must pay for your rides with GrabPay to tap into the benefits of Ride Cover. If you’re paying with cash or through corporate billing, then the ride will not be eligible for Ride Cover, and you will not be charged even if you’ve opted in on the plan. Also, Ride Cover does not cover GrabShare, GrabRent, and GrabBike rides.

If you wish to opt out after signing up, all you need to do is to go back to “Insurance”, and tap on “Ride Cover” under the “My Plans” tab. You will be able to opt out from there. As of now, though, Ride Cover is only available to selected active Grab users as it is still in its pilot phase.

Comments (0)