Alex Cheong Pui Yin

5th October 2021 - 4 min read

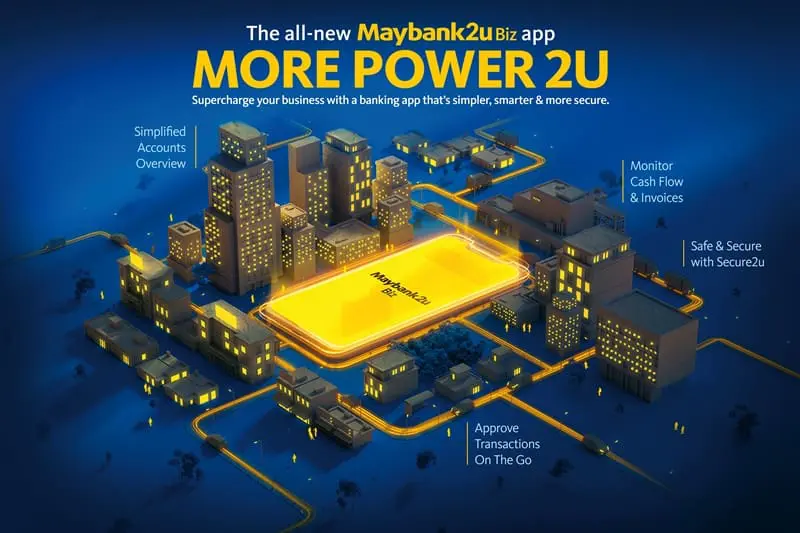

Maybank has launched the new Maybank2u Biz app today, catering to the banking needs of small and medium-sized enterprises (SMEs). It seeks to simplify the banking process for this group of users who are always on the go and multitasking, as well as equip them with selected non-banking tools that can ease business operations.

The new Maybank2u Biz app boasts a simple and intuitive user interface, along with value-added processes and tools that makes it easy to use for various forms of business, including partnerships, private limited companies, and even clubs, societies, and associations. A key highlight is the “maker-checker” authorisation process for transactions, which has been simplified without compromising on transparency. Checkers, for instance, can now approve up to 10 transactions at a time, within an extended seven-day approval period.

Aside from that, the Maybank2u Biz app has also been designed to make key financial data easy to understand for SME owners. They can get a full view of their accounts in Maybank on the dashboard of the app, thereby making it easy for them assess the financial health of their businesses at a glance.

On top of that, business owners using the app can also tap into a feature that lets them download their cashflow data (up to one year) in spreadsheet format whenever they want. This means they no longer have to wait for the traditional month-end statements in order to scrutinise their transactions. “With the information, business owners can now plan ahead, make better decisions, or even spot potential red flags in their cashflow early,” said Maybank.

Furthermore, the Maybank2u Biz app also features an “invoicing” tool, which allows business owners to create, issue, and track invoices. This tool enables them to customise the invoices by choosing from several ready-made templates, and sending the document out to customers through preferred communication channels such as emails or messaging applications. Once issued, business owners will then be able to track these invoices on their app dashboard.

Maybank clarified that the Maybank2u Biz app will be protected via the Secure2u feature. Secure2u is a security feature that is unique to Maybank, and it pairs your accounts with registered devices. As such, transactions performed can only be authorised on these devices via app pop-up notifications; you will no longer need to rely on traditional transaction activation codes (TAC) that are sent through SMSes, which reduces your exposure to fraud.

The group president and chief executive officer of Maybank, Datuk Abdul Farid Alias said that Maybank is committed to supporting SMEs given that they are the backbone of the country. “Hence, we have designed Maybank2u Biz to be more than just a banking application, but a business companion that will help ease SMEs’ burden and empower them to drive their businesses forward. We have made it simple because entrepreneurs should be spending more time making strategic decisions instead of managing daily operations,” he said.

Moreover, Datuk Farid said that he believes the Maybank2u Biz app will be well received by SMEs as Maybank currently serves 58% of the SMEs in Malaysia. “This is just the first phase of the application; we will continue to enhance it and bring in more features that will help SMEs power up their business,” he further stated.

The Maybank2u Biz app can now be downloaded for free from the Google Play Store and App Store. To celebrate this launch, Maybank is currently also running a campaign that lets business owners stand a chance to win cash rewards of up to RM30,000 when they download the new app. The campaign will run between today until 31 December 2021.

Previously covered recruitment-related stories and had a short stint as a copywriter for the property industry. She subsequently developed an interest in investment and robo-advisors.

Comments (0)