Alex Cheong Pui Yin

28th April 2022 - 2 min read

Permodalan Nasional Bhd’s (PNB) micro-investing app, Raiz has now been updated to allow investors to link debit cards from other banks, aside from Maybank, to the app. This comes following a partnership with digital payment service provider Visa.

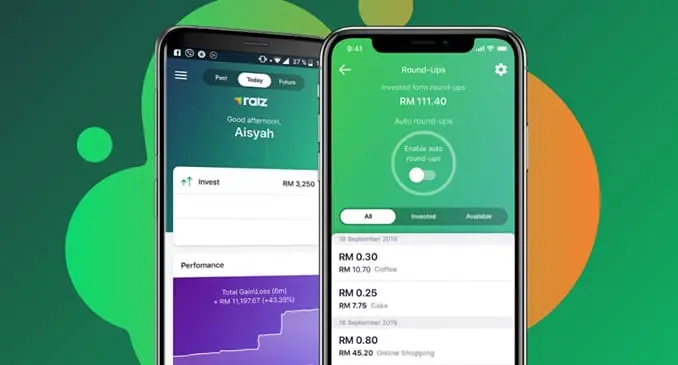

With this latest update, the Raiz app is now made accessible to individuals who do not have a Maybank account or debit card as well, enabling them to invest in Amanah Saham Nasional Bhd (ASNB) unit trust funds with just RM5. On top of that, they can also tap into Raiz’s unique round-up feature, which automatically rounds up their daily transactions to the nearest amount when they pay with the linked card, and “collects” the spare change for their investment.

Prior to this, users were only permitted to link the Raiz app to their Maybank debit cards and accounts as Raiz had established an exclusive partnership with the bank. However, Raiz did also clarify previously that it was looking to welcome more partners from other banking institutions and e-wallet providers.

The chief executive officer of Raiz Malaysia, Aidi Izham said this agreement with Visa is a pivotal moment for Raiz in Malaysia. “We are excited about the opportunities and growth we have had through our existing relationships with Maybank and PNB. This new partnership with Visa will allow more Malaysians to access all features of the Raiz app to improve their financial well-being,” he further commented.

Aside from enabling the Raiz app for non-Maybank users, Raiz Malaysia also stated that it is seeking to expand the app’s features, to be guided by their users’ feedback – but did not share further details. It currently has more than 100,000 active users.

The Raiz app was first launched back in July 2020. It was developed by Raiz Malaysia, a joint-venture company between Jewel Digital Ventures Sdn Bhd (a subsidiary of PNB) and Raiz Invest Australia Ltd (a subsidiary of Raiz Invest Ltd).

(Source: FintechNews Malaysia)

Comments (0)