Alex Cheong Pui Yin

4th August 2020 - 3 min read

(Image: The Star)

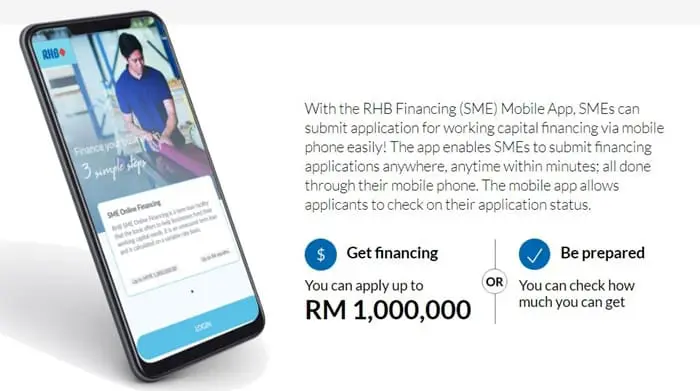

RHB Bank has launched its RHB Financing (SME) Mobile App, described as the first AI-powered “customer self-initiated” SME financing mobile app in the country. It is intended to offer increased convenience and accessibility for RHB’s SME customers who wish to apply for working capital financing.

Simply put, RHB’s new app automates the onboarding process, enabling the bank’s customers to submit their applications for working capital financing completely through their phones. It also allows them to communicate with RHB’s relationship managers without having to physically visit any branches.

According to RHB, its SME customers will be able to tap into fast term loans at competitive rates through the app, without the need for collateral. They can also conveniently apply for RHB’s BizPower Relief Financing facility, which provides them with a loan of between RM50,000 to RM1 million for a maximum tenure of up to seven years.

“This innovative app is powered by artificial intelligence (AI), machine learning, and big data capabilities, featuring facial recognition and real-time application processing capabilities. This puts more control in the hands of business owners, ensuring that they have access to a safe, secure, and efficient platform so that they can focus on building their businesses,” said RHB’s head of group business and transaction banking, Jeffrey Ng. He also added that approvals are faster for applications done on the app.

Ng further commented that the Covid-19 pandemic has caused a shift in customer preferences, with many now preferring remote loan applications instead of face-to-face meetings. “With this in mind, our focus is to continuously enhance and provide various digitally-driven products and services to make it even easier for them to conduct their transactions with us. In turn, this solution will drive our efficiency in service delivery as well as our SME market share,” he said.

RHB noted that the new app is meant to complement the existing SME Online Financing web portal. The bank also said that it has seen an encouraging response of about 5,000 submissions since the launch of the SME Online Financing web portal in 2018. In the following year, RHB aims to disburse a total of RM500 million through the new app to support small businesses.

For more information about the new RHB Financing (SME) Mobile App, head on over to its website. You can also download the app on Google Play or the App Store.

(Sources: The Edge Markets, Business Today)

Comments (0)