Alex Cheong Pui Yin

10th November 2023 - 2 min read

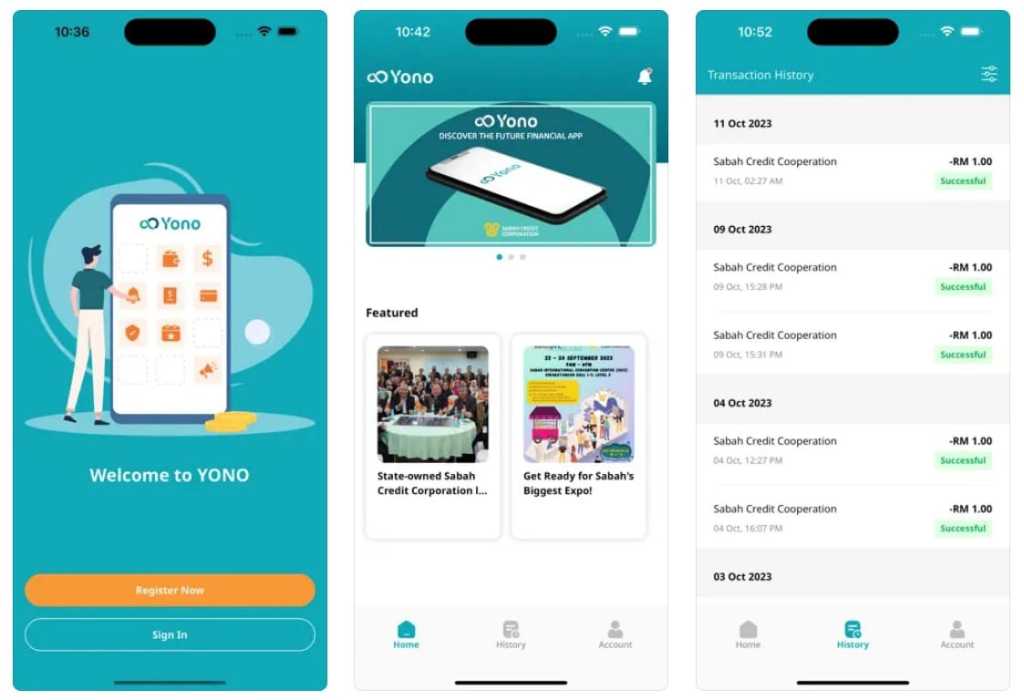

The Sabah government has launched a new one-stop financial superapp by the name of Yono, via the government-linked company (GLC) Sabah Credit Corporation. It offers a variety of financial services and features, including an in-app e-wallet, financing, insurance, and investment.

The Yono superapp – which stands for “You Only Need One” – is designed to be the next-generation extension of the state e-wallet Sabah Pay, which was launched back in 2020. It contains an in-app e-wallet called YonoPay with a wallet size of up to RM10,000, as well as financial products like mutual fund investments and loan facilities.

With regard to loan products specifically, the chief executive officer of Sabah Credit Corporation, George Taitim Tulas shared that the superapp offers two main loan products, namely the Small Instant Credit Facility and the Loyalty Instant Loan. They cater to various financing needs, provide generous borrowing limits and competitive interest rates (as low as 1%), and have an easy application process; approval can be granted in just one minute, thereby giving individuals quick access to the funds needed.

“Yono guarantees the utmost security and privacy, eliminating concerns about high-interest money lenders, electronic scammers, or illegal loan sharks. It provides a self-service, secure platform for individuals seeking a safe and reliable financial solution,” Tulas further said.

Meanwhile, Sabah’s state finance minister Datuk Seri Masidi Manjun said that Yono is a testament to the good progress made in the state’s digitalisation journey. He also urged the people of Sabah to support the Sabah Credit Corporation’s commitment in enabling financial inclusion and empowering citizens to manage their finances efficiently.

The development of Yono involved the assistance and contribution of many partners, including Alibaba Cloud, Payments Network Malaysia (PayNet), CTOS Data Systems, Fass Payment Solutions (FassPay), and Sunline Technology – just to name a few.

Yono can now be downloaded for free from Google Play and the App Store.

(Sources: Malay Mail, New Straits Times)

Comments (0)