Alex Cheong Pui Yin

22nd July 2022 - 3 min read

Shopping and rewards platform ShopBack has officially launched its ShopBack PayLater, a buy-now-pay-later (BNPL) service that lets users split their purchases into three monthly instalments with zero interest. This is with the aim of offering the public a flexible payment option while using ShopBack, and also kicks off a global rebranding exercise for the platform across its markets in Asia Pacific.

According to ShopBack’s FAQ, users using its PayLater service will need to make an upfront payment for the first instalment, while the second and third instalments will be paid in 30 and 60 days from the checkout date, respectively. Additionally, the second and third instalment payments will be automatically deducted from your default credit or debit card in your ShopBack account on the scheduled due date (ShopBack PayLater does not accept payments made via prepaid cards and e-wallets).

ShopBack also emphasised that there are no interest or hidden fees charged for its PayLater service. Late payments, however, will incur additional charges as per the following rates:

- Order value <RM100: Additional RM7.50

- Order value <RM500: Additional RM25

- Order value of RM500 and above: Additional RM75

ShopBack PayLater will be made available at over 2,000 online and physical stores. Popular brands include Malaysia Airlines (MAS), Love Bonito, ZALORA, JD Sports, and Royal Sporting House.

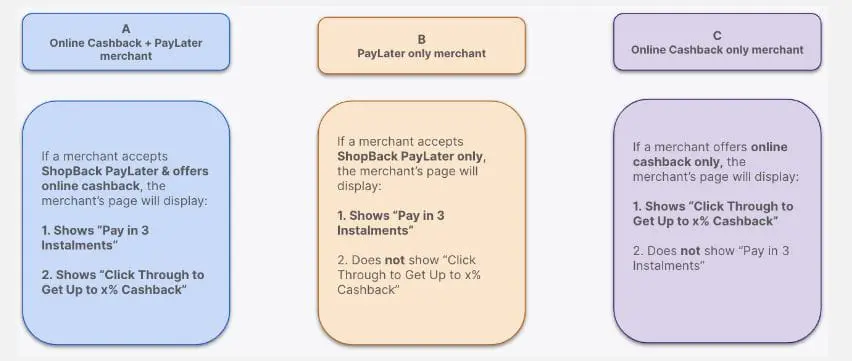

Note, however, that only selected merchants offering ShopBack PayLater will allow you to earn cashback through your BNPL payments. As you can see in the diagram below, some merchants may fall under the “PayLater Only Merchant” category (i.e. accepts ShopBack PayLater as payment method, but no cashback), so you may want to check beforehand:

If you do earn cashback from your purchases, however, the rewards can be used to offset your subsequent purchases or ShopBack PayLater instalments. You can also monitor your expenses by checking your spending limit and tracking your upcoming bills via the app.

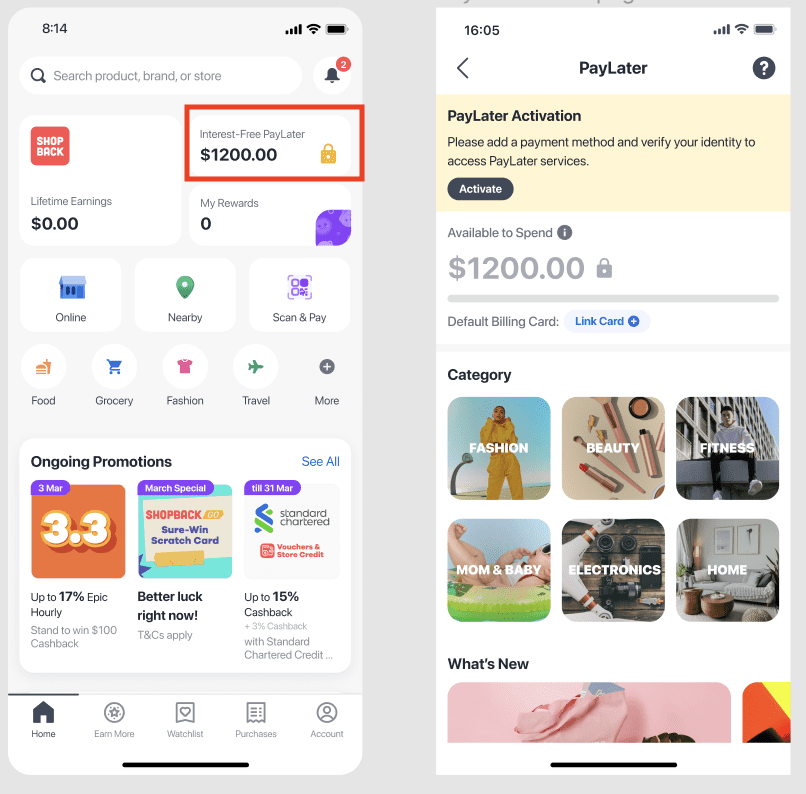

To give ShopBack PayLater a try, you’ll need to first activate the service via your ShopBack account. Simply fire up your app and tap on “Interest-Free PayLater” on your home screen, followed by “Activate”. As with most payment apps, you’ll be required to verify your identity using your MyKad, as well as provide other personal details. Additionally, you’ll need to link a credit or debit card issued by a local bank.

Do also be aware that most users will start with a credit limit of RM1,600, although this figure may be updated and adjusted based on their repayment history.

In celebration of this official rollout, ShopBack is currently running a campaign where new users can enjoy 25% off (capped at RM25) for their first ShopBack PayLater bill with no minimum spend. The campaign is set to run until 31 August 2022. On top of that, there are also prizes worth up to RM50,000 to be won when you make an in-store transaction with ShopBack PayLater on selected dates at participating stores.

To note, the ShopBack PayLater service is actually powered by hoolah, a BNPL firm that ShopBack acquired back in December 2021. In its FAQ, ShopBack explained that the payment services of ShopBack PayLater is provided by hoolah (such as the payment accounts and domestic money transfers), while ShopBack provides the user interface via its app. Users who already have a hoolah account (separate from ShopBack) can maintain their account separately, but cannot use it to make payments with ShopBack PayLater.

You can download ShopBack for free on Google Play, the App Store, or Huawei AppGallery.

Comments (0)