Alex Cheong Pui Yin

15th April 2024 - 2 min read

GXBank has announced an update to the terms and conditions of its Rewards Experience campaign, which includes the discontinuation of the RM29.40 GrabUnlimited subscription cashback as part of its new customer sign-up rewards. This revision is set to take effect starting from today (15 April 2024).

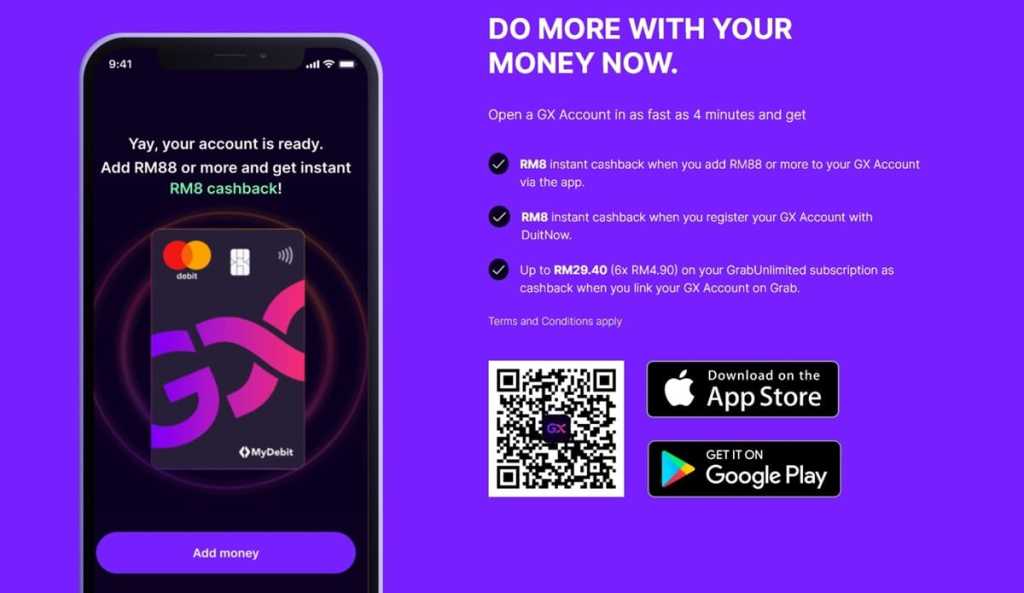

Prior to this, new GXBank customers who opened a GX Account and linked it to their Grab account were able to claim up to RM29.40 on their GrabUnlimited subscription as cashback (6x RM4.90 monthly subscription fee). This is on top of other sign-up perks, including an instant cashback of RM8 when they make a minimum deposit of RM88 into their account, and another RM8 instant cashback when they register their GX Account with DuitNow.

Following this latest update, the GrabUnlimited subscription cashback will cease to be provided, but customers who have fulfilled the qualifying criteria for the perk (linking their GX Account to their Grab account) prior to 15 April will still be able to tap into it. Meanwhile, other benefits offered by GXBank all remain unchanged.

Aside from this, GXBank also made several other revisions to the T&C document of its Rewards Experience campaign with the aim of improving clarity and transparency. Among other things, it included a new clause that urged customers to seek clarification from GXBank’s authorised representatives if they do not understand the T&C of its campaigns or products.

GXBank – which is backed by a consortium consisting of Grab, Kuok Brothers Sdn Bhd, and SingTel – received approval from Bank Negara Malaysia (BNM) to commence operations in Malaysia in September 2023. It subsequently launched its app and services to all Malaysians in November 2023, followed by the introduction of its highly anticipated debit card in January 2024. The digital bank also shared that it has plans to roll out new offerings in the first half of this year, including protection and lending products.

Comments (0)