Alex Cheong Pui Yin

18th January 2024 - 3 min read

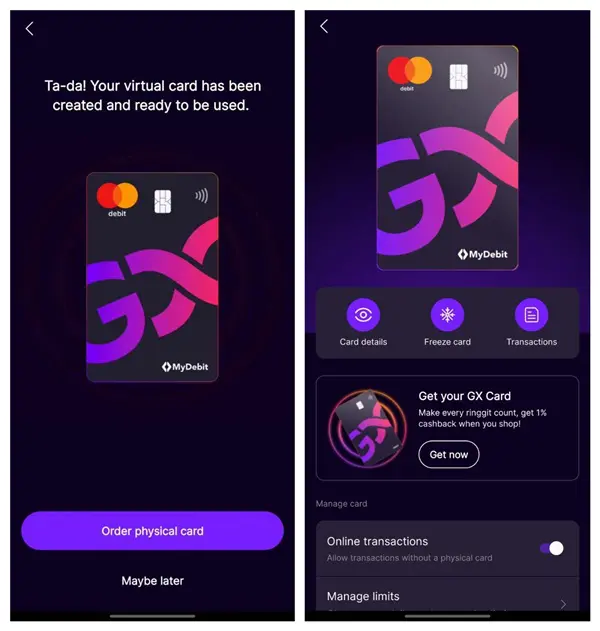

After plenty of hype over its imminent arrival in January 2024, GXBank has now officially begun rolling out its much-anticipated debit card to customers, to be made available gradually in batches. The GXBank debit card, which is issued by Mastercard, will be available as both a virtual and physical card.

“Great news! We’re starting to roll out our debit card to Malaysians one batch at a time as we continue to improve and refine the experience. If you don’t spot the card within your GX app yet, hang tight, we’ll be serving it up to you soon!” the digital bank shared in a post on its Facebook account.

For those of you who are fortunate enough to be part of this early experience, you will have received a push notification via your GXBank app, which will lead you to an in-app screen to apply for the card. You’ll be required to key in some details for the creation of the virtual card, such as your preferred name, after which you can also put in a request for a physical card.

Note that there’s actually a RM12 fee for the issuance of physical cards (upon activation), but it is currently waived until 31 December 2024 – along with a number of other charges as well. These include the MEPS withdrawal fee and admin fee for foreign transactions.

For context, the GXBank debit card comes with several perks, and its key benefit lies in the ability to earn unlimited 1% cashback when you use it for your various online and offline transactions. These include expenses such as bill payments, groceries, petrol, dining, and shopping.

Those who shop at Jaya Grocer, too, can tap into this 1% cashback benefit when they pay using the physical GXBank debit card, on top of earning 1.5x GrabRewards Points for every RM1 spent (an existing perk for GrabUnlimited subscribers). Meanwhile, transactions that are not eligible for the 1% cashback benefit include e-wallet reloads, insurance payments, as well as government- and charity-related transactions.

Aside from the unlimited 1% cashback benefit, GXBank also highlighted that its debit card has no markups or hidden fees for overseas transactions, so you can use it without worrying when you’re abroad.

If you’re not yet a GXBank customer but would like to register now to apply for the GXBank debit card, there’s an ongoing sign-up campaign that lets you earn some cashback! From now until 29 February 2024, you can earn RM8 cashback when you open a GX account and deposit a minimum of RM88 to your account, and another RM8 cashback when you link your DuitNow ID with your GX account. Additionally, if you link your GX account to your Grab account, you’ll be able to enjoy up to RM29.40 cashback on your GrabUnlimited subscription (6x RM4.90).

Comments (1)

air asia big card should quit now