Alex Cheong Pui Yin

23rd April 2021 - 2 min read

Maybank has said that it will enable the Secure2u feature for its MAE by Maybank (MAE) app, effective 24 April 2021 (that’s tomorrow!). With this, Maybank customers will no longer need to keep both the Maybank2u and MAE app installed in their phones for payment verification purposes.

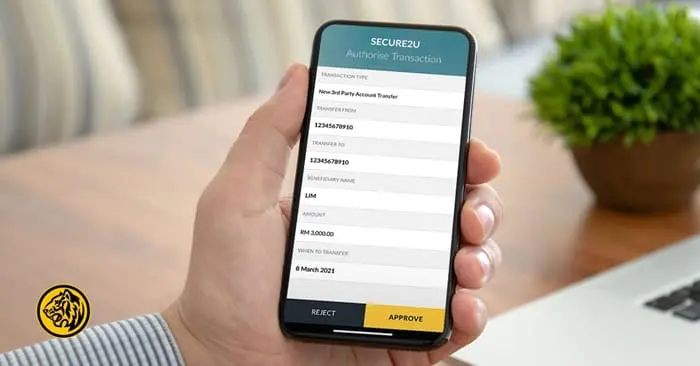

“Secure2u will soon be available on the app to give you a seamless banking experience. Effective 24 April, you’ll be able to approve all Maybank2u web, Maybank2u MY app and MAE app transactions via Secure2u on MAE!” said the bank in a message on its MAE app. For context, Secure2u is a payment verification feature that allows Maybank customers to authorise their transactions, used as an alternative to the SMS TAC – which was gradually phased out by the bank.

Although Maybank has endorsed Secure2u as a safer and more convenient authentication method, the feature was previously made available only on the Maybank2u app. This meant that customers who wished to use the bank’s new MAE app were still required to keep the old Maybank2u app just for payment verification purposes. This has been a matter of inconvenience for customers for a while now, especially since Maybank also revealed that the Maybank2u app is slated to be replaced by the MAE app. This latest update is expected to resolve this.

Following this latest update, MAE app users will have the convenience of approving all their online transactions via the Secure Verification method, where you need to tap on an “Approve” button to verify the payments. The MAE app will also become the default app for all Secure2u approvals starting from tomorrow. Existing MAE app users will be prompted to either log in again or register for the feature, whereas new MAE app user are required to sign up for an account to enable Secure2u.

You can find out more about this update on the bank’s FAQ on the MAE app and Secure2u here.

(Source: Maybank)

Comments (0)