Alex Cheong Pui Yin

7th June 2023 - 3 min read

Maybank customers using the MAE by Maybank2u (MAE) app are now able to pay for their purchases in Singapore, Thailand, and Indonesia more conveniently via cross-border QR payments, following the bank’s recent move in enabling support for such transactions. Likewise, tourists from these three neighbouring countries who visit Malaysia will also be able to use their own local banking apps to pay Maybank QRPay merchants for their purchases.

For MAE app users, specifically, they will be able to perform QR payments with any merchants in Singapore, Indonesia, or Thailand as long as the vendors display the NETS QR (Singapore), QRIS QR (Indonesia), or PromptPay QR (Thailand) codes. These QR codes are the national QR system for each respective country – essentially similar to our own national QR standard, DuitNow.

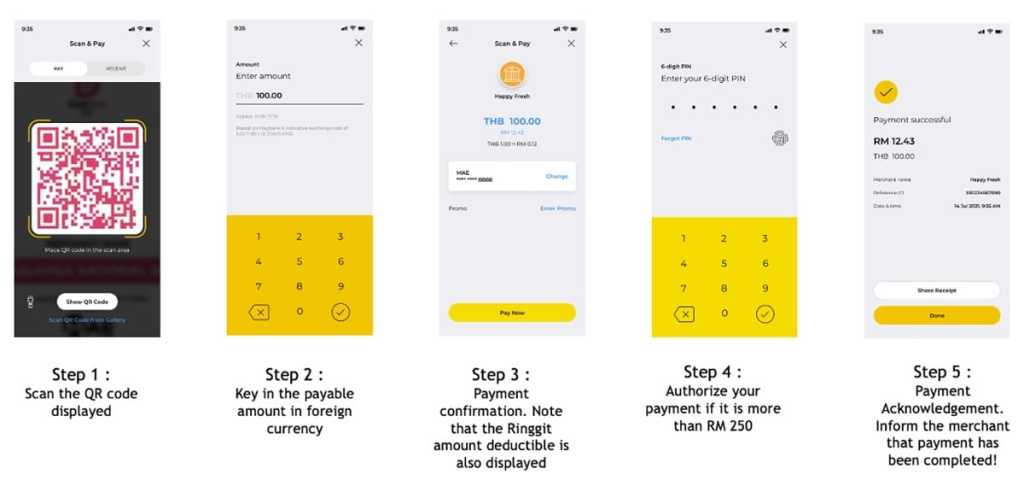

If you’d like to give the new feature in MAE app a try, simply fire up your app when you’re abroad, and open up the QR feature. Scan the merchant’s QR code, and key in the payable amount in the local currency (the currency in your app will be automatically converted based on your location). During the confirmation process of your payment, you’ll be able to see conversion rate, as well as the total MYR that is being deducted from your account – so it’s pretty transparent! Note that you will also be required to authorise your payment if it exceeds RM250.

Maybank also clarified that the daily transaction limit for cross-border QR payments is automatically set at RM1,000 (or its equivalent in foreign currency), but you can change this limit in your app if you prefer. Another thing to be aware of is that you can only select current and savings accounts (CASA) as your source of funds for cross-border QR transactions, so if you plan to go abroad and use the cross-border payment feature via MAE app, make sure to keep your current or savings account funds sufficient.

As for Maybank QRPay merchants, they will be able to receive payments from tourists in MYR in their accounts immediately, which means better convenience and security. Additionally, they can maximise their business opportunities as they are no longer limited to serving only tourists who are carrying cash; travellers who do not have immediate cash on hand can have the alternative to pay the merchants via cashless payment options instead.

Group chief executive officer of community financial services for Maybank, Dato’ John Chong said that the rollout of this new feature is key to promoting the digital economy and financial inclusion in the ASEAN region.

“This is timely as we noticed the significant increase in technological demands among the public as they look for banking solutions that offer unprecedented speed and new levels of convenience while ensuring the safety and security of their transactions, especially post-pandemic. Furthermore, the QR payment linkage between Malaysia, Singapore, Indonesia, and Thailand complements a growing network of bilateral payment interdependence that will contribute towards a more dynamic ASEAN and further development of the region,” said Dato’ John.

For context, Maybank’s support for cross-border QR payments via its MAE app is made possible thanks to Bank Negara Malaysia (BNM) successful efforts in launching a cross-border QR code payment linkage with Thailand, Singapore, and Indonesia. Maybank also said that it is planning to expand its cross-border QR payment feature across more countries soon.

Comments (0)