Alex Cheong Pui Yin

14th May 2024 - 2 min read

OCBC Bank has announced that it will be replacing the existing SMS one-time password (OTP) verification method for the authorisation of online debit and credit card transactions. Starting from June 2024, customers who perform these payments will need to approve them using the bank’s proprietary digital token feature, OCBC OneToken instead.

“To ensure smooth online card transactions experience, we urge customers to register for OCBC Online Banking and activate their OCBC OneToken before 31 May 2024,” the bank further shared in its notice.

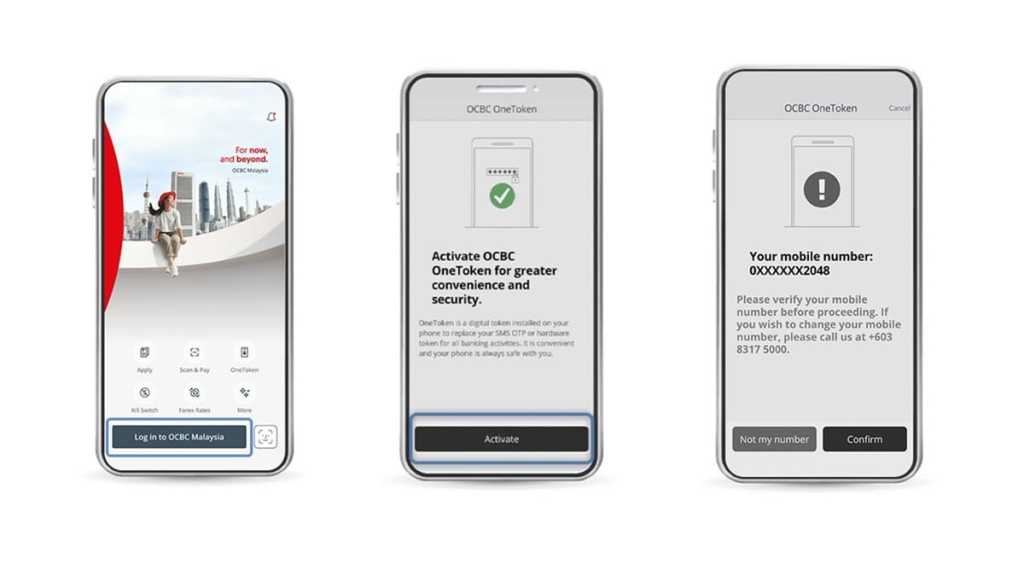

To activate your OCBC OneToken, you’ll need to first download the OCBC Malaysia Mobile Banking app and log in to your online banking account. From there, you will be prompted to set up your OCBC OneToken if you have not already done so. Tap on “Activate” and confirm your mobile number.

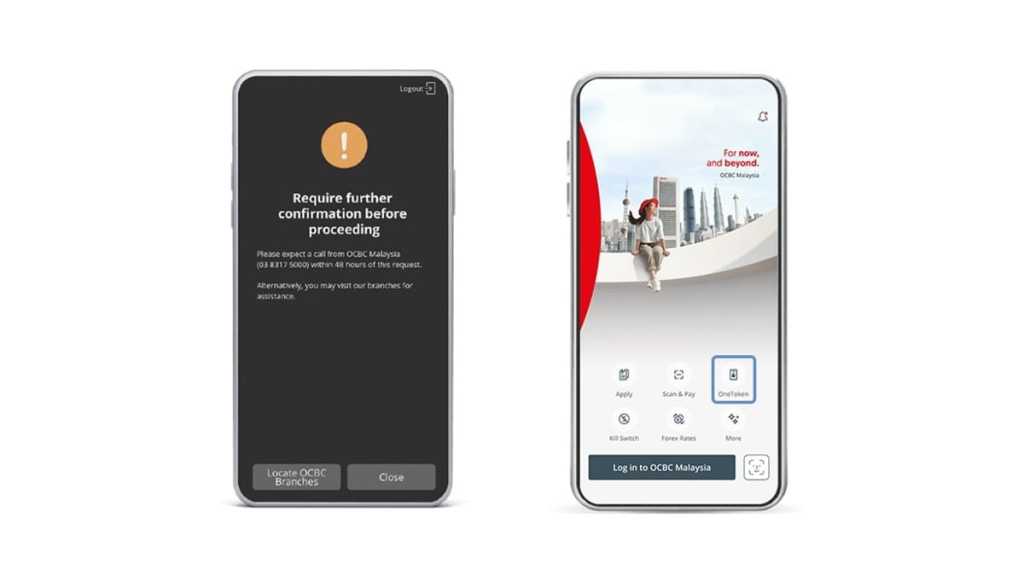

Upon submitting your request, OCBC Bank will call you within 48 hours to obtain further confirmation from you. The bank representative will also guide you along for the remaining activation process of your OCBC OneToken. Of course, if you prefer more immediate assistance, you can visit an OCBC Bank branch instead.

Once the process is completed, the OneToken feature will be ready for you to use after a mandatory 12-hour cooling period! You’ll be able to generate an OTP via the digital token feature when you need to perform and authorise online debit and credit card transactions, simply by tapping on the OneToken icon located at the right of the login screen.

For context, OCBC had begun encouraging its customers to adopt the OCBC OneToken verification method since 2022, stating that it is a more convenient and secure option for various reasons. These include its single-device activation feature, where your OCBC OneToken can only be registered to one device at a time. This means that only OTPs generated on your registered device can be used to authorise your transactions.

(Source: OCBC Bank)

Comments (1)

This bank along with UOB are among the banks where I find it is almost impossible to pay bills,etc.Reaching the stage where even the staff find it difficult.