Alex Cheong Pui Yin

14th May 2024 - 3 min read

RHB customers will soon need to use the bank’s RHB Secure Plus security feature to authorise their online purchases made via debit and credit cards. Replacing the existing SMS one-time password (OTP) verification method, this is in a bid to better protect its customers from online and e-commerce fraud, said the bank.

In its notice, RHB explained that customers will need to download the RHB Mobile Banking app in order to activate the RHB Secure Plus feature. Once done, log in to your banking account using your online banking credentials and take the following steps:

- Access your Profile by tapping on the icon on the top left corner of your home screen.

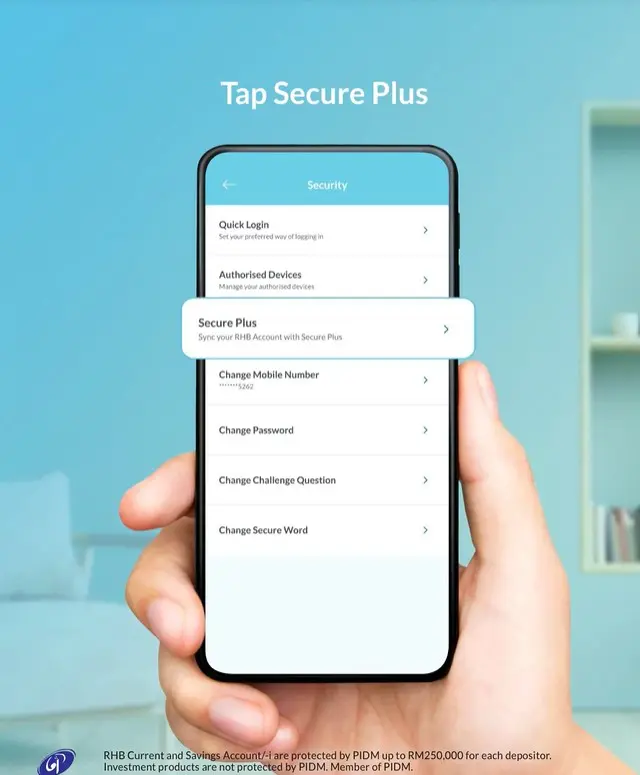

- Tap on “Security”, then “Secure Plus”. You may be asked to key in your password if you logged in to your mobile banking app using Quick Login earlier.

- Read through the terms and conditions shared, then confirm that you agree to the T&C to use Secure Plus and tap on “Authorise Now”.

- Tap on “Proceed” to register your device and bind the Secure Plus feature to your current device.

- Key in the OTP that is sent to you, and you’re done! RHB Secure Plus is now active on your device, and you will receive Secure Plus push notifications to approve or reject online transactions made via your cards.

RHB also reminded that you’re only allowed to link one authorised device to approve your transactions using the RHB Mobile Banking app.

“Once you have successfully linked your authorised device, there will be a 12-hour post registration intermission (cooling-off period) during which you will not be able to perform transactions on RHB Online and Mobile Banking,” the bank further emphasised, adding that only devices running on approved operating systems (Android 9.0 and above or iOS 15.0 and above) can support the app and Secure Plus.

Here is also a video guide from RHB on how to use Secure Plus to authorise your transactions once the cooling-off period is over:

RHB initially only required the use of Secure Plus for the authorisation of high-value transfers or transactions, starting from RM10,000. Since then, the bank has been seeking to expand the use of the security feature for other banking activities as well, in line with Bank Negara Malaysia’s (BNM) directive for banks to improve their security features and better protect their customers.

(Source: RHB Bank)

Comments (0)