Alex Cheong Pui Yin

24th May 2023 - 3 min read

UOB Malaysia has officially launched an upgraded version of its mobile banking app, reintroduced today as UOB TMRW. Powered by technologies such as data analytics and artificial intelligence (AI), the new app will replace the existing UOB Mighty, with the aim of offering a simpler, smarter, and more personalised banking experience for customers.

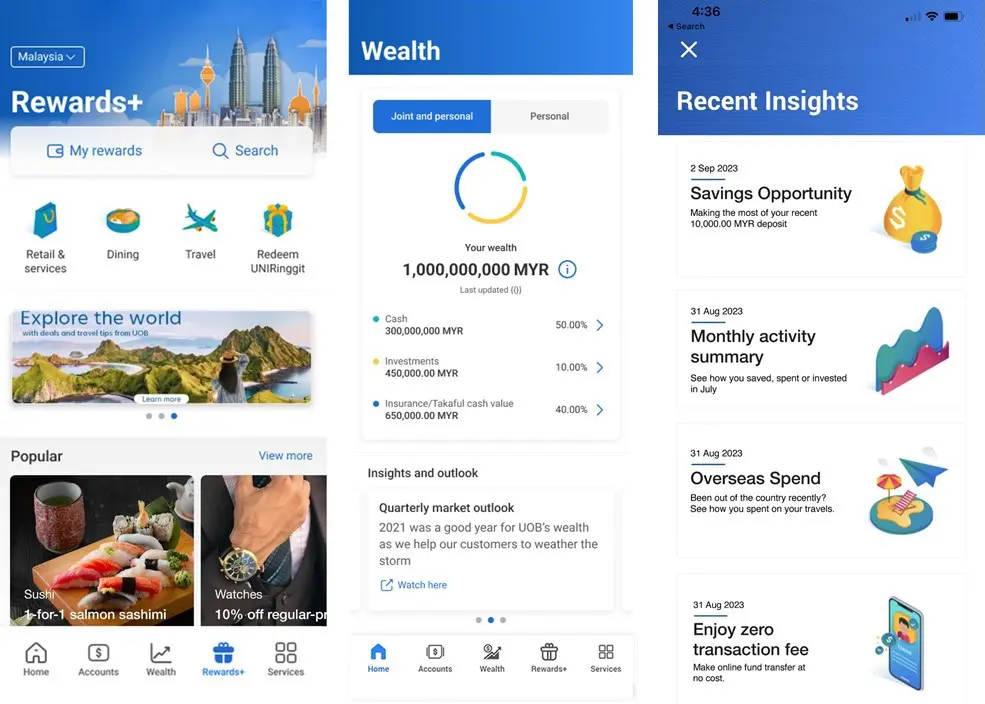

In a statement, UOB said that the refreshed app has been upgraded with “innovative and multidimensional capabilities in investments, payments, and rewards” to make it a customer-centric platform. For instance, you’ll be able to get an overview of your investment portfolios through the app, including key information such as mark-to-market values and real-time performances. This, in turn, allows you the flexibility to manage your wealth at any time, from anywhere.

The new UOB TMRW app also comes with a Rewards+ feature, where you can conveniently check your available rewards points and redeem rewards – such as travel miles, products, and vouchers – in real time. It is also possible for you to use your existing points to offset the balances on your credit card purchases, if eligible.

On top of that, the app is also set to see more updates later this year, specifically in the form of a comprehensive suite of self-service features for cards. Once rolled out, UOB customers will be able to conveniently perform selected card services through the app, such as card activations, card replacements, and applications for payment instalments.

Following this latest development, UOB said that existing customers who are currently using the UOB Mighty app are not required to take any specific action; their UOB Mighty app will be automatically updated to UOB TMRW from this month onwards. New UOB customers, meanwhile, can already download UOB TMRW for free from Google Play, the App Store, and Huawei AppGallery.

Meanwhile, Citi customers can look forward to accessing services and solutions offered via UOB TMRW by the third quarter of this year, as UOB is currently in the process of migrating and integrating Citi’s products, services, and IT system into its ecosystem. This comes following UOB’s acquisition of Citi’s consumer banking business in Malaysia after Citi announced its decision to exit retail banking in several countries in 2021.

For context, UOB’s earlier mobile banking app, UOB Mighty, was launched back in 2017. While the app has been continuously enhanced with best-in-class features and technologies over the years, UOB also expressed that an overhaul was timely after the Covid-19 pandemic so that it can enhance its digital capabilities and better serve its customers, especially in the areas of hyper-personalised digital banking experience and speed-to market.

“At UOB, we are committed to understand and serve the unique needs of each customer and this is achieved through a combination of data and relationship-led insights. Through UOB TMRW, the bank offers insights and solutions that are closely aligned to customer needs in a manner that engages them and better anticipates their life goals,” said the managing director and country head of personal financial services for UOB Malaysia, Ronnie Lim.

Comments (0)