Jacie Tan

26th July 2021 - 2 min read

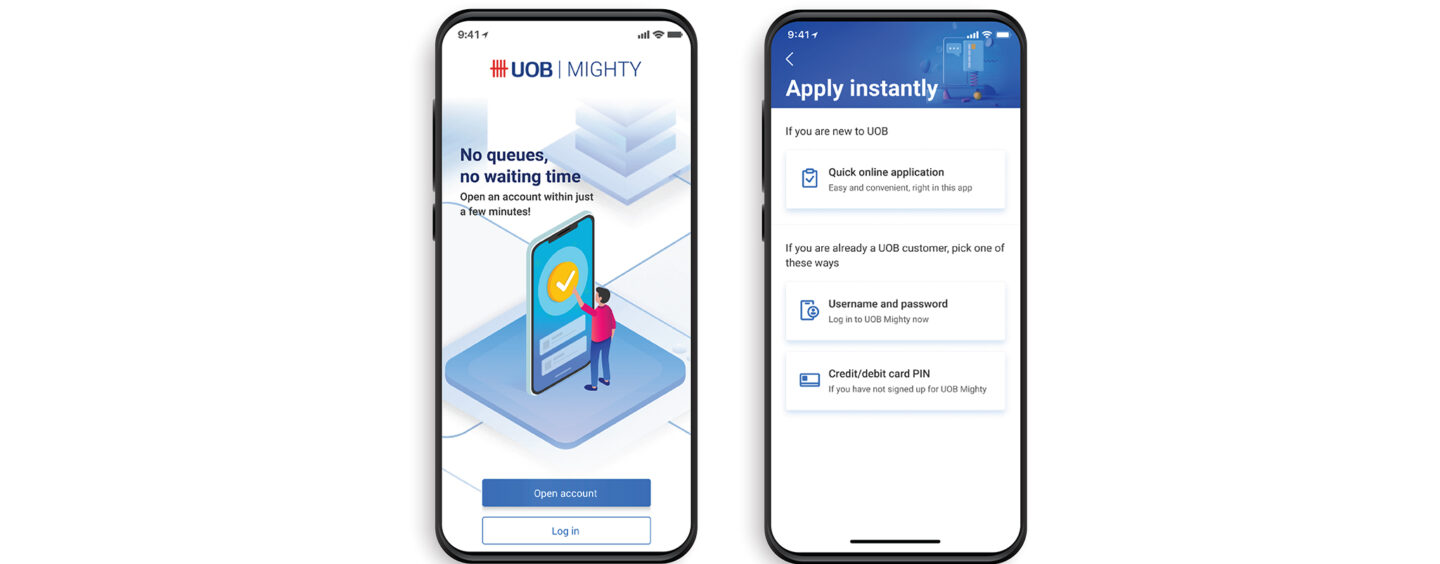

UOB Malaysia has launched a digital account opening service that allows customers to open a personal bank account wholly through the bank’s mobile banking app, UOB Mighty. Customers can now open a bank account via UOB Mighty in just 10 minutes, reducing the average time to open account by 60%.

By digitalising the application and account opening process, UOB customers are able to apply for a bank account without having to fill in any paper-based forms. With the integration of the electronic Know Your customer (e-KYC) solution to verify and authenticate identities, new customers do not need to visit a branch to verify their identity for account opening.

“Upon submitting the application, they will receive a notification within two minutes on their application status through the app,” said managing director and country head of personal financial services Ronnie Lim. “Once the application is verified and approved, customers can then transfer funds to their new bank account to activate it. Within minutes, they will be able to start using their preferred deposits account to grow and to manage their finances.”

According to Lim, the digital account opening service is in line with customers’ shifting preference to bank online amidst the Covid-19 pandemic. The UOB ASEAN Consumer Sentiment Study found that more than half of its respondents preferred to open a bank online, while 67% were willing to apply for a financial product via the Internet or mobile banking. Mobile apps were favoured among 80% of respondents while web browsers stood at 70%.

“As a bank that has served Malaysians for 70 years and counting, our focus has always been on innovating and improving our financial products and services to anticipate the needs of our customers,” said Lim. “Our aim is for them to enjoy a seamless digital banking experience with a full suite of banking features, from account opening to performing transactions, at their fingertips any time of the day.”

UOB is currently offering customers bonus interest of up to 6.68%p.a. upon the opening of a savings account via the UOB Mighty app. Customers can also receive Shopee vouchers of up to RM248 when they apply and spend with UOB debit or credit cards. For more information on the UOB Mighty digital account opening, you can visit the UOB website or download the mobile app.

Comments (0)