Alex Cheong Pui Yin

14th November 2023 - 4 min read

Grab-led digital bank, GXBank announced that it has began making its beta digital banking app available to an exclusive group of 20,000 Malaysian individuals starting from today. This comes following a successful internal testing phase, conducted among GXBank’s own employees and partners.

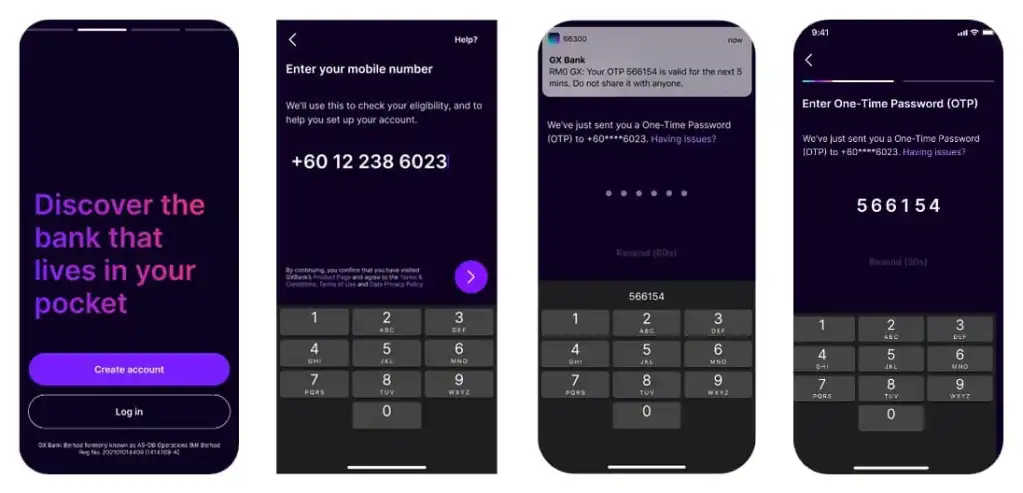

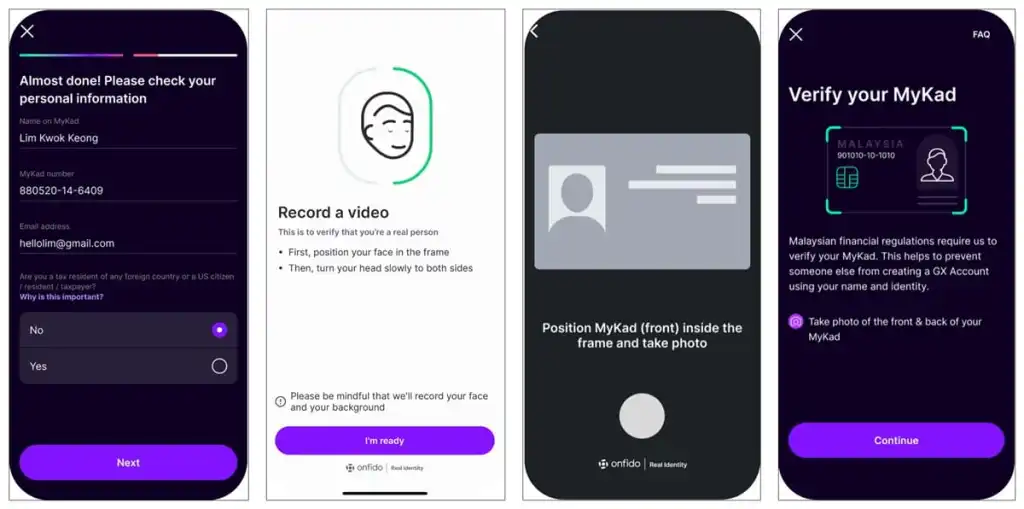

With the app now officially rolled out for beta testing, GXBank is able to share some of the features that users will be able to tap into within the app. Chief of these is the setting up of a banking account with GXBank, which can be done seamlessly and for free. As usual, you’ll be required to complete an electronic Know Your Customer (eKYC) verification process using your MyKad and a one-time password (OTP), as well as set up your security features, such as facial recognition using biometrics (existing Grab users can access GXBank through the Grab app itself).

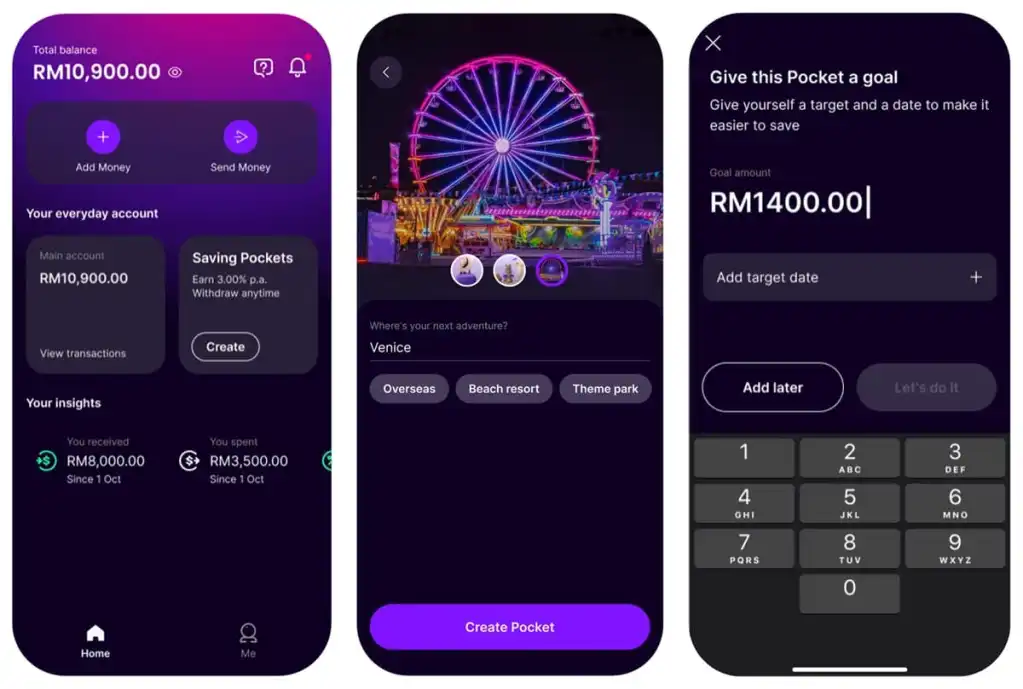

Once your account is up and running, you must deposit a minimum of RM10 to begin using the savings feature – a minimum amount meant to accommodate the needs of the underserved population. This is in comparison to the minimum deposit required for the setting up of bank accounts with conventional banks, which typically stands at a higher amount of RM20 and upwards.

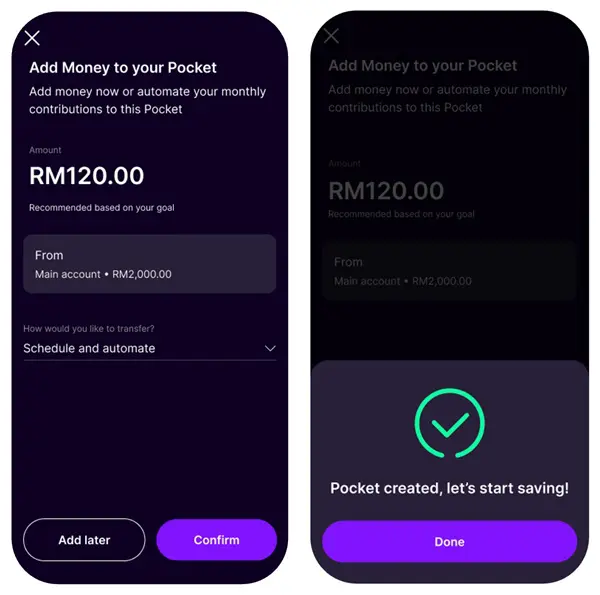

Another feature that will be made available to beta-testers is the Pockets goal-based savings feature; it essentially lets you save for specific needs and goals – including a new home, an upcoming holiday, and even retirement – with daily interest of up to 3% p.a.. Users can create up to 10 Pockets and monitor their savings progress within the app, as well as receive tips periodically to boost their savings.

In terms of security, users can lock and secure their accounts in the event of fraudulent or unauthorised transactions. They can also set limits to their daily spending to help them keep to their budget, thereby allowing for better financial management. Other notable benefits that users can look forward to as well include a cashback reward of RM20 (earned with a minimum deposit of RM100) and a complimentary GrabUnlimited subscription for up to six months.

Chief executive officer of GXBank, Lai Pei Si shared that during the development of the bank app, thousands of surveys had been conducted to identify the pain points of existing mobile banking apps that need to be resolved. Some issues that were highlighted include the daily system maintenance downtime imposed by incumbent banks, as well as the hassle faced when printing or sending documents and having to visit a branch.

“Our features consist of 24/7 system uptime for full banking access, it takes less than 10 minutes of onboarding process, and also instant paperless application for credit products (which will roll out in the near future),” said Lai, adding that customers’ needs will be supported through various channels, including an all-day customer support service. Additionally, all customers will be protected by Perbadanan Insurans Deposit Malaysia (PDRM), up to RM250,000 for each depositor – as per Bank Negara Malaysia’s (BNM) guidelines.

Moving forward, Lai said that the GXBank app will be updated to support other languages, namely Bahasa Malaysia and Mandarin, once it is officially launched. A waiver on the RM1 MEPS withdrawal fee at automated teller machines (ATMs) nationwide will also be introduced in the future, in addition to unlimited cashback rewards when customers use GXBank’s debit card for transactions once it is rolled out.

“As we continue to test the stability of our app and gather feedback from users, we hope to develop a digital banking experience and app that is uniquely tailored to the financial needs of Malaysians of all generations,” Lai further commented.

GXBank – which is backed by a consortium consisting of Grab, Kuok Brothers Sdn Bhd, and SingTel – is the first of five digital bank licence applicants in Malaysia to be greenlit by BNM to commence operations. The remaining four are expected to announce their operations sometime between now until the April 2024 deadline set by BNM.

If you’d like to participate in the beta-testing of the GXBank app, you can head on over to its official website here to register and join the waitlist.

Comments (0)