Olivia Song

24th January 2019 - 5 min read

One of the most common resolutions we make every year is to spend less and save more. Most of the time, we fail miserably. But would it have helped if we had the ability to track where we spend our money?

This 2019, why not try out a financial management app? These apps let you keep track of your spending, set a budget for expenses

and keeping to them, and even set savings goals if you want to. We’ve tried some of the most popular ones available for both Android and iOS, and here are our recommendations.

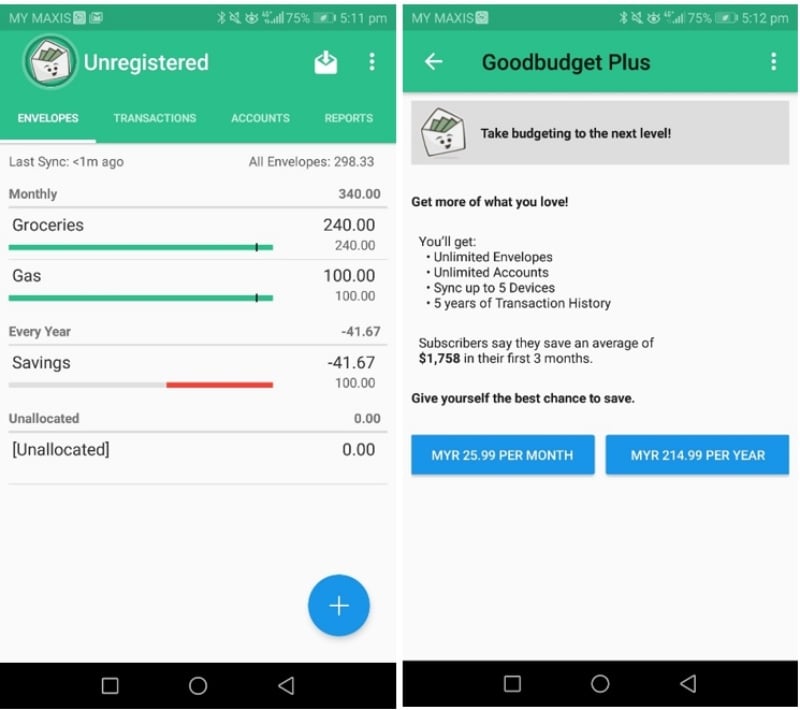

Goodbudget Budget Planner

Goodbudget is an “envelope budget” app, taking inspiration from the old-school budgeting method of storing cash for separate categories of expenses in different envelopes. Users can set separate budgets for different “envelopes”, check on the percentage of your spending these categories and see how it affects your overall budget.

It is a simple and effective solution for users who want more control over their personal cash flow. The only down side of the app is that it doesn’t sync with bank accounts, forcing users to manually input income or changes in their bank accounts. That said, this app is a great tool for anyone that just wants to be more committed into budgeting and be on track with their spending.

The free version will have ads and a limited number of “envelope” budgets, but the paid version removes ads and adds more features such as transaction history and multi-device syncing.

Price: Free, RM25.99 per month or RM214.99 per year for ad-free subscription

Availability:

Apple App Store, Google Play, Web

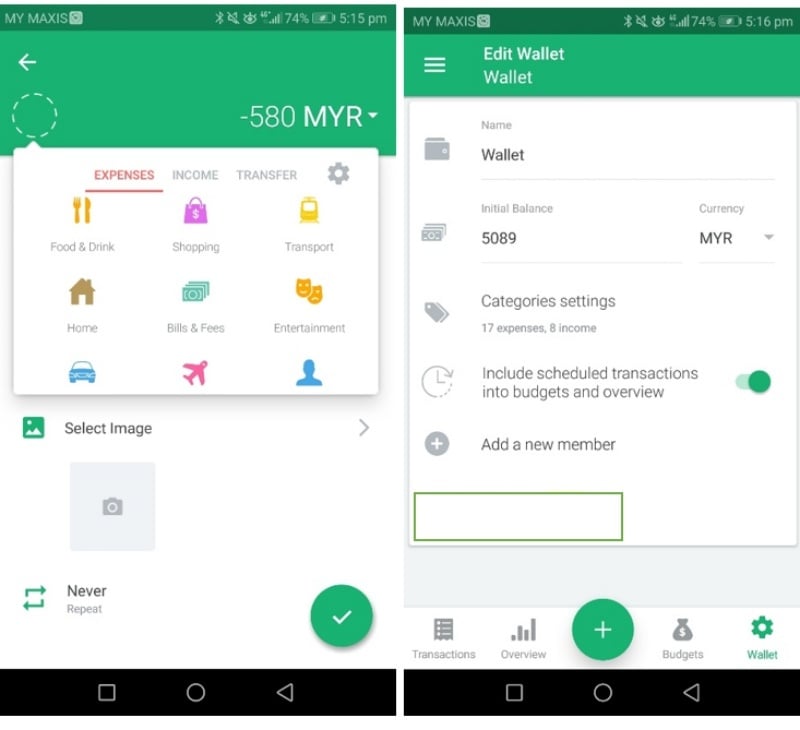

Spendee

Spendee is a bright and easy budgeting app to get your hands on this 2019. It has colourful displays and graphs to show your spending habits and to top that, there’s customisable categories too (something which a lot of apps don’t allow for, surprisingly!).

You can use the app to track expenses like grocery shopping, bills, and others. You can also upgrade your Spendee to Premium or Plus if you require more functions. Spendee Premium allows you to sync to unlimited bank accounts, link e-wallets, unlock unlimited budget options, and have shared wallets for family finances or shared finance goals.

With Spendee Plus, you’ll be able to do pretty much most of what Premium offers but without bank account syncing, auto categorisation, and backup. On the other hand, the only downside of using Spendee is that users will not be able to access it on the iPad. That said, Spendee also has a web app version that enables data import and bulk editing.

Price: Free, Spendee Plus (RM3.90-RM34.90), Spendee Premium (RM6.90-RM52.90)

Availability:

Apple App Store, Google Play, Web App

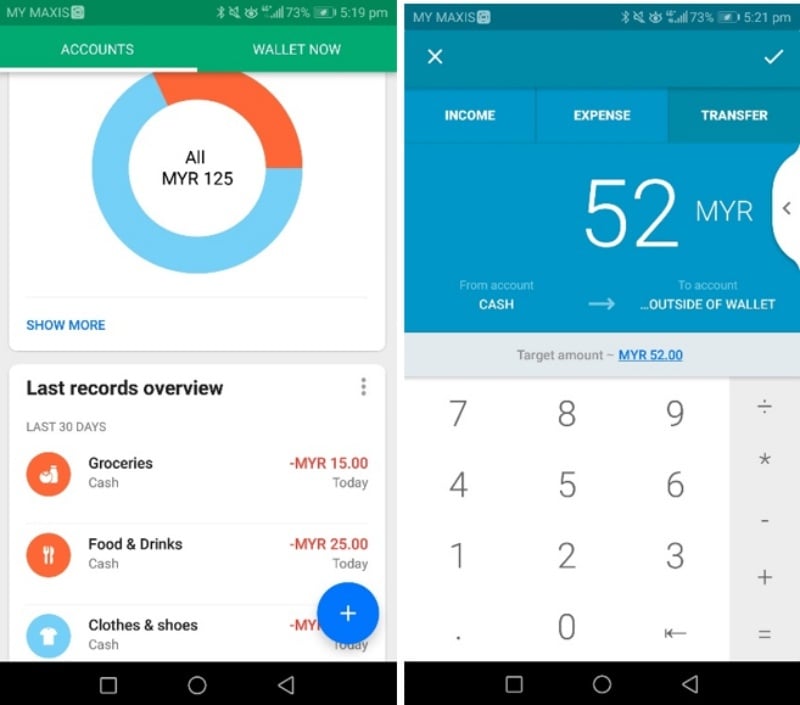

Wallet

If all you want is just an app to track your spending, Wallet is a good choice. Sure, it has the bells and whistles like bank sync and budget setting capabilities, but you don’t need to set those up and still have a great overview of your spending habits.

With Wallet, you’ll be able to plan, manage, and get personal finance reports that break down your spending pattern for the specified time frame. It also supports multiple currencies and even of course, set savings goals for the future.

Another special feature is that you’ll be able to upload your Loyalty or Reward cards to track on your special rewards and points. Overall one of the handiest free finance managing apps there is out there! The Premium version just unlocks more accounts, bank sync, as well as advanced charts and reports for the power user.

Price: Free, Premium subscription from RM3.92/month

Availability:

Apple App Store, Google Play

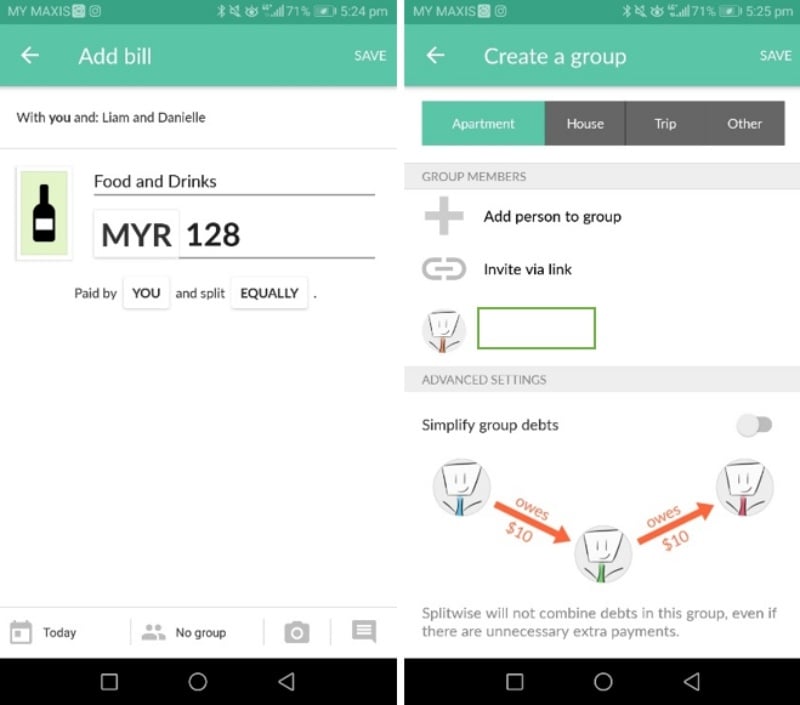

Splitwise

Splitwise is a very convenient app that helps you and your peers/ roomies split bills or rental fees fairly. It also offers features like an email reminder to alert you to pay up your debts. You’ll first need to create groups with your friends and key in the amount that was spent and split it among the amount of people that are supposed to chip in with. You will then see the balance on your own smartphone screen and resolve the debt when you have paid, so it alerts the main payee you have paid your part. All you have to do is have your friends download the Splitwise app then you won’t need to keep reminding them to pay up, because what’s more awkward than poking at someone to settle debt!

Price: Free, In-App Purchase (RM 3.90 – RM 117.99 per item)

Availability:

Apple App Store, Google Play

There’s an app for that…

With millions of apps available in both the Apple App Store and Google Play Store, there’s almost an app for everything you possibly could need. The apps listed here are some of the most popular ones, but there are plenty others that you may prefer. Most of the apps may look cluttered and complicated at first, but once you get the hang of it, you’ll likely find one that is simple and useful enough for your needs. Have an app that isn’t mentioned here? Let us know in the comments section below!

Comments (0)