Alex Cheong Pui Yin

24th July 2023 - 4 min read

(Update on 25 July 2023: Boost has amended its FAQ with a change to the profit/interest charge of the PayFlex feature.)

Boost is finally rolling out its long-awaited Mastercard prepaid card, although only to a small pool of selected Boost Premium Wallet users for now. Known as the Boost Beyond Card, it will allow you to make both online and offline payments at any Mastercard touchpoints worldwide, using either your Boost Wallet balance or an additional Boost PayFlex feature.

According to Boost’s support page, users who successfully apply for the card will be issued a virtual card instantly, and they can begin to use it for their online payments right after – no activation needed. Meanwhile, to get a physical card, you will need to opt in and pay a one-time card issuance fee of RM20.

Boost also highlighted that its prepaid cardholders will be able to choose if they’d like to make card payments via their Boost Wallet or the Boost PayFlex feature. If you choose Boost Wallet as your source of fund, your prepaid card payments will draw from your Boost Wallet balance to make a lump-sum, upfront payment. Meanwhile, the Boost PayFlex feature allows you to defer the payment of your purchases for 30 days, or split your payments into instalments over a specified period – similar to the buy-now-pay-later (BNPL) payment method – as long as it is within your allowed PayFlex credit limit.

At present, the PayFlex feature – which is shariah-compliant – will automatically split your payment into three instalments, but there are plans to add additional instalment options with a longer instalment cycle in the near future. Do also be aware that there are fees to use this feature, as indicated below:

| PayFlex payment options | Applicable fees |

| Pay in 30 days | – Wakalah fee: 4% of your transaction amount, or RM5, whichever higher (capped at RM10 per transaction) – Late payment charges: 1% p.a. (calculated on daily basis) |

| Pay in instalments | – Wakalah fee: RM10 flat per transaction – Profit/Interest rate: 2.5% charge on transaction amount – Late payment charges: 1% p.a. (calculated on daily basis) |

If you’d like to tap into Boost Payflex for your Boost Beyond Card, you’re required to first register for PayFlex through your Boost app. Here’s a video tutorial from Boost to help you out:

Meanwhile, if you’re using the Boost Beyond Card to make payments while travelling abroad or making overseas purchases, note that there is an overseas transaction fee of up to 2% of the transaction amount. To use your card abroad or for cross-border transactions, you’ll have to enable the “International Payments” function for your card ahead of time (can be done in the “Card Settings” section).

Finally, note that the Boost Beyond Card currently does not allow ATM withdrawals. However, Boost plans to enable support for this in the future.

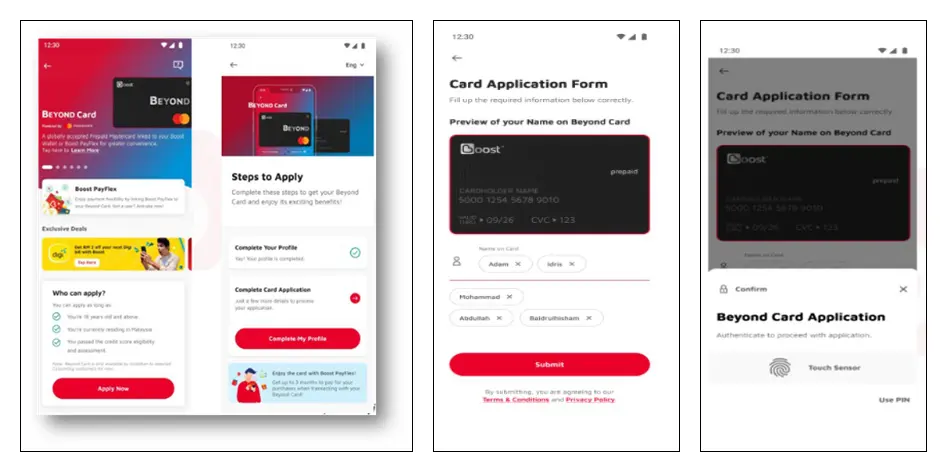

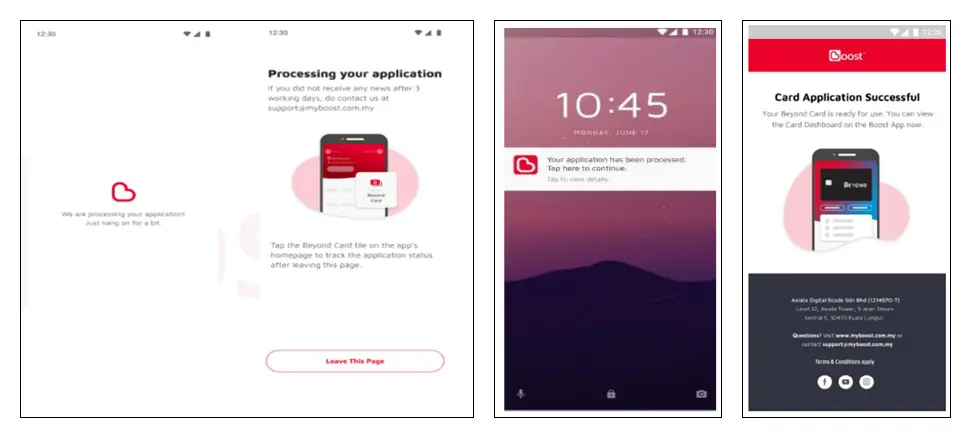

If you’re one of the lucky ones who have been selected to try out the Boost Beyond Card, you can go ahead and apply for the card from your Boost app dashboard. Simply click on the “Beyond Card” tile, followed by “Apply Now”, and then fill in all the required details. Once you’ve made all the necessary payments (where applicable) and submitted your form, your card application will take up to three working days to be processed. If your application is successful, you’ll be notified via the Boost app and email.

Boost said that it expects to roll out the Boost Beyond Card to more eligible users in the future, but no concrete timeline has been shared as of yet. The e-wallet service provider first announced its plans for this prepaid card in partnership with Mastercard back in 2021.

(Source: Boost)

Comments (2)

Join

The Profit Rate on Instalment is 2.5%, not 1.5%