Alex Cheong Pui Yin

26th January 2022 - 3 min read

Boost has shared its ambition to become a full-spectrum fintech player in the upcoming year, with various initiatives in the pipeline to drive it towards its goal. Among other things, the financial service provider will be launching a buy-now-pay-later (BNPL) payment solution, a prepaid card via its partnership with Mastercard, as well as a premium loyalty tier in its BoostUP programme.

With regard to the upcoming BNPL solution, the chief executive officer of Boost, Sheyantha Abeykoon noted that this flexible and interest-free payment option has seen a huge growth over the past year, and Boost has the right “components” to offer it as well. This is especially following the recent rebranding of its fintech holding arm to build itself as a regional financial services powerhouse with four key pillars (Boost Life, Boost Biz, Boost Credit, and Boost Connect).

Specifically, Boost’s BNPL service will tap into the fintech company’s consumer base via Boost Life, and connect them to its merchant base via Boost Biz and Boost Connect. Underwriting capability, meanwhile, will be performed via Boost Credit.

Aside from that, Boost also urged its users to look forward to the launch of a physical and virtual Mastercard prepaid card, thanks to its partnership with the payment service provider. Boost had actually already announced this back in early December 2021, saying that the introduction of the prepaid card is one of several solutions that it hopes to roll out with the help of Mastercard. It also noted that there is a huge opportunity to tap into as approximately 65% of cash in transaction on Boost occurs via online banking.

Additionally, Boost is hoping to further improve its recently refreshed BoostUP programme with a premium loyalty tier that offers exclusive benefits. This is on top of other efforts, such as allowing more flexible redemptions where users can redeem rewards with a combination of Boost Stars and cash.

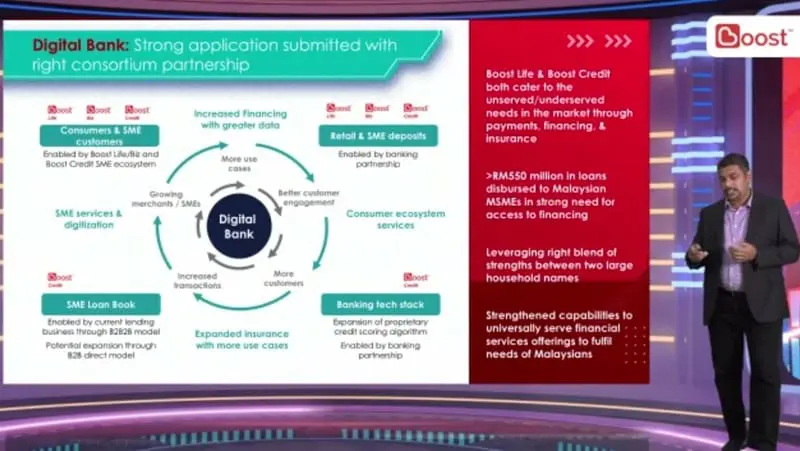

Sheyantha also spoke briefly on Boost’s journey in becoming a digital bank, especially since it is one of the many applicants who are currently vying for the five digital banking licences offered by Bank Negara Malaysia (BNM). He said that Boost already has a strong record in lending and catering to the needs of the unserved or underserved segments through its payments, financing, and insurance services. In fact, it has already disbursed more than RM550 million in loans to local MSMEs. As such, he believes that Boost has the right ecosystem to serve the financial needs of the people as a digital bank.

Outside of these, Boost also highlighted its goal to become a “champion” of small and medium enterprises (SMEs). They aim to achieve this via initiatives such as Boost Makan as well as an e-commerce platform where SMEs can source raw materials at competitive rates.

“We have come a long way from starting our business as an e-wallet, then setting up a lending business with Boost Credit. Today, we have presented a strong proposition as a fintech provider coupled with extensive experience as a scale lender with an e-wallet business and a profitable cross-border payments business. If our digital bank licence bid is successful, it will take our fintech business to the next level, completing our ambition of becoming a full-spectrum fintech player to create an inclusive digital ecosystem for consumers and merchants across the region,” said Sheyantha.

Comments (0)