Jacie Tan

9th April 2021 - 2 min read

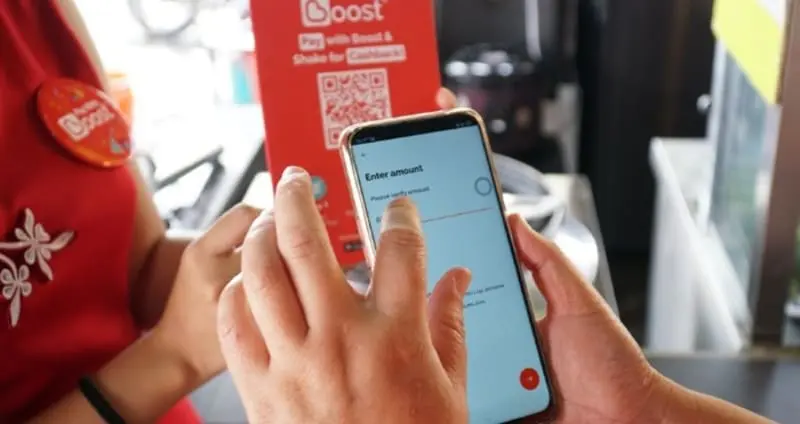

E-wallet app Boost will no longer allow funds sourced from credit card top-ups to be used towards investment purposes. From 28 April onwards, all investments made on Boost will be limited only to funds from online banking or debit card top-ups.

Currently, the Boost app allows users to make investments using the funds in their Boost e-wallet on several different platforms, including HelloGold, Opus, PTPTN SSPN-i, and PTPTN SSPN i-Plus. According to Boost, all of these investment platforms are included in the new policy, as well as any other investment partners in the future.

It is not out of the ordinary for e-wallet companies to take steps to limit or reduce credit card top-ups. BigPay gradually reduced the maximum credit card reload amount from RM10,000 when it first started out to the current cap of RM1,000 per month. BigPay cited the fees charged by credit card companies as the reason behind its current policy. Recently, Grab also released a notice about using GrabPay on unlicensed platforms after cryptocurrency platform Binance announced payment support for e-wallets including GrabPay.

Interestingly, Boost chose to explain the move as a way to help its users minimise risk exposure. “It is safer to invest via online banking or debit card with funds that you own. We want to help you minimise exposure in this uncertain economic situation, allowing you to invest safely,” Boost stated in its notice published on its app.

“We understand the importance of safety and consistently strive to improve our efforts to continuously look after our users,” the notice read before concluding with the hashtag #BoostGotYou.

For reference, HelloGold is a gold exchange platform, Opus is an investment platform offering a money market fund and a bond fund, while SSPN-i is a savings scheme from PTPTN with a 10-year average dividend of more than 4% and has tax benefits.

Comments (0)