Alex Cheong Pui Yin

6th July 2023 - 3 min read

Hong Leong Bank (HLB) has updated its existing HLB Wallet to a new version that not only allows it to be used by adults (aged 18 and above), but also minors (aged 12 to 17). Additionally, selected adult users can upgrade their HLB Wallet to a higher tier called HLB Wallet+ for additional features, such as the multi-currency feature.

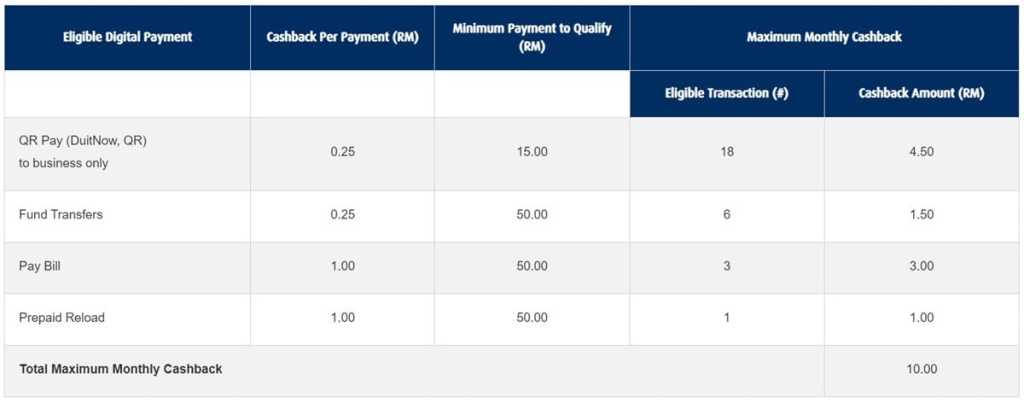

According to bank, the new HLB Wallet will continue to enable users to perform online transactions such as QR payments, bill payments (including JomPAY billers), fund transfers, and prepaid reloads. You can also continue to earn up to RM10 instant cashback per month when you perform selected digital payments with specified minimum amounts, including QR payments, bill payments, and prepaid reloads:

Like before, the HLB Wallet will also be tied to your HLB savings account and HLB Connect access; all HLB customers who apply for a HLB Wallet will be given an account number, a Visa debit card/card-i, and HLB Connect app access. This means that the money in your HLB Wallet is automatically protected by Perbadanan Insurans Deposit Malaysia (PIDM) as well, up to RM250,000 per depositor, and HLB Wallet users can also use the issued debit card to withdraw cash at any HLB automated teller machines (ATMs).

While all the features mentioned above are available on HLB Wallet, there will be some difference in the types of facilities that can be accessed by adult and minor HLB Wallet users. Some key instances include:

| Minors (12 to 17 years old) | Adult users (18 years old and above) | |

| Wallet size | RM2,500 | RM4,999 |

| Features (accessed via HLB Wallet and HLB Connect) | – QR payments – Fund transfers – Bill payments – Prepaid reloads * Total of all transactions via HLB Connect capped at RM200 daily | – QR payments – Fund transfers – Bill payments & JomPAY billers – Prepaid reloads * Users allowed to set their own cap up to a maximum limit specified by HLB |

| HLB Visa debit card (issued with application of HLB Wallet) | – Offline retail purchases – Online retail purchases * Daily limit of RM200 for each category, respectively | – Offline retail purchases – Online retail purchases – Cash withdrawal * Users allowed to set their own cap up to a maximum limit specified by HLB |

| Application for HLB Wallet | – Must be facilitated by parents – Parents must make initial deposit of RM20 for their child/children to activate the HLB Wallet | – User to apply for and activate own HLB Wallet |

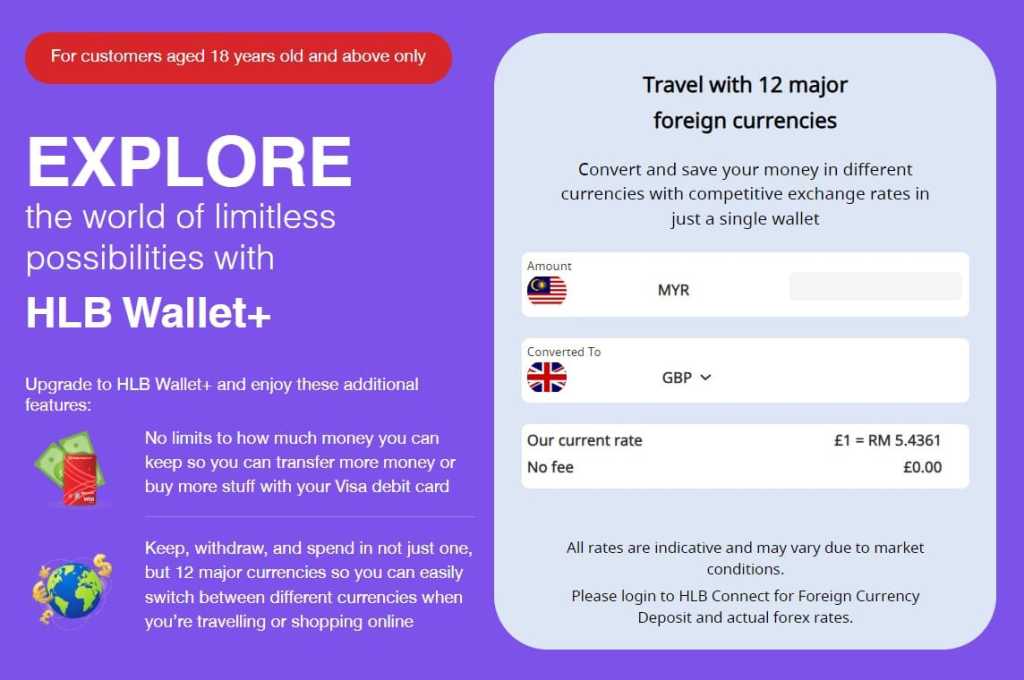

In addition to this basic version of the HLB Wallet, selected adult users can also opt to upgrade their digital wallet to a higher tier called the HLB Wallet+. This tier will give them access to some extra features, namely an unlimited account size and the multi-currency feature. The multi-currency feature allows users to trade or spend in a total of 12 foreign currencies, including US dollar (USD), pound sterling (GBP), Chinese renminbi (CNH), euro (EUR), and Japanese yen (JPY) – which is great if you’re a frequent traveller.

For context, the previous version of HLB Wallet – which was launched early this year – was only open to adult users, and allowed all users access to the multi-currency feature. Back then, it was marketed as “the only multi-currency e-wallet that rewards you with instant cashback for your spending”. The app itself is free to use, but the standard fees and charges for a HLB bank account and debit card will apply.

(Source: HLB)

Comments (0)