Alex Cheong Pui Yin

9th June 2020 - 3 min read

(Image: Business Today)

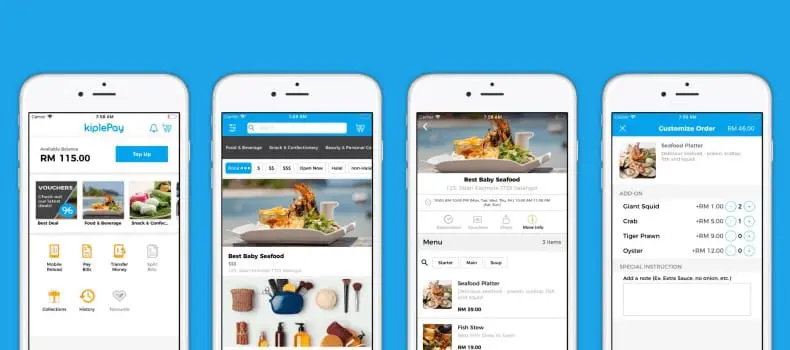

A partnership between KiplePay and Visa has now allowed KiplePay to issue Visa prepaid cards to its users. The company also became the latest to join Visa’s Fintech Fast Track programme.

According to the chief executive officer of KiplePay, Kay Tan, the partnership with Visa is an endorsement of KiplePay’s progress in the fintech industry. It will also allow the payment service provider to further develop its products and solutions for its users.

“Once we issue a Visa prepaid card, we are able to leverage on Visa’s global acceptance footprint. We’re extremely excited to enable both online and offline payments using the 16-digit payment credential to our customers,” said Tan.

Tan added that KiplePay’s vision has always been focused on powering the masses, and that the company has been driving an inclusive cashless agenda across different communities. This ranges from instant disbursement of funds for government aids to powering small merchants and student communities.

(Ng Kong Boon from Visa)

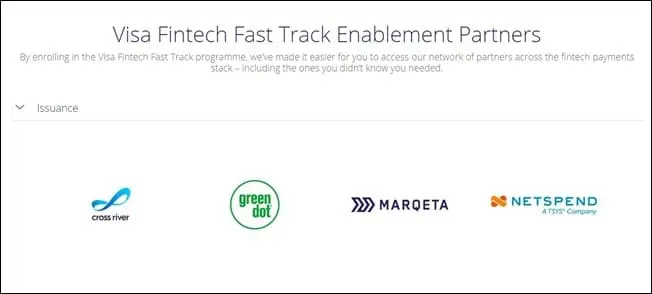

Meanwhile, Visa’s country manager (Malaysia), Ng Kong Boon, said that KiplePay’s enrollment as a partner of its Fintech Fast Track programme and a principal card issuer will enable Visa to reach out to underserved segments in Malaysia. “This is aligned with our objectives and the government’s goal to accelerate the use of digital payments in the country,” he said.

Visa has been actively expanding its Fintech Fast Track programme in Malaysia, encouraging fintech companies to tap into its network to explore new digital payment and commerce opportunities. The programme allows them to access and collaborate with Visa’s network of enablement partners across the fintech payment process, including issuance, push payments, and value-added services.

Through their partnership, KiplePay and Visa aim to enhance their e-wallet products, including money withdrawals and access to 61 million merchants in more than 200 countries. They also plan to use features such as loyalty programmes, mobile discounts, peer-to-peer transfers and personalised e-wallet services to encourage KiplePay customers to make online and offline payments through a single app. Additionally, KiplePay e-wallet users and white label customers will also be allowed to link their e-wallet offerings with a physical or virtual Visa card for a more seamless payment process.

KiplePay, which was founded in 2017, has been working in the present economic climate to bring new payment solutions for the Malaysian public and business community to operate in the “low-touch economy”. Previously, the company has collaborated with Bank Islam to pioneer kipleUNI, an e-payment facilities for universities in Malaysia. It also launched a digital platform initiative with the Coalition of Malay Small Traders to help its traders resume their businesses during the Covid-19 pandemic.

(Source: The Star, The Edge Markets)

Comments (0)