Alex Cheong Pui Yin

5th December 2023 - 3 min read

TNG Digital (TNGD) has officially launched its new Dana Rahmah initiative in partnership with Allianz General Insurance and Yayasan Prihatin Nasional (PRIHATIN), seeking to provide free personal accident (PA) insurance coverage to B40 individuals through public donation and fundraising. Specifically, it aims to raise RM2.8 million to provide coverage for approximately 70,000 eligible individuals.

In a statement, TNGD explained that the public can already use their TNG eWallet to donate to the initiative. The accumulated amount will then be used to purchase plans for those who are in need under Allianz General’s specially designed Group Personal Accident Allianz4All. Each plan is priced at RM40, and offers the following benefits:

- Up to RM30,000 payout for death or permanent disablement due to accident

- Up to RM30 allowance for medical expenses due to any injuries

- Hospital income of up to RM50 per day due to accident (capped at 30 days)

- RM500 funeral expenses

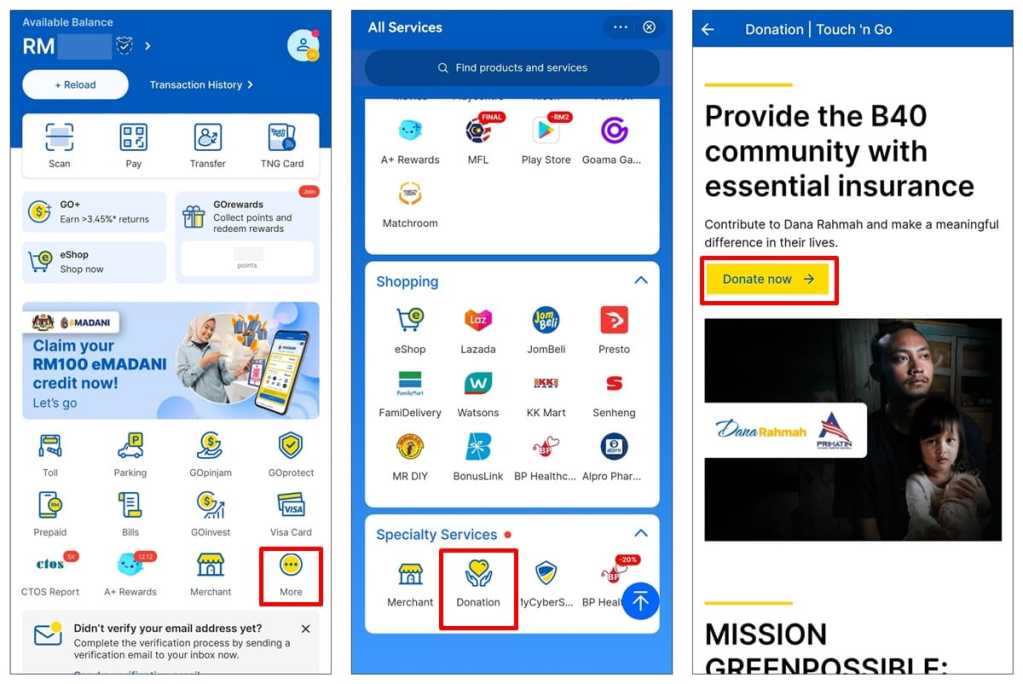

If you’re interested in contributing to this initiative, simply fire up your TNG eWallet app and tap on “More” to view all the services available on your TNG eWallet. Scroll all the way down to “Specialty Services” and tap on “Donation”. You can then click on “Donate Now” to make a direct donation (no minimum donation requirement).

TNGD also noted that donations made towards the Dana Rahmah initiative are eligible for income tax claims. As such, sponsors are advised to keep proper records of their donations to facilitate their tax claim process.

Meanwhile, B40 individuals who would like to apply for the insurance plans sponsored under Dana Rahmah can do so starting from January 2024 via the TNG eWallet app. It will be opened to registered TNG eWallet users with verified accounts, who also meet the B40 eligibility criteria as verified by PRIHATIN.

“At TNGD, we firmly believe in treating people fairly and creating a tangible, positive impact through our accessible financial products. Our mission is to promote financial inclusion and digital equality for all, including enhancing the welfare of those who need them. With the Dana Rahmah initiative, we are leveraging our network of users to crowdsource donations and our technological capabilities to champion Tech 4 Good, by providing insurance coverage to underprivileged B40 individuals alongside our partners,” said the chief executive officer of TNGD, Alan Ni.

Meanwhile, the deputy chief sales officer of Allianz General, Sazali Rahman said that this partnership is one that will greatly help those who are unable to afford insurance. “Malaysians spend less than 2% of our economy’s gross domestic product (GDP) on non-life insurance. This shows that there is a large gap in protection, particularly in the B40 or underserved segment where the insurance spend would be even lower than average,” he said.

Finally, the economic and internationalisation advisor of PRIHATIN, Datuk Abdul Malik Abdullah said that the organisation hopes the initiative will be effective in reaching out and providing sponsored insurance to qualified applicants. He also hopes that more of such programmes, with similar altruistic objectives, can be rolled out in the future.

(Source: TNG Digital [1, 2, 3])

Comments (0)