Alex Cheong Pui Yin

4th January 2024 - 2 min read

Touch ‘n Go (TNG) eWallet has expanded its digital remittance service, GOremit, to now support more than 50 countries. This is up from the initial 10 countries that it encompassed when the feature was first launched back in 2023.

In a statement, TNG eWallet said that the expansion of its GOremit feature came about following requests from users for more international remittance options. As such, they are now able to remit money to Japan, Hong Kong, the UK and various other European countries. Previously, the service only allowed money transfers to selected Southeast Asian countries – like Indonesia, Singapore, and Thailand – and several other countries in the Asian region, such as India and Nepal.

TNG eWallet further emphasised that the remitted money can be conveniently transferred to recipients’ bank accounts, or arranged as cash pick-ups at selected locations. Some countries also allow you to remit money straight to the recipient’s preferred local e-wallet, if the service is supported.

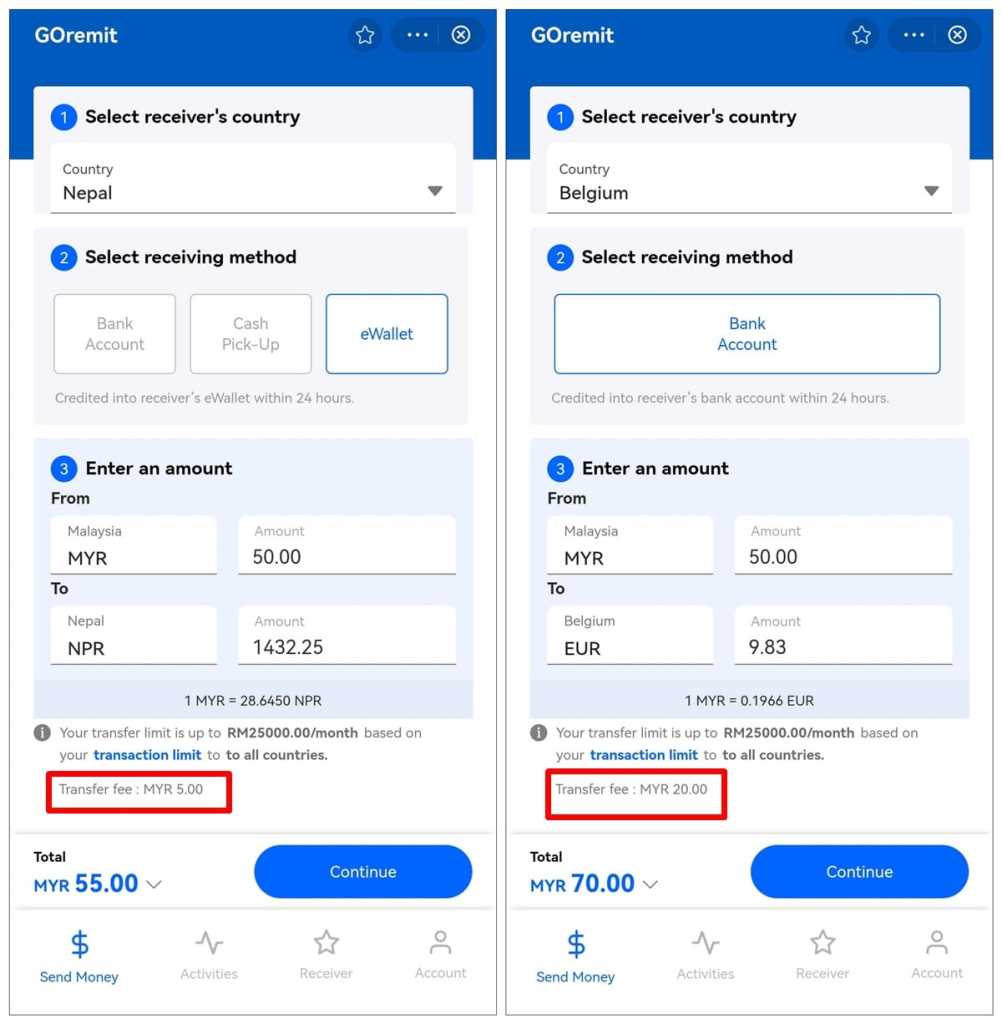

Of course, do note that the transfer fee for your remittances will depend on factors like the recipient’s country and the transfer method that you opt for, ranging from RM5 to RM20. Meanwhile, the minimum transaction amount stands at RM50, while the maximum is set based on your TNG eWallet tier (this service is only available for Pro and Premium users).

Aside from that, TNG eWallet said that users can even earn points for their remittance transactions via the recently revamped GOrewards programme. They can then use the points to redeem cashback vouchers, rewards, and even entries for lucky draws.

Chief executive officer of TNG Digital, Alan Ni said that this expansion for GOremit is expected to address the pain points and hassle that are often associated with international fund transfers.

“This enables our customers to send money with complete confidence and peace of mind. It adds convenience to our users’ lives. All transactions are conducted seamlessly and securely through the eWallet, and users can view their transaction history from a single platform,” Ni said, adding GOremit will be especially useful for customers like students who are studying overseas, foreign domestic workers, and merchants who often carry out international business transactions.

(Source: The Malaysian Reserve)

Comments (0)