Alex Cheong Pui Yin

1st April 2022 - 3 min read

Touch ‘n Go (TNG) eWallet has rolled out a new digital personal loan product, GOpinjam. With this, eligible users will be able to borrow up to RM10,000 with no processing fee, and a flexible repayment period of up to 1 year.

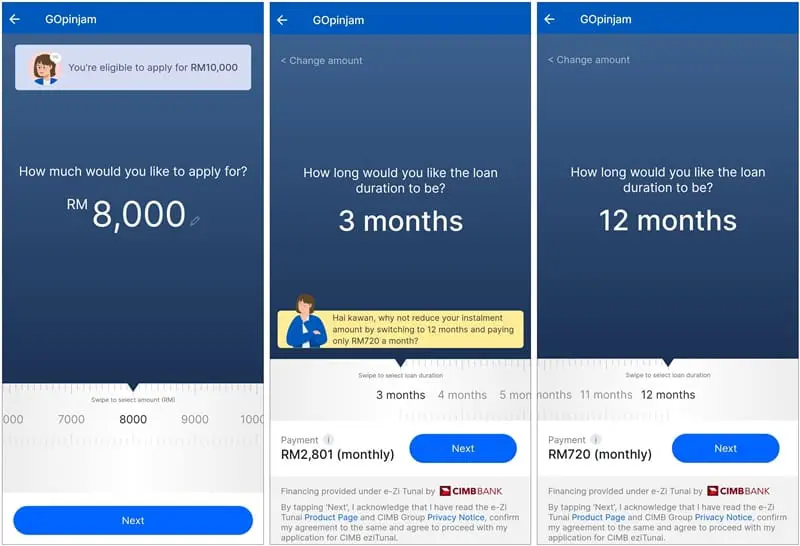

GOpinjam is offered in collaboration with CIMB Bank, with the underlying personal loan product being CIMB e-Zi Tunai. Users will be able to take out a loan amount of between RM100 to RM10,000, depending on their eligibility; each person will be granted a conditional limit – calculated based on their monthly income, credit score, and other factors.

The effective interest rates for GOpinjam, meanwhile, ranges between 8% to 36% p.a., depending on your loan amount and the repayment period selected. The repayment period offered can range between one week to a year. For instance, someone who has a monthly income of RM4,800 may be able to choose a repayment period of between three to twelve months when they opt to take out a loan of RM8,000.

Interestingly, each user is allowed to apply for more than one loan, provided that the cumulative amount of all the loans does not exceed RM10,000 at a time.

To apply for GOpinjam, you need to be a Malaysian citizen aged between 21 to 63 years old, with a minimum monthly income of RM800. If you’d like to check it out, tap on the GOpinjam tile in the main page of your TNG eWallet app, after which it’ll guide you through each step with instruction prompts. You’re also required to verify your identity through the standard electronic Know-Your-Customer (eKYC) procedure, and also upload one of the following supporting documents:

- One-month payslip from your employer

- Full EPF statement showing three months of contribution

- B/BE form e-Filing acknowledgement receipt

From there, it’ll take approximately three working days for approval. Once approval is granted, a push notification will be sent to alert you, and you must acknowledge it as well as enter your TNG eWallet PIN to accept the loan offer. When you’ve confirmed your acceptance, the fund will be disbursed to you in real-time through TNG eWallet or your CIMB/CIMB Islamic Bank account.

As for repayment, you can repay your GOpinjam loan via the TNG eWallet, online instant transfer, or at any CIMB branch or CIMB cash deposit machine. There is a late payment charge of 1% on outstanding instalments if you fail to repay in time, and TNG also said that it may utilise the available balance in your eWallet to cover the overdue amount in such situations.

Finally, note that the underlying loan product for GOpinjam, CIMB e-Zi Tunai, is not a shariah-compliant product. TNG eWallet does state, however, that it is looking to introduce an Islamic financing product soon.

(Source: TNG eWallet)

Comments (8)

Hello good afternoon I just want to ask if how to avail the touch n go loan ??

Thanks

Login to your Touch ‘n Go App and simply tap to apply for GoPinjam. =)

Kenapa sy nk calculate income sy pn xboleh? Sy letak 3k dy ckp sorry unble to proceed? Sy letak 10k pn xblh jgk

saya dah apply hampir seminggu. sampai sekarang tiada jawapan

I haven’t received any notification.. it has been 7day since i registered gopinjam… When will they approve my submission?

They never will. I applied on the day they launched GoPinjam and I’m yet to receive any notification for the approval or rejection. It’s worthless and a waste of time. Just save up to buy whatever you plan on buying my man. This bs isn’t worth it. I applied for a very small amount and it took so long that I just don’t give a shit anymore haha.

dah approve ke

I punya dah approved . You guys kena contact CIMB and update dgn dorang tiap ii hari