Alex Cheong Pui Yin

21st July 2023 - 3 min read

Touch ‘n Go (TNG) eWallet has upgraded its WalletSafe insurance feature, which now comes with two plan options that you can choose from: the Basic Plan and Pro Plan. Some new and enhanced features that you can tap into include a death benefit of up to 20x of your TNG eWallet account balance (due to accidents), additional payouts for deaths due to road accidents or public transport, as well as protection against wallet/mobile device theft and unauthorised card transactions due to theft.

Underwritten by AIA General Berhad, here are the full benefits of the WalletSafe Basic Plan and Pro Plan laid out for your convenience:

| WalletSafe Basic Plan | WalletSafe Pro Plan | |

| Premium (for 6-month plan) | RM1 | RM6 |

| Unauthorised transactions for TNG eWallet* * Inclusive of unauthorised GO+ transactions, but not capital investment in GO+ | Up to RM25,000 | Up to RM25,000 |

| Death due to accidents | 10x of your TNG account balance (up to RM25,000) | 20x of your TNG account balance (up to RM50,000) |

| Additional payout if death is due to road accidents or public transport | 10x of your TNG account balance (up to RM25,000) | 20x of your TNG account balance (up to RM50,000) |

| Unauthorised card payments due to theft | N/A | Up to RM1,500 |

| Theft of personal belongings (wallet and mobile devices) | N/A | Up to RM1,000 |

For those who are familiar with WalletSafe, you’ll probably recognise that the Basic Plan is actually a revised version of the original WalletSafe, which offered coverage for the following:

- Unauthorised transactions for TNG eWallet (up to RM25,000)

- Death due to accidents (up to 10x of your TNG eWallet account balance)

- Death due to Covid-19 (up to 10x of your TNG eWallet account balance).

According to TNG eWallet’s FAQ for WalletSafe, however, this earlier plan has been terminated as of 20 July 2023, and therefore is no longer available for purchase. For those who purchased the original WalletSafe cover before 20 July, the previous benefits will continue to apply until the expiry of your insurance certificate. You can, however, opt to switch over to one of the new WalletSafe plans if you prefer.

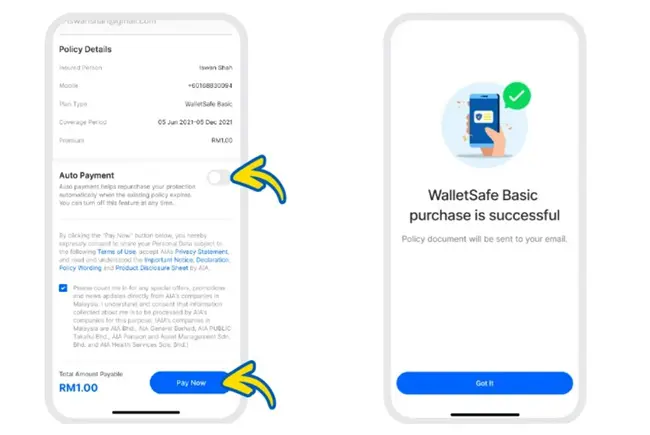

Meanwhile, TNG eWallet users who have never subscribed to WalletSafe before, but are now interested, can do so by tapping on the “GOprotect” tile on the homepage of their app, and then choose “WalletSafe”. You’ll then be guided along the way to purchase your insurance plan.

Once you’ve completed the payment via your TNG eWallet, a confirmation email will be sent to you, containing details such as your certificate number, effective date, and expiry date. You’ll also receive your e-certificate through this email.

Finally, note that as was the case before, WalletSafe is applicable only to users aged between 18 to 70 years old who have verified TNG eWallet accounts. This means that you must first go through the electronic Know Your Customer (eKYC) process to verify your account before you can purchase your plan. Do also be aware that you’re only allowed to purchase one WalletSafe plan per account, and cannot purchase the plan for another person.

(Source: TNG eWallet)

Comments (0)