Alex Cheong Pui Yin

24th August 2023 - 3 min read

Touch ‘n Go (TNG) has rolled out a personal accident insurance via its TNG eWallet called ParkInsure, which provides monthly coverage to protect against misfortunes that could happen at parking areas – provided you use a linked TNG card to enter the compound. These include accidental deaths, permanent disablement, forcible car break-ins, and snatch thefts – among other things.

ParkInsure is available as either a conventional insurance or a takaful plan, underwritten by Allianz General Insurance and Zurich General Takaful Malaysia, respectively. Depending on your preferred plan, there are some differences in the benefits that you are entitled to, as can be seen below:

| Benefits | ParkInsure coverage (conventional insurance by Allianz General) | ParkInsure coverage (takaful plan by Zurich General Takaful) |

| Accidental death/permanent disablement | RM70,000 | RM70,000 |

| Snatch theft inconvenience benefit | RM1,500 | RM1,500 |

| Forcible car break-in | RM1,500 | RM1,000 |

| Key reimbursement | RM100 | RM200 |

| Car accident | Not applicable | RM200 |

| Transport allowance (transport charges for trip to hospital due to an accident) | RM200 | Not applicable |

| Reimbursement for loss of enhanced TNG NFC Card (due to snatch thefts or car break-ins) | RM10 | Not applicable |

Both plans cost RM5 per month (not including the 6% sales and services tax (SST)), and will be renewed on a monthly basis; payment will be deducted from your TNG eWallet each month, two days prior to the expiry of your chosen plan. Do also be aware that you can only purchase these ParkInsure plans for yourself as the subscriber and the insured must be the same person.

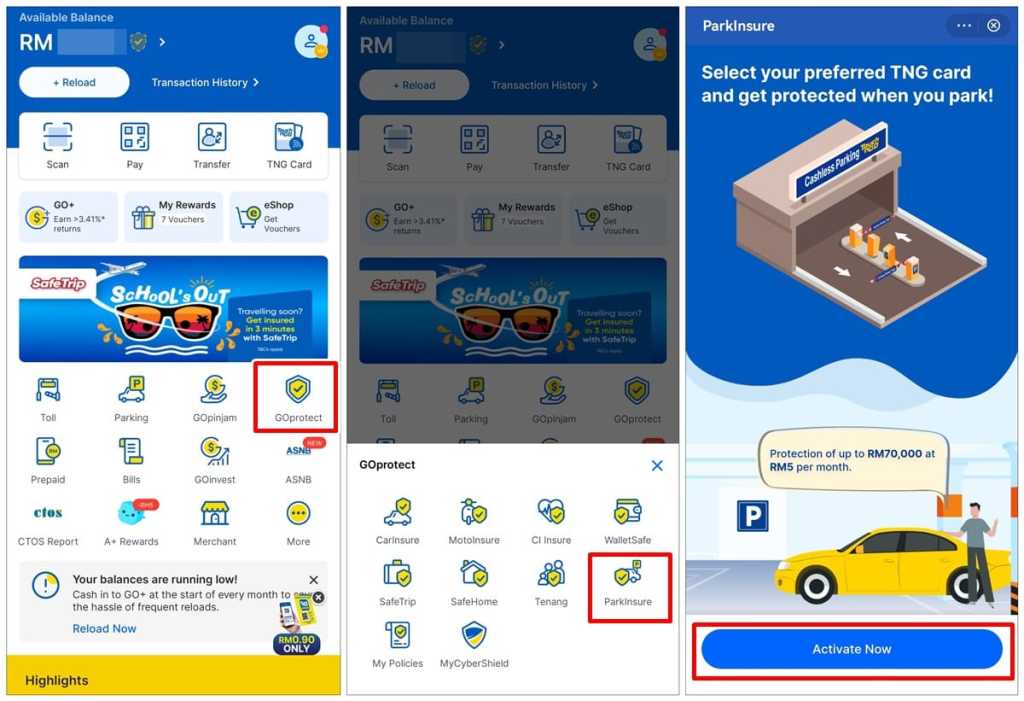

To purchase the plans, tap on the GOprotect tile, followed by ParkInsure. From there, you’ll be prompted to choose a TNG card from your eWallet account to link to the plan; remember, you must use this linked card to enter parking areas if you wish to enjoy the coverage offered by your ParkInsure plan – otherwise, you will not be protected. Also, note that you cannot remove or unlink the TNG card from ParkInsure during the plan coverage period (except for lost, stolen, or expired cards).

After making your payment, you will receive a confirmation email from TNG to let you know that your purchase has been successful. Your policy and takaful certificate, meanwhile, can be accessed from the “My Policies” tab in your TNG eWallet. In the event of an unfortunate event, policyholders can submit their claims through the insurers’ hotline within 30 days after filing a police report within 24 hours.

Chief executive officer of TNG Digital, Alan Ni shared that the introduction of ParkInsure is meant to serve as an extension to the usual motor insurance. “No matter how careful or vigilant people are, mishaps and unforeseen circumstances can happen, and they need to have adequate financial resources to get the necessary help at the crucial time,” he commented.

(Source: TNG eWallet)

Comments (0)