Pang Tun Yau

15th January 2020 - 2 min read

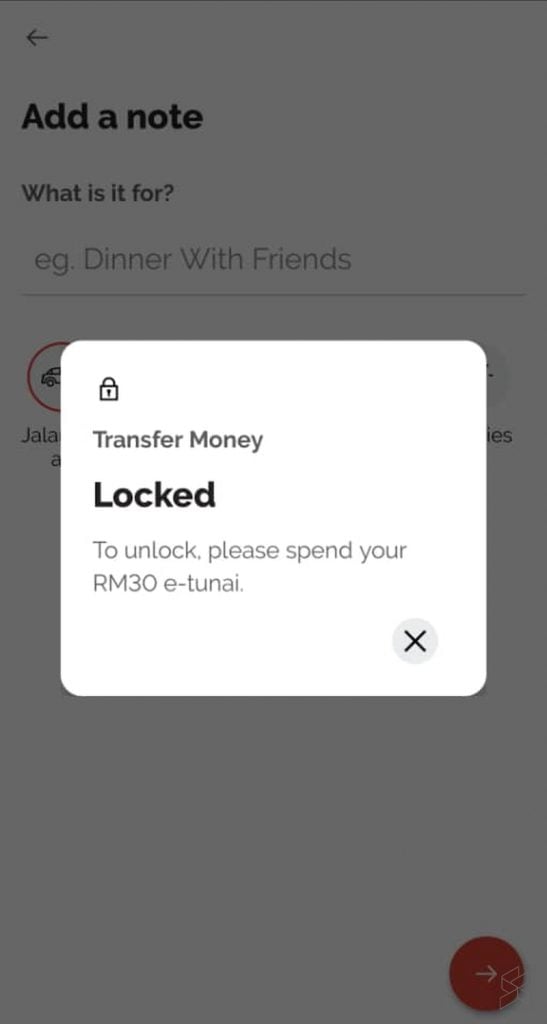

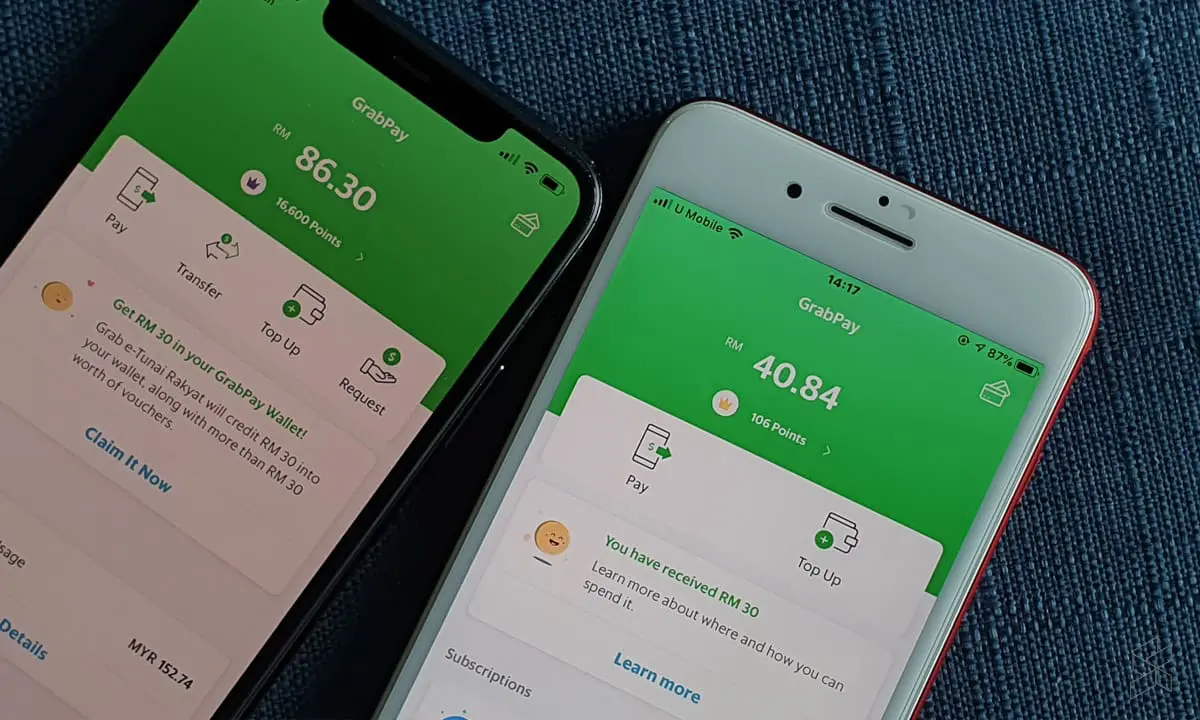

Malaysians who have received the RM30 e-wallet credit as part of the e-Tunai Rakyat initiative will find that the e-wallet’s peer-to-peer (P2P) funds transfer feature is locked until they have used up the RM30 credit.

First spotted by SoyaCincau, the imposed lock appears to be the quickest way to ensure that Malaysians use the RM30 credit and not transfer the credit out to a friend or even a bank account (which is possible on Boost). This fact was stressed several times since Budget 2020, that the RM30 credit was to be consumed by using e-wallets.

On Grab, the “Transfer” feature is removed completely for those who received their RM30 e-Tunai Rakyat credit. Boost, on the other hand, only locks the feature when a user with RM30 e-Tunai Rakyat credit attempts a P2P transfer. We expect TNG eWallet will display a similar behaviour. A Facebook user has revealed that P2P transfers will not be disabled on TNG eWallet. It looks like the e-wallet is able to separate the e-Tunai Rakyat credit from the user’s own credit, and so the P2P transfer can be used only for the user’s credit (and not the RM30 e-Tunai credit).

(Source: SoyaCincau)

(Source: SoyaCincau)

While we cannot confirm this ourselves since our RM30 credit still haven’t been credited to our e-wallets, numerous users have confirmed this on social media.

In a response to SoyaCincau, Grab states that the Transfer and Request features will be restored once the RM30 credit has been fully utilised. To assist users, the Grab app will also display a user’s remaining e-Tunai Rakyat credit and its expiry date.

Nevertheless, since this affects all three e-wallets, it should not affect your decision for which e-wallet to claim your e-Tunai Rakyat RM30 credit from. If you are still undecided, here’s what Boost, Grab, and TNG eWallet are offering as additional perks if you choose their e-wallet.

(Source: SoyaCincau)

Comments (0)