Alex Cheong Pui Yin

4th December 2020 - 4 min read

Boost has added two new micro-insurance plans to its existing offerings, namely GeneralProtect and LifeProtect. Intended as an extension to the #BoostGotYou “Stay At Home” edition campaign which was launched last month, the plans also comes with a unique payment feature, allowing you to purchase them with Boost Coins instead of actual currency.

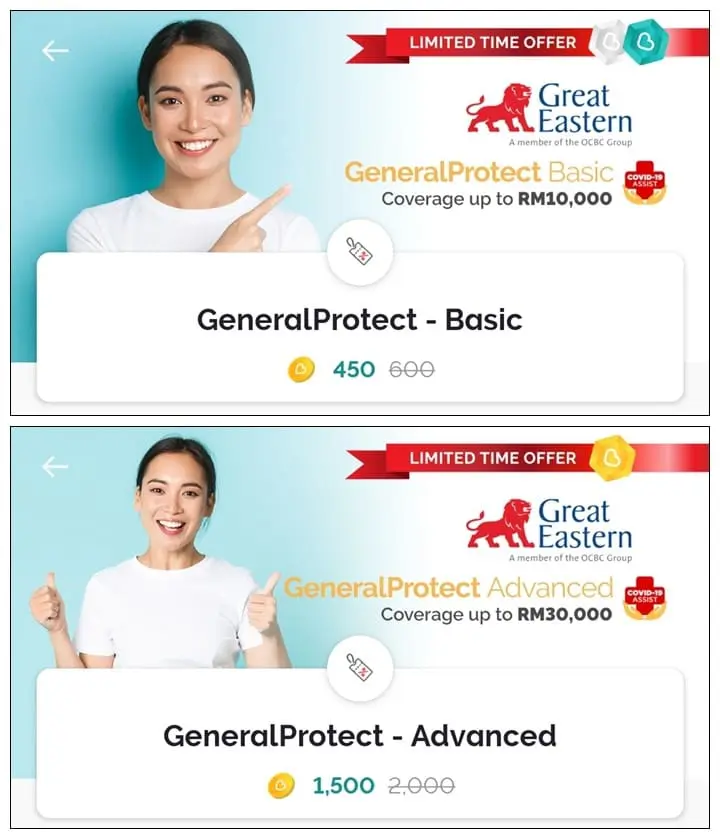

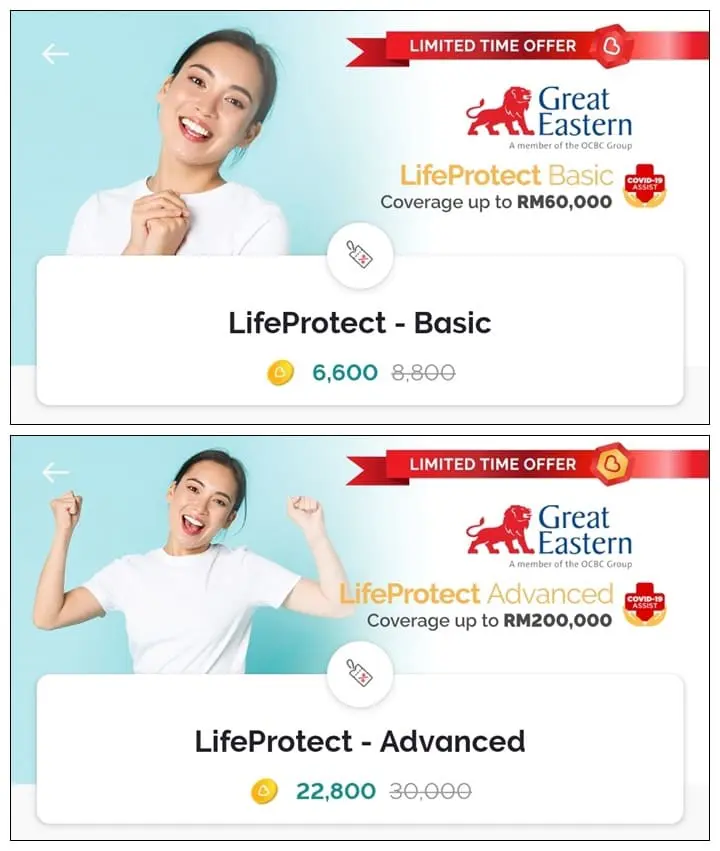

Boost’s new GeneralProtect and LifeProtect micro-insurance plans – which are underwritten by Great Eastern – come in Basic and Advanced packages.

The GeneralProtect plan is a monthly policy that provides 24-hour worldwide personal accident coverage. Open to individuals aged between 18 to 65 years old, the benefits of the Basic and Advanced packages for the GeneralProtect Plan include:

| GeneralProtect Basic | GeneralProtect Advanced |

| – Sum insured of RM5,000 upon accidental death

– Sum insured of RM5,000 in the event of permanent disablement due to accident – Sum insured of RM10,000 for accidental death while travelling in public transportation

|

– Sum insured of RM15,000 upon accidental death

– Sum insured of RM15,000 in the event of permanent disablement due to accident – Sum insured of RM30,000 for accidental death while travelling in public transportation – Reimbursement of up to RM200 for in the event of snatch theft |

Meanwhile, the LifeProtect plan is a one-year term policy available to those between the age of 18 to 59 years old, with the following benefits:

| LifeProtect Basic | LifeProtect Advanced |

| – Sum assured of RM30,000 in the event of major head trauma, coma, blindness, and loss of speech and hearing

– Sum assured of RM30,000 upon accidental death – Sum assured of RM60,000 for accidental death while travelling in private transportation – Reimbursement of up to RM1,000 for medical expenses incurred due to accident |

– Sum assured of RM100,000 in the event of major head trauma, coma, blindness, and loss of speech and hearing

– Sum assured of RM100,000 upon accidental death – Sum assured of RM200,000 for accidental death while travelling in private transportation – Reimbursement of up to RM2,500 for medical expenses incurred due to accident |

Both plans also come with the additional Covid-19 Assist coverage, a bonus protection that entitles you to RM200 daily hospitalisation cash per day (up to 60 days) if you’re diagnosed with Covid-19. You will also get a death benefit of RM20,000 upon death due to the coronavirus.

Most interesting of all, though, is that you can purchase these plans by exchanging Boost Coins for them instead of using actual currency – which is a first for this e-wallet. In fact, Boost is currently offering a discounted rate for users who purchase the new plans from now until 31 December 2020, with the following “prices”:

- GeneralProtect Basic: 450 Boost Coins per month (Normal: 600 Boost Coins)

- GeneralProtect Advanced: 1,500 Boost Coins per month (Normal: 2,000 Boost Coins)

- LifeProtect Basic: 6,600 Boost Coins (Normal: 8,800 Boost Coins)

- LifeProtect Advanced: 22,800 Boost Coins (Normal: 30,000 Boost Coins)

Note that the prices listed above for the LifeProtect plan (Basic and Advanced) include an advanced payment of the first three months of premium. The LifeProtect plan itself is subject to a monthly payment of Boost Coins subsequently (2,200 and 7,600 Boost Coins per month for Basic and Advanced, respectively).

(Image: The Star)

The chief executive officer of Boost, Mohd Khairil Abdullah commented that Boost is committed to do what it can to contribute to the Malaysian society during the current challenging period. “The provision of micro-insurance coverage is just the start of what we plan to do with digital financial services through our e-wallet platform. We have bigger plans to further expand on this service over the next couple of years,” he said.

To check out these new micro-insurance plans by Boost, you can tap into the “Insurance” tile in the app, or head on over to the BoostUP Rewards section.

Comments (0)