Alex Cheong Pui Yin

21st June 2022 - 3 min read

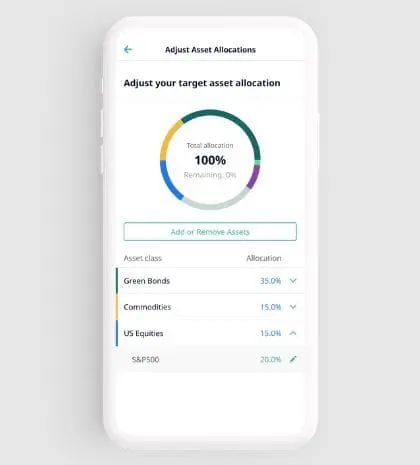

Wealth management platform StashAway has officially launched its Flexible Portfolios feature for all investors, allowing them to customise their own unique portfolio by picking their preferred asset classes and adjusting the allocations. It is the first of such products to be introduced in Malaysia.

With this, StashAway investors will be able to choose from a list of curated exchange-traded funds (ETFs) that represent more than 55 different asset classes. Among others, you’ll be able to select from options such as the S&P500, Nasdaq100, REITs, Gold, Emerging Markets, Blockchain – with underlying ETFs from global fund managers like Vanguard, ARK, and iShares.

Note, though, that you must allocate a minimum of 3% for each selected asset class within your Flexible Portfolio, although there is no minimum investment amount requirement. You are also required to keep at least 1% of your assets in cash for rebalancing and any necessary platform fees.

Aside from that, StashAway will help to calculate the risk level of its investors’ Flexible Portfolios, ensuring that they know exactly how much risk they are taking as they carry out their customisation.

The robo advisor further clarified that it will help you to rebalance your portfolio when your asset allocation changes due to market fluctuations or other factors. “When market changes influence the asset allocation of your portfolio, we will re-align it to its target proportion (weightage) by buying and/or selling specific assets. Your portfolio is also rebalanced when you make a deposit, request a partial withdrawal, or make a change in the allocations within your portfolio,” it noted in the FAQ for the new feature.

However, StashAway will not reoptimise your Flexible Portfolio for you even if there are changes in economic conditions. Instead, it will notify you if there are major changes to your portfolio’s risk level, and it falls upon you to make the necessary adjustments so that your portfolio still meets your needs and risk appetite.

As for fees, there will be the usual management charges of between 0.2% p.a. to 0.8% p.a. (depending on your investment amount), and no subscription, switching or rebalancing fees. Unfortunately, users are currently unable to convert an existing portfolio to Flexible Portfolio, but StashAway said that it is working to make the customisation experience even more flexible.

Country manager of StashAway Malaysia, Wong Wai Ken said that the launch of Flexible Portfolio is timely as it is a function that was highly requested by its users. “We really value feedback from our investors, and many were keen to create or customise their own portfolios according to their risk appetites. We are excited that our clients are becoming more and more savvy as they invest with us, and are pleased to enable them to have a say while we still deliver on two of our core values: investment intelligence and risk management,” he said.

StashAway’s Flexible Portfolio had actually already been rolled out earlier back in May 2022, but it was only made accessible to small pool of selected investors in a beta run then. Now, with the official introduction of the feature, StashAway is offering a launch promo that waives the management fees on any fresh funds deposited into any Flexible Portfolios. Investors will be able to take advantage of this promo for up to a year, all the way until 30 June 2023.

(Sources: StashAway, FintechNews Malaysia)

Comments (0)