Jacie Tan

9th July 2021 - 2 min read

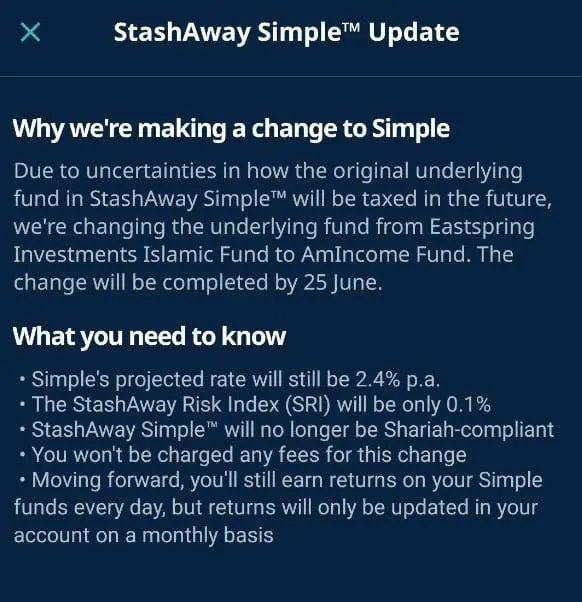

StashAway has changed the underlying fund for StashAway Simple from Eastspring Investments Islamic Fund to AmIncome Fund.

“Due to uncertainties in how the original underlying fund in StashAway Simple will be taxed in the future, we’re changing the underlying fund from Eastspring Investments Islamic Fund to AmIncome Fund,” said StashAway in a notice in its app. This is the first time StashAway has switched its underlying fund since introducing the Simple product and the switch was completed at the end of June.

According to StashAway, Simple’s projected rate will remain unchanged at 2.4%p.a. and users will not be charged any fees for the switch. However, there are several other changes that arise as a result of the switching of funds.

Most notably, StashAway Simple will no longer be Shariah-compliant – unlike the previous underlying fund, AmIncome Fund is not Shariah-compliant. Furthermore, the StashAway Risk Index (SRI) for Simple will now only be 0.1%; when StashAway Simple was first introduced with Eastspring as its underlying fund, the SRI was at about 1.8%.

StashAway also stated that moving forward, you will still earn returns on your Simple funds every day, but the returns will only be updated in your account on a monthly basis.

Comments (0)