Alex Cheong Pui Yin

9th May 2022 - 3 min read

Versa has introduced a new investment solution, Versa Invest, which is said to provide users with “higher potential returns” than its existing cash management solution, Versa Cash. Managed by asset management firm, Affin Hwang, it offers three portfolios to meet the varying risk appetite of its users.

Specifically, the three portfolios provided under Versa Invest are Versa Conservative, Versa Moderate, and Versa Growth – each meant to cater to different investment goals and risk preferences. At present, however, only Versa Moderate and Versa Growth are available for investment; Versa Conservative is expected to be rolled out at a later date.

The Versa Moderate portfolio is described as a “balanced portfolio [that is] suited for mid to long-term goals”, whereas Versa Growth is “crafted for longer term, [with] high risk for higher potential returns”. According to Versa, each portfolio will let you invest in over 250 global companies.

Here are some key details about both portfolio:

| Portfolio | Average annual return over past three years | Allocation | Examples of companies included in portfolio |

| Versa Moderate | 9.1% p.a. | – 32% equity – 67% bond – 1% cash | – Alphabet – Amazon – Apple – BNP Paribas – Haier – Microsoft – Tencent – Tesla |

| Versa Growth | 15.7% p.a. | – 60% equity – 38% bond – 2% cash | – Alphabet – Amazon – Apple – Microsoft – Moderna – Nvidia – Tencent – Tesla |

Versa also highlighted that investors will be growing their wealth with top fund managers from well-known fund houses such as Baillie Gifford, Blackrock, Nikko, and Allianz Investment. The minimum entry requirement to invest with Versa Invest is set at a low RM100, with no sales and withdrawal fees charged. There is, however, an annual management fee of 1% p.a., a trustee fee of 0.04% per annum, as well as fund level fees of 0.6% to 0.76% p.a..

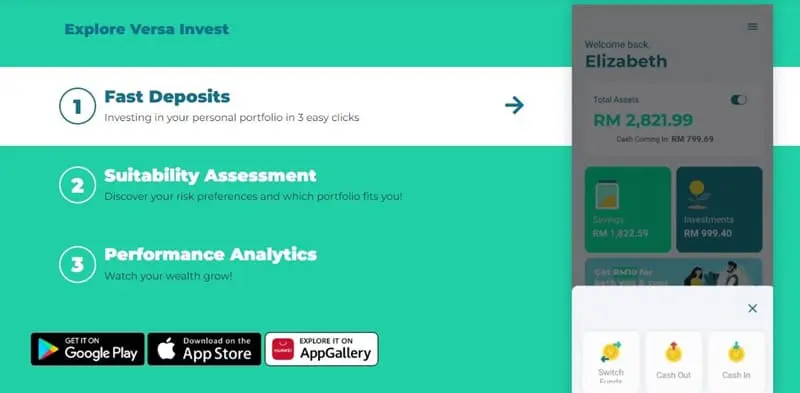

If you’re interested to check out the new Versa Invest, you can access the feature via the Versa app. Upon logging into your account, you’ll need to complete a Suitability Assessment, where you’re required to key in some basic information about yourself, including your current age and annual income, investment horizon, and expected returns. Versa Invest will then help you to build your risk profile, after which you can choose the fund that you wish to invest in. Confirm and deposit your preferred investment amount, and you’re done!

Versa further noted that current Versa users can make use of the Switch function if they want. It allows them to seamlessly transfer funds from their existing cash management portfolio in Versa Cash to Versa Invest with no transfer fees.

Prior to this, Versa only has Versa Cash, which allows Malaysians to tap into money market funds and earn interest rates of up to 2.46% p.a.. With the launch of Versa Invest, Versa now features a model that is similar to many other robo-advisors and digital investment apps, where they also have a cash management function and an investment function. Examples include StashAway (StashAway and StashAway Simple) as well as KDI (KDI Save and KDI Invest).

(Source: Versa)

Comments (0)