Alex Cheong Pui Yin

9th July 2021 - 2 min read

Wahed Invest has launched its Wahed FTSE USA Shariah ETF (HLAL) in Malaysia, which will provide local investors with exclusive access and passive index exposure to a Shariah-compliant US equities exchange traded fund (ETF).

With this, you will be able to invest in large- and mid-cap firms within the United States, encompassing sectors such as technology, energy, and healthcare. The fund has a total of 219 constituents (as of June 2021), with major names including Apple, Tesla, and Intel. Here’s a list of the top 10 constituents of the fund, along with the net market capitalisation and the weightage that each carries within the fund:

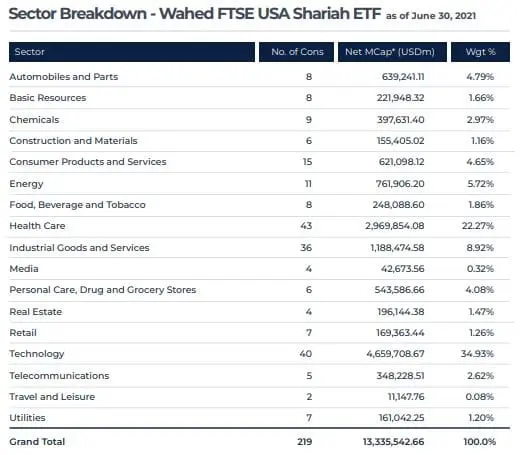

You can also see the sector breakdown of the fund here; the technology sector is a dominating sector with almost 35%, followed by healthcare and industrial goods and services at 22.27% and 8.92%, respectively:

In introducing the fund, Wahed Invest clarified that 97.5% of your investment will be distributed to the Wahed FTSE USA Shariah ETF. The remaining 2.5%, meanwhile, will be allocated as cash. Wahed Invest also noted that the Wahed FTSE USA Shariah ETF is a low-cost fund, with an expense ratio of 0.50%.

Another benefit to the fund is that it uses the FTSE USA Shariah Index as a benchmark index. The FTSE US Shariah Index is one of the world’s leading index that has been fully certified as shariah-compliant through the issue of a fatwa – based off principals determined by its shariah consultant, Yasaar Limited. It essentially monitors the constituents of the parent FTSE USA Index based on their businesses and financial ratios to confirm their shariah status.

The Wahed FTSE USA Shariah ETF (HLAL) had actually first debuted in the United States back in 2019. Listed on Nasdaq, it was Wahed Invest’s first ETF. You can find out more about the fund on Wahed Invest’s website. Alternatively, here’s the latest factsheet of the Wahed FTSE USA Shariah ETF.

(Source: Wahed Invest)

Comments (0)