Jacie Tan

18th June 2020 - 10 min read

The spread of the Covid-19 virus has vastly impacted the health and economic landscapes of countries all over the globe, with Malaysia being no exception. In response to the Covid-19 pandemic, the Malaysian government declared a movement control order (MCO) on 18 March 2020, where all except the most critical economic industries were instructed to shut down.

While most businesses have been allowed to resume operations in May under the subsequent conditional and recovery MCO periods, the effects of the restrictions as well as the pandemic in general have been forecasted to contribute to a decline in economic activity for a prolonged period – or in other words, an economic recession.

What Is A Recession?

A recession is usually characterised as a significant decline in general economic activity in a specific region. The most popular rule-of-thumb definition of a recession was introduced by US economist Julius Shiskin, where a recession is identified by two consecutive quarters of declining gross domestic product (GDP). Other markers of a recession include a decline in real income, employment, industrial production, and wholesale-retail sales.

Recessions In Malaysian History

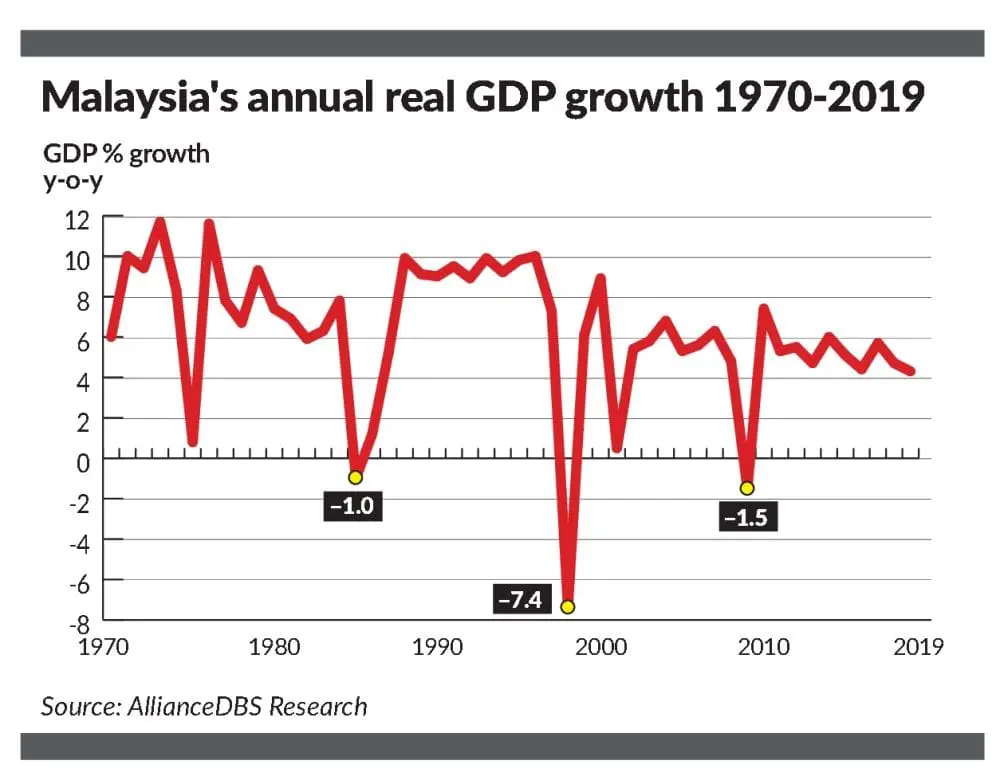

Malaysia has had three significant periods of major economic crises since its independence, each with its own causes, economic impact, and recovery policies.

1985-86: Commodities Shock

Malaysia fell into its first major recession post-independence in 1985, triggered by the US high-interest rate policy (known as the Volker shock) that resulted in a massive collapse of global commodity trade. The nation’s economy contracted by 1% in 1985 and the unemployment rate increased to 8% the year after. The Malaysian government responded with reduced state spending under a contractionary fiscal policy, exchange rate devaluation, and a decided shift towards the private sector. By way of recovery, the current account went into surplus in 1987 and by 1988 the Malaysian economy had entered into its second high-growth phase since independence; however, the public debt overhang continued well into the 1990s.

1997-98: Asian Financial Crisis

The financial crisis that began as a currency crisis in Thailand set off a series of currency devaluations and massive flights of capital from the Asian region, Malaysia included. Net portfolio investments shrank to a deficit of RM12.9 billion in 1997 from a surplus of RM10.3 billion in 1996, the GDP contracted 6.7% in 1998, and the ringgit fell to its lowest of against the US dollar in January 1988. Malaysia fixed the ringgit exchange rate to the US dollar, introduced selective capital controls, and announced a RM2 billion fiscal stimulus package as part of its policy response. Although the economy recorded a positive growth rate in the second quarter of 1999, it only regained its pre-crisis level of GDP by mid-2000.

2008-09: Global Financial Crisis

The global financial crisis was triggered by the bursting of a speculative bubble in the US housing market in 2008, impacting Malaysia in terms of trade and investments. Share prices in Malaysia fell by 20% between 2007 and 2009, a massive exodus of short-term capital flows took place, and exports fell by 45% between July 2008 and January 2009. The economy contracted 1.7% in 2009. The government released two fiscal stimulus programmes amounting to RM67 billion, and responded with expansionary monetary policy with Bank Negara Malaysia cutting interest rates thrice to lower the overnight policy rate to 2%. In response, Malaysia’s GDP growth rebounded to positive territory in the last quarter of 2009.

(Image via: The Star)

Malaysia And Recession In 2020: What It Means For You

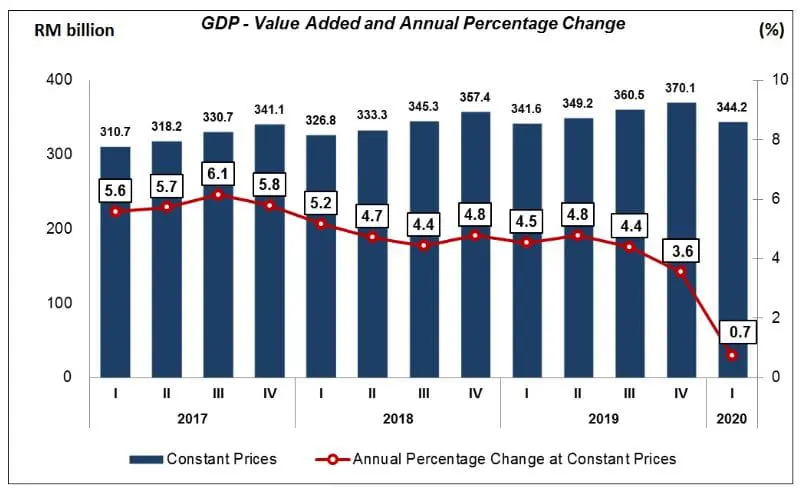

The Department of Statistics Malaysia revealed that Malaysia’s gross domestic product (GDP) grew by 0.7% in Q1 2020, when it was expected to grow between 3.9% to 4.2%. Virtually every economic analyst is forecasting the GDP figures for Q2 2020 to be one of the worst in recent memory – given that this period covers the entire Movement Control Order (MCO) alongside the Conditional and Recovery MCOs where there were barely any economic activity.

If, as expected, the GDP growth goes into negative territory in Q2 2020, Malaysia will only officially enter the official definition of an economic recession if Q3 2020 is also a negative growth quarter.

(Source: Department of Statistics Malaysia)

Despite the best efforts of the government with the multiple economic stimulus packages, it is highly likely that Malaysia will enter an economic recession this year. In April 2020, Bank Negara Malaysia projected Malaysia’s GDP for the year to be between 0.5% and -2%. The Department of Statistics Malaysia forecasted a decline of -1.7%, while the World Bank projected a -0.1% growth.

As a comparison, Malaysia’s GDP growth in 2019 was 4.3% in 2019, and 4.8% in 2018.

So, what does this mean for the everyday Malaysian? What are the effects of a recession and how can they be seen in our daily lives.

Increased unemployment rate

In March 2020, unemployment in Malaysia rose to 3.9%, whereas in April it spiked to 5%, the highest it has been since 1990. It is highly likely that the unemployment rate will keep rising thereafter. During a recession, businesses tend to see less demand as well as reduced output – which leads to the next logical step of cutting back on labour. This can be in the form of laying back on new hires or even retrenching current employees, both of which contribute to high joblessness in the labour market.

If you’re a fresh graduate looking for your first job during the recession, you can expect it to be a little tougher getting hired than normal, whereas current members of the workforce may see their companies downsizing or freezing new hires.

Reduced wage growth

Miniature people businessman standing on calculator and talk to staff about salary and wage increase

During a recession period, it is unlikely that the nation would see a high upward pressure on wage levels. For the same reasons that businesses will be slow to hire as discussed above, employers will also have less room to offer their workers higher wages or salary increases when a recession is ongoing.

In a survey run by the Federation of Malaysian Manufacturers in April, employers revealed that they were likely to take cost-cutting measures in the next 3-6 months, including unpaid leave, removal of non-contractual allowances and benefits, reduction in hours of work per day, and pay cuts. Therefore, besides reduced mobility in the labour market, you can also expect companies to be more cost-sensitive when it comes to offering competitive wages or additional benefits.

Issues with debt servicing

With workers facing unemployment, pay cuts, and unpaid leave, some individuals will find themselves in difficulty when it comes to paying off their existing debt – be it housing, car, and personal financing, or even credit card bills. Generally, debt obligations need to be paid off each month even if your income has been affected during tough times.

However, Bank Negara Malaysia (BNM) has acknowledged the difficulty faced by Malaysians in paying off their loans with the introduction of a six-month automatic bank loan moratorium. All individuals and SMEs were given a six-month automatic deferment for all loans starting April 2020, offering some respite to those who are unable to make their loan repayments due to the Covid-19 pandemic.

Difficulty in building savings

There are several reasons why a recession isn’t conducive to saving. For starters, if your source of income is affected, it is likely that you will find yourself with less money to save at the end of the month. In fact, you may even have to dip into your savings to pay for your necessities and debt obligations.

Moreover, the central bank often carries out overnight policy rate (OPR) cuts to encourage spending and stimulate the economy. While a lower OPR can be beneficial to the consumer in the form of lower interest rates for loans, it also decreases the interest rates for savings accounts and fixed deposits, slowing down the rate at which you can grow your savings. BNM has already slashed the OPR three times this year, with analysts predicting that it will be further reduced to 1.0% by the end of 2020.

What Can You Do To Survive In A Recession?

Take advantage of available initiatives

The arrival of the Covid-19 pandemic impacted the nation hard, which prompted the government and the central bank to introduce a list of initiatives to help those affected as well. To aid the Malaysian economy in the current recovery phase of its six-phase strategy recovery plan, the government has also introduced a list of 40 initiatives as part of its PENJANA economic recovery plan, which include a childcare subsidy, work-from-home tax deductions, and e-wallet credits – among many, many others.

In short, there are various forms of assistance that you can make use of during this economic downturn, so make sure you keep yourself up-to-date and well-informed on them, now and in the near future too.

Upskill for employability

If you are out of a job, you could use this time to upskill yourself in order to become more employable. For example, MDEC has partnered with Coursera to offer unemployed Malaysians 3,800 courses to learn digital and data skills – including professional certificates designed for jobs in high demand under the post Covid-19 normal. Under the PENJANA economic recovery plan, the government has also allocated a fund of RM2 billion to support various upskilling and reskilling programmes through a variety of different avenues. Moreover, you can consider starting a side business on one of Malaysia’s many e-commerce platforms to earn some income to tide you over or help build up your savings.

Make informed decisions

In times like these, it’s more important than ever to keep yourself well-informed and make smart choices, especially when it comes to keeping your finances in check. For example, when BNM announced the automatic moratorium, there was quite a bit of confusion regarding the effects of the deferment on interest calculations, payment amounts, and so on – which we addressed in this article here. Whenever you’re about to make a decision that directly impacts your finances, make sure to do your research and educate yourself on all the implications beforehand.

Use the best financial products

With the lowered OPR and interest rates during the current period, it can be discouraging to see that you’re not earning the same amount of interest on your savings as before. However, this is all the more reason to ensure that your savings account or fixed deposits are offering you the best available rates on the market. You can check out the best high-interest savings accounts or fixed deposit promotions at RinggitPlus and decide to make the switch to immediately earn higher interest rates on your deposits.

And if you don’t already have a reliable cashback credit card, now is the time to look for a good one. Cashback credit cards can save you up to hundreds of Ringgit off your normal expenditure each year, and every sen counts when you’re going through tough times.

***

Hopefully, this article has helped shed a bit more light on what exactly a recession is, its effects on the everyday Malaysian, and the steps you can take to make living through a recession a more manageable affair. If you would like an easy way to stay informed and up-to-date on all things related to finance, drop your email in the orange subscription box at the top of the page and get personal finance updates straight to your inbox.

Comments (0)