Jacie Tan

8th April 2020 - 16 min read

(Image: Bernama)

The Covid-19 pandemic and the accompanying movement control order (MCO) implemented by the Malaysian government has affected individuals, businesses, and the economy alike. However, various parties – from the government to banks and insurance providers – have stepped up to provide Malaysians with various types of financial assistance to minimise the negative impact of the Covid-19 pandemic.

You can look through this list of financial assistance measures available during the ongoing Covid-19 situation and find out more about which types of assistance you could be entitled to.

Covid-19 Financial Assistance For Malaysian Individuals

Bantuan Prihatin Nasional (BPN)

Under the Prihatin Economic Stimulus Package, the government will be giving out one-off cash aids to households earning RM8,000 and below and individuals earning RM4,000 and below.

| Eligible category | Amount of cash aid | Expected recipients | Payment schedule |

| Households earning RM4,000 and below | RM1,600 | Up to 4 million households | Payment of RM1,000 in April and RM600 in May |

| Households earning RM4,001 – RM8,000 | RM1,000 | Up to 1.1 million households | Payment of RM500 in April and RM500 in May |

| Single individuals aged 21 years and above earning RM2,000 and below | RM800 | Up to 3 million individuals | Payment of RM500 in April and RM300 in May |

| Single individuals aged 21 years and above earning RM2,001 to RM4,000 | RM500 | Up to 400,000 individuals | Payment of RM250 in April and RM250 in May |

You can find out everything you need to know about applying for the BPN aid here.

Covid-19 Special Assistance Fund

(Image: The Star)

The government set up a special Covid-19 fund with a RM1 million grant, aimed at providing a RM100 daily allowance to those who are diagnosed or quarantined due to Covid-19. Malaysians who fulfill this criteria may apply if they have lost their source of income or are not being paid during the period of quarantine or treatment.

Those who are eligible may make their applications through the National Disaster Management Agency (NADMA).

6-month electricity bill discount

Tenaga Nasional Berhad (TNB) electricity customers will be able to get discounts on their electricity consumption for a period of six months, from 1 April to 30 September 2020. The amount of discount varies according to the type of consumer you are and your total monthly consumption.

There is no application needed to get this discount; all eligible and registered TNB customers will be given the discount automatically. For residential users, the discount rates are as shown in the table below.

| Monthly usage | Discount |

| 0-200 kWh or up to RM43.60 | 50% |

| 201-300kWh or RM43.70-RM77 | 25% |

| 301-600kWh or RM77.10-RM231.80 | 15% |

| More than 600kWh or RM231.90 and above | 2% |

RM600 monthly allowance for employees on forced unpaid leave

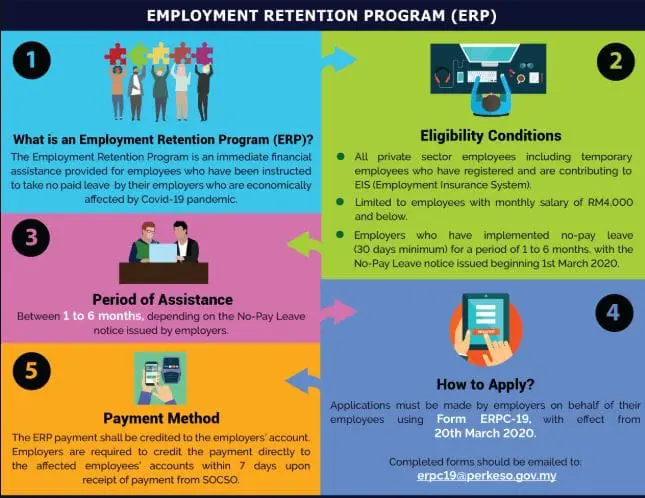

Under the Employment Retention Programme (ERP) by SOCSO, RM600 per month (up to a maximum of 6 months) will be provided to employees who have been issued with no-pay leave due to the Covid-19 pandemic. Only employees who are registered and contributing to the the Employment Insurance System (EIS) and receive a notice of no-pay leave of a minimum of 30 days are eligible. The assistance is only available to those earning RM4,000 and below a month.

The application for this allowance must be made by employers on behalf of their employees. You can find out more about it on the SOCSO website here.

Employment Insurance System (EIS) for loss of employment

Employees who have been recently retrenched are encouraged to make claims from the Employment Insurance System (EIS), which provides financial assistance to those who have experienced loss of employment due to retrenchment, company downsizing, and so on. Under this scheme, recently let go employees can seek a job search allowance (JSA), which varies depending on wages and contribution qualifying conditions.

Employees who are registered and contributing to the EIS for a minimum of 12 months qualify for the benefit payment. However, the EIS has a temporary financial incentive called SIP Plus 60 worth RM600 a month for a maximum of 3 months for those who have suffered loss of employment and are registered with EIS but do not meet these contribution qualifying conditions.

You can find out more about the benefits under EIS on the SOCSO website.

Tax deductions for donations

(Image: PMO)

The Ministry of Finance announced that individuals and corporations that donate to the Covid-19 fund and the Ministry of Health will be eligible for tax deductions.

According to a statement released by LHDN on 26 March, tax deductions will be allowed for the following donations:

- Cash and kind to the Ministry of Health’s Covid-19 Fund

- Cash to NADMA’s Covid-19 fund

- Donations to approved organisations and institutions

Automatic moratorium on bank loans

(Image: The Star)

On 25 March, Bank Negara Malaysia (BNM) announced an automatic deferment of individual and SME loans for a period of six months. This means that from April to September 2020, all banks and development financial institutions would automatically offer a six-month deferment on repayments for all individual and SME loans that are denominated in Malaysian Ringgit and have not been in arrears for more than 90 days as at 1 April.

While BNM stated that interest will continue to accrue and be compounded during the moratorium period, Malaysian banks stepped up to announce non-compounding interest for the duration of the loan deferment period. However, interest would still continue to accrue for both Islamic and conventional loans; if you’re looking for an in-depth analysis on the interest payments and whether or not you should take up this moratorium, you can read more about it in our article here.

While the moratorium announced by BNM only covers banks and development financial institutions, other institutions have also come forward to announce repayment relief measures during this time. The Malaysian Insolvency Department announced a six-month deferment on bankruptcy repayments, whereas AEON Credit Service, which is a non-bank financial institution, offered a one-month deferment for all its loans during the month of April.

Credit card instalment plan

In line with BNM’s directive on the matter, banks will be automatically converting outstanding credit card balances into 3-year term loans with a 13% p.a. interest rate to assist those in financial difficulties. Individuals who are unable to meet the minimum monthly repayment for 3 consecutive months will be automatically enrolled in this conversion programme.

The interest rate of 13% p.a. under this term loan is lower than the usual 15–18% p.a. that is usually charged on unpaid credit balances, and the monthly instalments make it easier for cardholders to manage their repayments. Moreover, cardholders who have converted their card balances into a term loan can then immediately ask for a 6-month deferment from their bank under the loan deferment measures announced by Bank Negara.

PTPTN loan deferment

The government will be deferring the repayment of Perbadanan Tabung Pendidikan Tinggi Nasional (PTPTN) for six months until 30 September 2020. Initially, the agreement was to defer PTPTN loan repayments for three months, but the deferment period was extended to six months on 26 March.

According to the PTPTN website, the deferment is automatic and borrowers need not make any applications to be entitled to it. All direct debit and salary contributions will be automatically postponed during the deferment period. However, those who wish to continue with their payments should make a formal application on the official portal between 23 March and 15 August 2020.

Special Covid-19 insurance coverage

Some insurance providers have decided to offer additional complimentary coverage specific to the Covid-19 disease – such as lump-sum payouts upon diagnosis and death benefits. Additional coverage like these are offered as an extra benefit in addition to existing insurance policies. You can check here to see which insurance companies are offering additional benefits specific to Covid-19 cases.

If you are wondering how your normal insurance coverage is affected by Covid-19 outside of any special benefits, you can find out more about Covid-19 and your life, medical, and travel insurance policies here.

Insurance premium payment deferment

As part of the PRIHATIN Economic Stimulus package, the prime minister announced a three-month premium deferment for insurance policyholders whose source of income is affected by the Covid-19 pandemic.

According to the Life Insurance Association of Malaysia (LIAM) and the Malaysian Takaful Association (MTA), the following policyholders will be considered eligible for the deferment: individuals who have been infected, subjected to mandatory quarantine, or suffered a loss of income; and SMEs and self-employed individuals who have experienced a loss of income due to the Covid-19 pandemic.

As the premium deferment is not automatic, policy and certificate holders will have to reach out to their respective providers to make the necessary applications.

LIAM and MTA are also extending the period during which policyholders can reinstate any lapsed life insurance policies or takaful protection, as well as waiving fees and charges imposed for changes made to policies/certificates.

Insurance and takaful industry Covid-19 Test Fund

Announced during the PRIHATIN Economic Stimulus Package, the insurance and takaful industry have launched a special Covid-19 Test Fund (CTF) amounting to RM8 million to subsidise the cost of Covid-19 testing at private hospitals or laboratories.

Those with group or individual medical and health insurance policies who are referred by registered doctors to undergo a Covid-19 test at a recognised private lab will be eligible to claim from CTF. The payout for reimbursement is up to a maximum of RM300 per test and limited to one reimbursement per individual.

You are entitled to be referred for a test if you are classified as a person under investigation (PUI) as defined by the Ministry of Health, or a contact of a positive case. The funding is available for tests done from 27 March onwards, as long as the policy is in force as of that date and at the conducting of the test.

You may refer to LIAM’s official website for more information on applying to the fund.

Covid-19 Financial Assistance For Malaysian Businesses

Wage subsidy programme

The government is offering a 3-month wage subsidy to employers for each employee earning RM4,000 and below. The amount of the wage subsidy is tiered according to the size of the company as below:

- RM600 subsidy for each eligible worker for companies with more than 200 employees. The subsidy will be given to a maximum of 200 employees (an increase from the 100-employee limit as announced previously).

- RM800 subsidy for each eligible worker for companies with 76-200 employees.

- RM1,200 subsidy for each eligible worker for companies with up to 75 employees.

The programme is available for employers who are registered with the Companies Commission of Malaysia (CCM), the local authorities, and SOCSO before 1 January 2020. Employers who choose to accept this wage subsidy are bound to keep their workers in employment for at least 6 months.

Employers who wish to apply for the wage subsidy programme can do so on the dedicated PRIHATIN SOCSO website, which will be open for applications from 9 April 2020.

An earlier version of this wage subsidy programme, revealed during the first round of the PRIHATIN Economic Stimulus Package, offered a standard RM600 subsidy for employees earning less than RM4,000 a month whose employers have suffered a loss of income of more than 50%. Employers who have already made their applications to SOCSO before the upgraded programme was announced on 6 April need not make a new application, unless the list of employees who are eligible for the subsidy has been updated.

Discount for electricity bills

As announced in the first Economic Stimulus Package 2020, businesses would receive a 15% discount if they are in the following sectors: hotel operations, travel agencies, local airlines offices, shopping malls, convention centres, and theme parks. Meanwhile, all other businesses are entitled to a 2% discount off their electricity bills.

The discount should be automatically applied to your electricity bills based on the type of business you own. However, if you would like to find out more about the eligibility requirements and processes behind this discount, you can head over to TNB’s website.

Automatic moratorium on SME bank loans

The automatic moratorium on bank loan repayments sanctioned by BNM (see above) applies to SMEs as well as individual loans. Therefore, companies with SME loans will also be entitled to the six-month payment deferment starting April 2020.

Just like with the individual loans, interest will not be compounded for SME loans during the moratorium period – thanks to the initiative of the Malaysian banks.

Non-retail or corporate clients who are Maybank customers may also be eligible for non-compounding interest, as Maybank has gone a step further to declare non-compounding interest for these clients in addition to individual and SME customers. However, as non-retail and corporate customers do not fall under the purview of the automatic moratorium, they will need to submit the required application for moratorium through their Maybank relationship managers or corporate bankers.

Moratorium on loan repayments for cooperatives

Cooperatives may apply to defer their loan repayments to the Cooperative Development Revolving Fund (TMP-JKP) for six months, starting from April to September 2020. The announcement was made by the Ministry of Entrepreneur Development and Cooperatives (MEDAC).

Applications may be made to Suruhanjaya Koperasi Malaysia (SKM) via email. Cooperatives will have to state that their cooperative has experienced a loss of income due to the Covid-19 pandemic.

As cooperative banks fall under the purview of SKM, cooperative banks do not technically fall under the purview of BNM’s automatic loan moratorium. However, SKM has announced that two cooperative banks (Bank Rakyat and Co-opbank Pertama) will be offering a six-month moratorium starting 1 April 2020.

Special Relief Facility (SRF) for SMEs

The Special Relief Facility (SRF) for SMEs consists of a RM5 billion fund aimed at providing relief assistance to Malaysian SMEs who are affected by the Covid-19 outbreak.

This relief facility provides working capital of up to RM1 million per SME at a financing rate of up to 3.50% p.a. (inclusive of any guarantee fee), for a maximum tenure of 5.5 years including a 6-month moratorium on repayments. It is available until 31 December 2020 and applications can be made through participating banks.

The SRF has been enhanced since it was first introduced. Its allocation was increased from RM2 billion to RM5 billion, and the maximum financing rate was lowered from 3.75% p.a. to 3.50% p.a..

All Economic Sectors (AES) Facility

The AES facility is aimed at enhancing access to financing for Malaysian SMEs in all economic sectors, in particular underserved SMEs, and to support growth. The financing rate for this facility goes up to 7%p.a. and the maximum financing amount is RM5 million per SME; the maximum tenure offered is 5 years. The fund has a total allocation of RM6.8 billion and applications can be made through participating banks.

Automation and Digitalisation Facility (ADF)

The ADF’s allocation of RM300 million is part of the total RM6.8 billion set aside for the AES Facility. The scope for the ADF is more specific as it is aimed at incentivising SMEs to automate processes and digitalise operations; hence, the purpose of the financing is limited to purchase of equipment, machinery, and other technology support services to enhance productivity and efficiency.

The financing rate is up to 4% p.a., with a maximum financing amount of RM3 million per SME and a maximum tenure of 10 years. Applications are open until 31 December and can be made through participating banks.

Agrofood Facility (AF)

The Agrofood Facility is aimed at increasing agrofood production for Malaysia and for export purposes. Malaysian SMEs can apply for the facility with the purpose of capital expenditure, working capital, and/or development of agrofood projects. The financing rate offered goes up to 3.75% p.a., with a maximum financing of RM5 million per SME and a maximum tenure of 8 years. The total allocation for AF is RM 1 billion and applications may be made through participating banks.

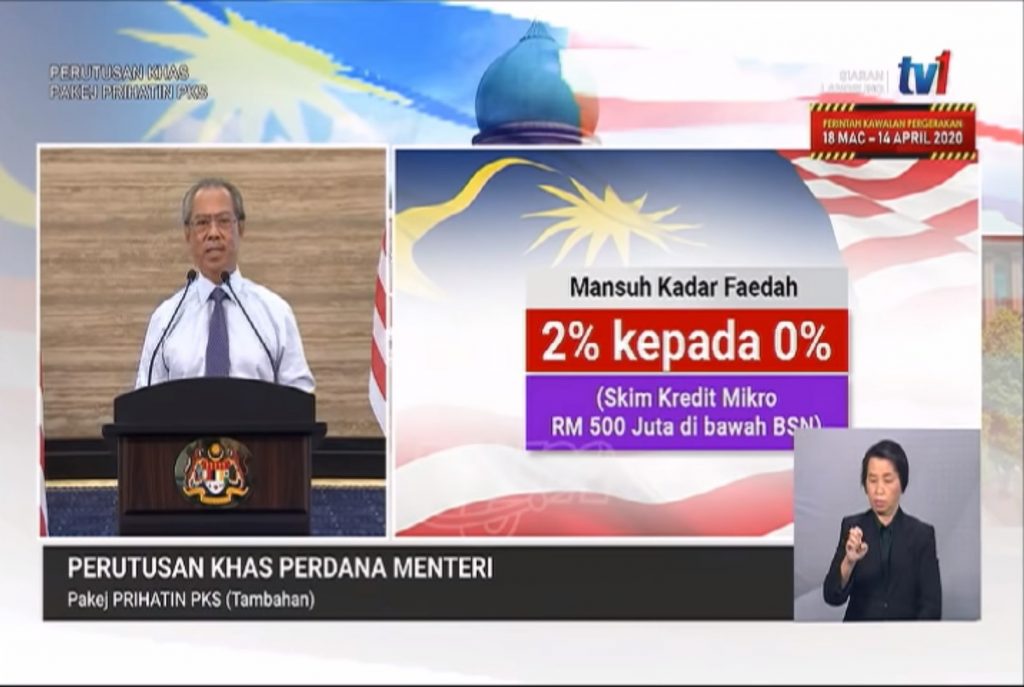

0% Interest For Micro Credit Facility

This micro credit scheme by Bank Simpanan Nasional (BSN) is open to micro enterprises whose businesses are impacted by the Covid-19 outbreak. It offers a 0% interest rate of loan amounts up to RM75,000 for tenures between 1-5.5 years, including the first six months of moratorium.

Micro enterprises which are Malaysian-owned, registered with SSM, in operation for at least 6 months, and have been impacted by Covid-19 can apply online through BSN. The scheme has also been extended to TEKUN Nasional with a maximum loan limit of RM10,000 per micro enterprise.

The micro credit facility was introduced in the first Economic Stimulus Package 2020 at an interest rate of 4%. This rate was lowered during the PRIHATIN Economic Stimulus Package announcement to 2%, before being abolished altogether in the PRIHATIN Tambahan package for SMEs.

A business is considered a micro enterprise if it has a sales turnover of less than RM300,000 or less than 5 employees.

RM3,000 Special Grant for micro enterprises

Announced as an additional measure under the PRIHATIN Tambahan additions for SMEs, the government will provide RM3,000 for each micro-enterprise under the PRIHATIN Special Grant, with a total allocation of RM2.1 billion. The micro-enterprises must be registered with LHDN to be eligible and the government will obtain the list of eligible micro-enterprises from the authorities.

Tax break for landlords offering rent discounts

Property owners who offer a rent discount or exemption to their SME tenants will be allowed tax deductions equal to the amount of the rent deduction for the months of April to June 2020. This tax break is dependent on the condition that the rent discount is at least 30% of the original rental amount.

Meanwhile, SME retail owners who are paying rent for premises owned by government-linked companies such as MARA, PETRONAS, PNB, PLUS, and UDA will have their rent exempted or discounted.

Reduced foreign worker levy

The government is allowing a 25% decrease on the foreign worker levy to all companies whose employees’ permits are ending between 1 April and 31 December 2020. However, this levy decrease is not applicable to domestic helpers.

***

In times like these, it’s important to be aware of the different initiatives that have been offered by the government, financial institutions, and other bodies – the scale of the economic repercussions means nobody must be left behind, as the Prime Minister puts it. Hopefully, this article has helped offer you an overall picture of the various types of financial assistance out there during this Covid-19 pandemic and how you can apply for them. We will be updating this article as and when more assistance is announced for Malaysians.

Stay informed, and stay safe.

Comments (0)