Alex Cheong Pui Yin

3rd July 2020 - 3 min read

Bank Negara Malaysia (BNM) has enabled online applications for individuals who wish to obtain their Central Credit Reference Information System (CCRIS) reports, allowing them to submit their requests from the comfort of their homes.

You can make your online application with the following steps:

- Download and fill in the application form.

- Prepare all the required documents:

- Scanned copy of your MyKad (front and back) or passport

- Scanned copy of two supporting documents, such as your driving licence, utility bills, or bank/credit card/EPF statement

- Submit your completed form and attach the supporting documents through BNM’s webform.

Within the form, you can specify if you’d like to collect your CCRIS report at a selected financial institution or receive it via your email. If you choose to collect your report at a financial institution, you’ll have to provide the name and address of the institution.

To clarify, CCRIS reports are credit reports issued by BNM, similar to but less comprehensive than those provided by private credit reporting agencies such as Experian or CTOS. They’re meant to give you an overview of your financial health and creditworthiness, containing information such as current credit terms, missed payments, and loan or credit facility applications that have been made in the past 12 months.

CCRIS reports from BNM can be obtained for free, whereas you need to pay for the reports provided by private credit reporting agencies. However, these latter reports may contain more information, such as a “credit score” that gives you an overall grade for your credit health.

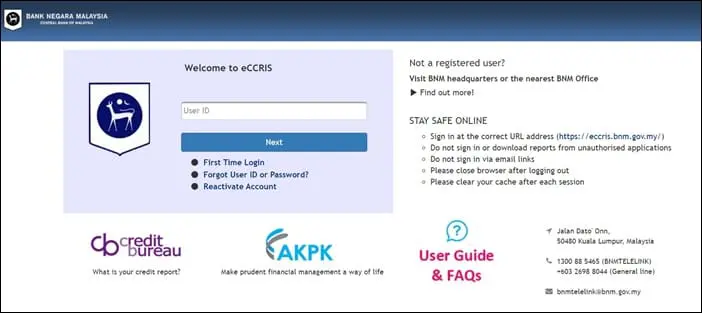

Aside from this new way of obtaining your CCRIS report online, you can also get your CCRIS report through BNM’s online eCCRIS system, which was launched in 2018. This remains the easiest way to keep tabs on your credit health, as you can view your latest reports anytime via the portal. However, if you’re not a registered user, you’ll need to first visit a BNM or Agensi Kaunseling dan Pengurusan Kredit (AKPK) office to request for a 6-digit PIN and verify your identity at a CCRIS kiosk (which can also print your latest report on the spot).

Once you’ve activated your eCCRIS account, you can access your report from anywhere and at any time.

Prior to this, applying for your CCRIS report can be a tedious process of waiting in line and applying for it at a counter. It is also possible to email or fax your application in writing, but this process could take up to 4 weeks before you receive your report.

(Source: Bank Negara Malaysia)

Comments (0)