Alex Cheong Pui Yin

24th March 2023 - 4 min read

Malaysian buy-now-pay-later (BNPL) and digital payment service provider IOUpay is reportedly undergoing a company restructuring, with more than half of its staff and its entire management team dismissed. This came following the suspension of new user registration for its BNPL app myIOU since more than a week ago, as well as an ongoing investigation of its former chief financial officer, Kenneth Kuan, for “significant fraud”.

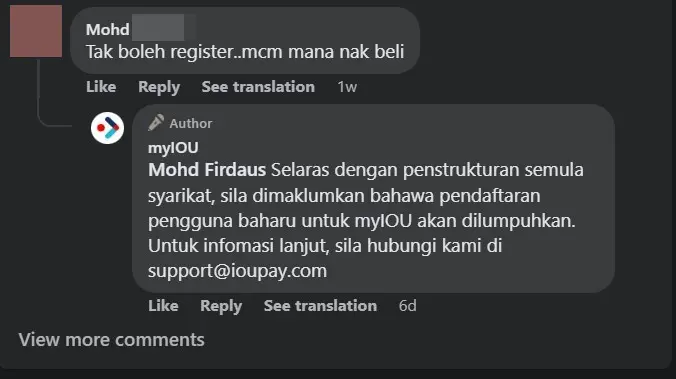

Based on several comments seen on myIOU’s Facebook, new user registrations for the BNPL app had apparently been suspended since two weeks ago. This was eventually confirmed by the myIOU social media team, who responded with:

“In line with company restructuring, [we] regret to inform that new user registration for myIOU will be disabled. For more enquiries, please contact our team at support@ioupay.com.”

Merchants who signed up to use IOUpay’s services were also informed of the company restructuring exercise via a notice, which told them as well that their payout settlement for successful transactions during a specific period will be delayed until further notice. That said, this issue was subsequently resolved for some merchant partners, if not all.

These setbacks are ultimately signs of a deeper turmoil, specifically on the management level, and can be traced back to exchanges that started in early March 2023. Based on notices posted online, IOUpay was asked by shareholders to hold an extraordinary general meeting (EGM), with the aim of removing its current board of directors. This included group managing director Aaron Lee and chairman Isaac Chong (who was subsequently appointed as executive chairman two days after the request to hold the EGM).

Things were then made complicated when IOUpay also received several documents at the same time, implicating Aaron Lee in some forms of breach of duties. This prompted the now former chief financial officer (CFO) Kenneth Kuan to call for the suspension of Lee.

However, Kuan’s request was denied, and he was in turn terminated with immediate effect following a “preliminary review by the executive chairman of cost levels and financial performance in the company’s Malaysian business”. IOUpay accused him of misappropriating up to AUS$7 million in company funds through a previous partnership meant to provide financing opportunities for newly-hired Malaysian federal civil servants. Understandably, this resulted in Kuan being investigated by the police for significant fraud, with recovery efforts underway.

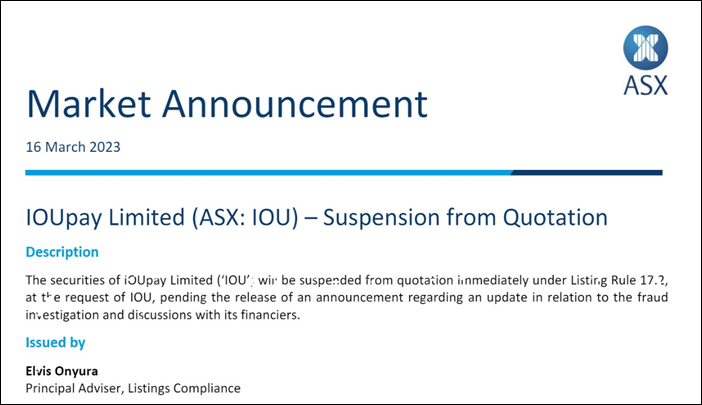

Just one day after officially dismissing its CFO on 13 March, IOUpay – which is listed on the Australian Securities Exchange (ASX) – then paused and halted the trading of its securities until 16 March due to a pending announcement to the market. Come 16 March, however, things were still unresolved. Instead, IOUpay’s securities were suspended from quotation immediately, “pending the release of an announcement regarding an update in relation to the fraud investigation and discussions with its financiers.”

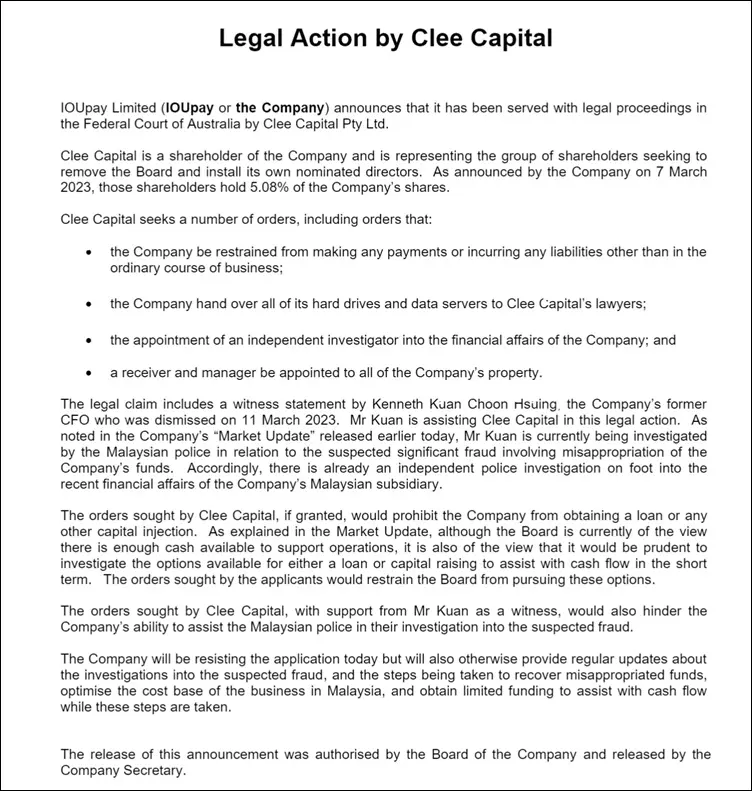

Fast forward to 22 March, IOUpay was dealt yet another blow. One of its shareholders, Clee Capital Pty Ltd had decided to initiate legal proceedings in the Federal Court of Australia against IOUpay. Notably, it is one of the shareholders who had earlier requested for the EGM to remove the current board of directors, aiming to appoint its own nominated directors instead.

According to IOUpay’s notice shared online, Clee Capital had sought several orders against it, including restraining IOUpay from making any payments or incurring any liabilities other than those required in the usual business proceedings. If the orders are granted, IOUpay will be prohibited from a loan or any other capital injection. Additionally, the legal claim also included a witness statement by dismissed CFO, Kenneth Kuan.

On its part, IOUpay said that it will resist the legal application, as well as provide regular updates about the investigations into the suspected fraud. It will also carry out cost optimisation initiatives for its business in Malaysia, as well as obtain limited funding to assist with any cash flow issues.

For context, aside from offering its BNPL myIOU service in Malaysia, IOUpay also claims to be one of Malaysia’s top three mobile banking processing, e-KYC, and authentication platforms – processing over 17 million authentication and mobile banking transactions each month. It also provides bill payment services (prepaid and postpaid). Additional, it counts banks such as AmBank, Bank Islam, and Standard Chartered among its clients, as well as major brands like Senheng, Mazda, and TBM Malaysia.

(Source: Vulcan Post)

Comments (0)