Alex Cheong Pui Yin

22nd July 2021 - 3 min read

Robo-advisor StashAway has notified clients that it will be re-optimising their portfolios in a bid to adapt to a “new economic environment” following recent developments in global economic movements. In particular, it highlighted the entry of the United States’ (US) economy into an inflationary growth period, whereas other (non-US) economies are experiencing disinflationary growth.

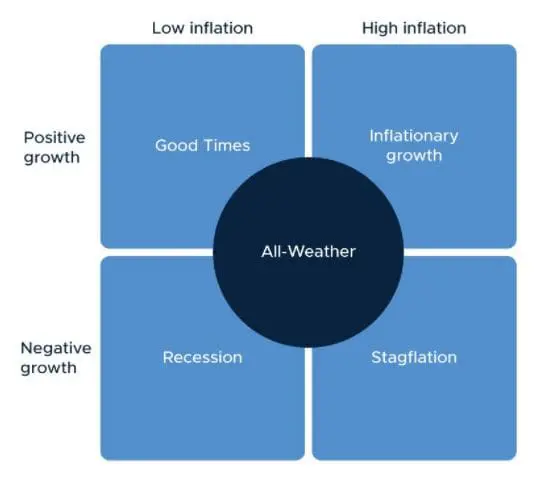

According to StashAway, recent indicators from the US economy has shown that it has begun heading into an inflationary growth environment. This is essentially a state where the country experiences positive growth but also high inflation – and it is one of the four economic regimes featured in the Economic Regime-based Asset Allocation (ERAA) investment framework used by StashAway to manage its clients’ portfolios.

“Inflationary growth doesn’t tend to last (the US economy has experienced only several short-lived episodes of inflationary growth since 1990), but we could stay in this regime as long as it takes to vaccinate people, reopen borders, and restore supply chains,” said the co-founder and chief information officer of StashAway, Freddy Lim in the announcement post.

Meanwhile, economies outside of the US are seeing growth outpacing inflation – a situation referred to as disinflationary growth in the ERAA framework (positive growth, low inflation). “While inflation is outpacing growth in the US, growth is outpacing inflation in the global ex-US economy. Compared to the US, global inflation is rising, but is rising at a significantly slower rate than it is in the US in absolute terms,” Lim explained.

Consequently, these two factors have convinced StashAway that it is necessary to carry out a re-optimisation exercise, allowing it to readjust the asset allocation of its clients’ portfolio to defend against inflation and tap into global growth opportunities. Specifically, this round of re-optimisation will see changes such as:

- Maintaining or increasing exposure to China’s technology

- Broadening inflation-protection assets beyond just gold, namely:

a) US assets: New equity allocations for consumer staples, energy, and REITs

b) International assets: Increase in allocations to emerging market bonds, and new equity allocations to commodity-exporting countries

With this latest update, StashAway hopes to provide better management and returns for their clients’ portfolio in the long term. “We manage your portfolios for long-term success. Remember that another one of the keys to a successful investment outcome is to stick to your long-term investment plan,” it said.

StashAway has carried out a total of three re-optimisation exercises since its launch in July 2017 – namely in December 2017, August 2019, and May 2020.

(Source: StashAway)

Comments (0)