Jacie Tan

19th January 2021 - 11 min read

Yesterday, Prime Minister Tan Sri Muhyiddin Yassin unveiled the government’s new PERMAI stimulus package, the fifth economic stimulus package in Malaysia aimed at combatting the negative effects of the Covid-19 pandemic. Worth RM15 billion, the PERMAI stimulus consists of 22 initiatives – some of which improve on current initiatives that are already ongoing or accelerating the implementation of said initiatives.

So, if you’re wondering why some of the initiatives under PERMAI sound rather familiar, it’s because they may have already been announced or implemented before. To help clear things up, we go through the PERMAI highlights to see which are part of existing initiatives and which are brand-new benefits.

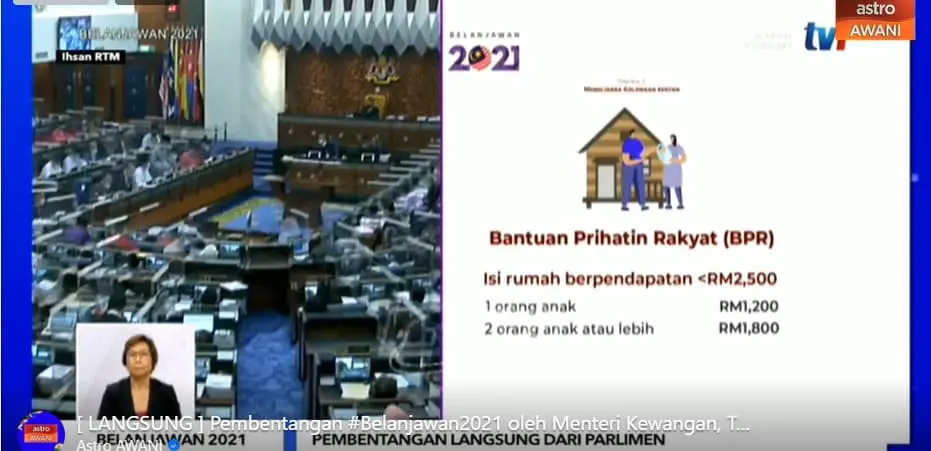

Accelerated Bantuan Prihatin Nasional (BPN 2.0) & Bantuan Prihatin Rakyat (BPR) Payments

According to the PERMAI announcement, the final round of BPN2.0 payments will be accelerated starting from 21 January 2021. As for the BPR aid, it was revealed that for the first round of instalments, households earning up to RM5,000 per month will receive RM300 each while for those under the single category earning up to RM2,000 per month will receive RM150.

Is it new? No.

BPN 2.0 was announced under last year’s PRIHATIN stimulus package, with the first phase already paid out in October 2020 and the final phase slated for January 2021. Under PERMAI, the final phase is meant to be “accelerated” – but payments will begin on 21 January, which is still within the month of January as originally announced.

Meanwhile, the BPR programme was introduced in Budget 2021 last year as a successor to the Bantuan Sara Hidup (BSH) aid, with a RM6.5 billion allocation expected to benefit 8.1 million people. It had not been stated when the BPR payments will be given out. It was suggested in the PERMAI announcement that the payments would be accelerated too, but no date or timeline was shared.

RM2,500 Tax Relief On Purchase Of Mobile Phones, Computers & Tablets

You can claim a special tax relief of up to RM2,500 on the purchase of mobile phones, computers, and tablets for YA 2021 – on top of the main lifestyle tax relief given on sports equipment, reading materials, Internet bills, and selected electronic devices expenditure.

Is it new? No (Extended for 1 year)

This special tax relief was first introduced last year to boost work-from-home arrangements and was in force from 1 June to 31 December 2020.

Covid-19 Testing Now Eligible For Medical Tax Relief

The scope for tax relief related to full medical check-up expenses has been expanded to cover Covid-19 screening.

Is it new? Yes.

You can now claim up to RM1,000 in tax relief for full medical check-ups and Covid-19 tests for YA2021. Lembaga Hasil Dalam Negeri (LHDN) allows you to claim tax relief for medical expenses with a sub-limit specifically for medical check-ups. In Budget 2021, the tax relief limit was raised from RM6,000 to RM8,000 and the sub-limit was doubled from RM500 to RM1,000.

Covid-19 Vaccination Programme

(Image: The Malaysian Reserve)

Planning for the Vaccination Programme is on track, with the government having signed three agreements with vaccine producers. Malaysia is expected to receive the first batch of vaccines by the end of February with the first batch to be vaccinated by early March.

Is it new? Not really.

Malaysia signed its first vaccination deal with Pfizer in November 2020 and the Special Committee on Covid-1189 Vaccine Supply Access Guarantee (JKJAV) has been in talks about fine-tuning the Covid vaccination plan since early this year.

Enhancing Cooperation With Private Hospitals

The government will allocate RM100 million to further the public-private partnership in combating the pandemic, with private hospitals agreeing to receive and treat both Covid-19 and non-Covid-19 patients to help relieve the public healthcare system.

Is it new? Not really.

News of an agreement between the private and public healthcare sectors regarding the treatment of Covid-19 patients have been making headlines for the past week or so. As of now, it seems that the government is in the final stages of ironing out the details with the private hospitals. While LIAM and MTA have also expressed willingness to support this partnership in terms of insurance coverage, it is also still in talks with the Ministry of Health and Bank Negara Malaysia to work out how this will happen.

One-off Provision & Allowance For Frontliners

Healthcare frontliners will be given a one-off provision of RM500 while other frontliners will be paid RM300 in the first quarter of this year. The existing monthly allowance of RM600 to healthcare frontliners and RM200 to other frontliners will continue until the Covid-19 pandemic is over.

Is it new? No.

The provision for healthcare frontliners was announced in the tabling of Budget 2021 and the provision for non-healthcare frontliners was added in the winding up of the Budget. The one-off assistance was set to be paid some time in 2021 with no firm date. Meanwhile, the monthly allowance was first kicked-off in February 2020 and increased in March.

EPF i-Sinar Advance Facility & Withdrawal Process

The Employees Provident Fund (EPF) will provide an advance of up to RM1,000 from the amount applied under the i-Sinar Category 2 facility, starting 26 January. The announcement also said that the Category 2 advance withdrawal process has been simplified as members only need to provide a self-declaration and submit supporting documents online.

Is it new? Yes (and no)

For i-Sinar Category 2 applications, the payment was meant to be given by the end of the following month after application approval – and you would need 2-3 weeks to obtain said approval. Thanks to the advance feature, Category 2 applicants can now receive an interim payment of up to RM1,000 from 26 January for those who have already applied, and within 7 days from applying for new applications.

As for the simplified withdrawal process, there doesn’t seem to be much difference to the application process for Category 2 members post-PERMAI. Prior to the PERMAI stimulus, Category 2 members also only needed to make an online declaration and supply supporting documents to make an application. Applications for EPF i-Sinar Category 2 have been open since 11 January.

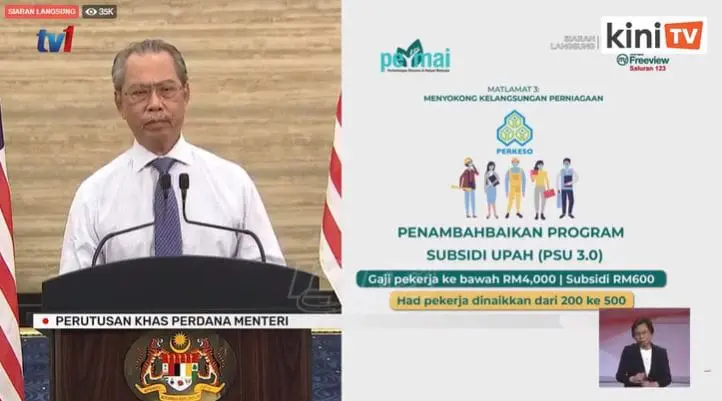

Wage Subsidy Programme 3.0

The enhanced Wage Subsidy Programme 3.0 will be open to all employers operating in MCO states. Approved employers will receive a wage subsidy of RM600 for each employee with a salary of less than RM4,000 for one month up to 500 workers.

Is it new? Yes.

While there have been previous versions of the Wage Subsidy Programme – from the first programme that ran from March to September and the second one that ran from October to December – this third version is a new introduction under PERMAI. You can find out more about the Wage Subsidy Programme 3.0 here.

Continuing The Moratorium & Loan Repayment Assistance

In the PERMAI announcement, the prime minister emphasised that the extended moratorium and reduced loan repayment instalments as announced previously will continue to be offered.

Is it new? No.

As explained by the prime minister himself, this particular initiative is not new, as applications for the targeted repayment assistance were set to be open until 30 June 2021. However, the reassurance of the availability of this aid is sure to be welcome given the second round of movement control order (MCO 2.0) currently in place as well as the ongoing flood situation in the country.

Moratorium For PTPTN Repayments

(Image: Malay Mail)

National Higher Education Fund Corporation (PTPTN) borrowers affected by the Covid-19 pandemic or floods can apply for a three-month PTPTN loan repayment moratorium until 31 March 2021.

Is it new? Not really.

The government had already announced in early January that it would be deferring the loan repayments for PTPTN borrowers for yet another 3 months until 31 March 2021. PTPTN has extended the moratorium a total of 3 times since April 2020. However, the inclusion of flood victims in addition to those affected by Covid-19 is a newer update.

Sales Tax Exemption On Passenger Vehicles

The sales tax exemption for locally assembled and imported passenger vehicles is extended until 30 June 2021.

Is it new? Not really.

The sales tax exemption first came into force in June and was slated to end on 31 December 2020. However, just before the end of the 2020, the Finance Ministry had already announced that the exemption would be extended until 30 June 2021.

Electricity Bill Discounts

(Image: The Malaysian Reserve)

Six business sectors nationwide (hotel operators, theme parks, convention centres, shopping malls, local airline offices, and travel and tour agencies) will receive a discount of 10% on electricity bills from January to March 2021. Other domestic and non-domestic TNB users will get an electricity rebate of 2 sen/kWh from 1 January to 30 June 2021.

Is it new? Yes (and no).

The power discount for the six business sectors, which is funded by the government, is new under PERMAI. Under the Economic Stimulus Package last year, selected businesses were given a similar 15% discount in electricity bills from April to September. As for the TNB 2 sen/kWh rebate, this was already announced at the end of last year.

Provision Of 1GB Free Internet Access

The 1GB of free Internet data offered to the public will be extended until 30 April 2021. Moreover, the special subscription package previously offered to SPM and STPM students will be extended to all students of higher learning institutions.

Is it new? No (extended/expanded)

First introduced in March as part of PRIHATIN for the duration of the first MCO period, the free Internet was extended to the end of 2020, and then once more until March 2021. With PERMAI, the free data is now extended by one extra month. As for the special package for students, the scope has now been widened under PERMAI.

SOCSO’s Self-Employment Social Security Scheme For Delivery Riders

(Image: SoyaCincau)

The government has allocated RM24 billion towards coverage for SOCSO’s Self-Employment Social Security Scheme, as a way to appreciate the contribution of delivery riders in particular during the MCO period.

Is it new? No.

As announced by the prime minister, almost 32,000 applications from delivery riders have already been received under the scheme, so it is not new under PERMAI. The allocation was made as part of Budget 2021, announced last year.

Relaxed EIS Programme

The government has agreed to relax the conditions for the Employment Insurance System (EIS) or SIP PRIHATIN to assist those suffering from loss of employment. Employees who do not meet the minimum contribution conditions, or whose contract was not extended after having been renewed for at least 3 times previously, are eligible to apply for the SIP PRIHATIN assistance of 30 percent of their monthly salary for a period of 3 months.

Is it new? No.

Enhancing the EIS was already mentioned during the tabling of Budget 2021 and SOCSO had already come out with an FAQ detailing the changes to SIP PRIHATIN last year.

One-Off Payment For Tour Guides, Taxi & Bus Drivers

The government will provide a one-off financial assistance of RM500 to tour guides and drivers of taxis, buses, tour buses, rental cars, and e-hailing vehicles. An additional amount of RM66 million has been allocated to ease the burden of these parties.

Is it new? Yes.

A similar one-off payment was given as part of the Economic Stimulus Package in February 2020 and later again in the PRIHATIN stimulus, but this new round of one-off assistance is new.

PERMAI Prihatin Special Grant

The government will expand the existing Prihatin Special Grant Plus assistance to cover 500,000 SMEs in the MCO states, with a payment of RM1,000 each while 300,000 SMEs in other states will receive RM500 each. This expansion will involve an additional allocation of RM650 million. Should any state be declared a red zone with MCO imposed, the government stands ready with additional assistance.

Is it new? Yes.

The Prihatin Special Grant Plus that was introduced in Budget 2021 was initially only for traders and hawkers in Sabah, and now has been greatly expanded under PERMAI.

Tax Deductions For Donors

Donors who have been assisting those impacted by the Covid-19 pandemic in cash and kind will be given tax deductions.

Is it new? No.

It is likely that the prime minister is referring to existing tax deduction incentives, where individuals and business can claim for a tax deduction based on their gross business income or aggregate income for eligible charitable donations. Since last year, donations made to aid in the battle against Covid-19 – such as to the Covid-19 fund and Ministry of Health and others – have been considered eligible.

***

The MCO period is a tough one for many Malaysians, which is why the rakyat depend heavily on the government to provide the necessary assistance to tide the nation over to the other side. With this in mind, it’s important to stay up to date on all the various forms of assistance available – including keeping track of what is already being offered.

Comments (3)

Special tax relief of up to RM2,500 on the purchase of mobile phones, computers, and tablets for YA 2021 – on top of the main lifestyle tax relief given on sports equipment, reading materials, Internet bills, and selected electronic devices expenditure.

Extension

Q:

So, if i bought a PC in Oct 2020 and claimed the special tax relief in my filing 2021 Apr for 2020 taxes,

Can i buy another PC in 2021 and claim the special tax relief for 2021 taxes filed in 2022 Apr?

My 2 cents:

The WSP3.0 already announced in Budget 2021, the scope is expanded under PERMAI, not a total new WSP.

For electricity discount, it is not new too. The same six sectors will enjoy 10% discount for three months, compared to 15% discount for six months in 2020, which announced on 27 Feb. The 2 sen rebate should not be in the picture as it was just an ordinary review of ICPT every six months.

How to apply the Permai Prihatin Special Grant ?