Alex Cheong Pui Yin

4th November 2022 - 3 min read

Online remittance service provider Wise Malaysia has announced that it is updating the fees for selected services offered via its Wise card, with the revisions set to take effect starting from 3 January 2023. These include streamlining the fee structure for ATM and cash withdrawals, as well as introducing a new fee for account funding transactions in certain currencies.

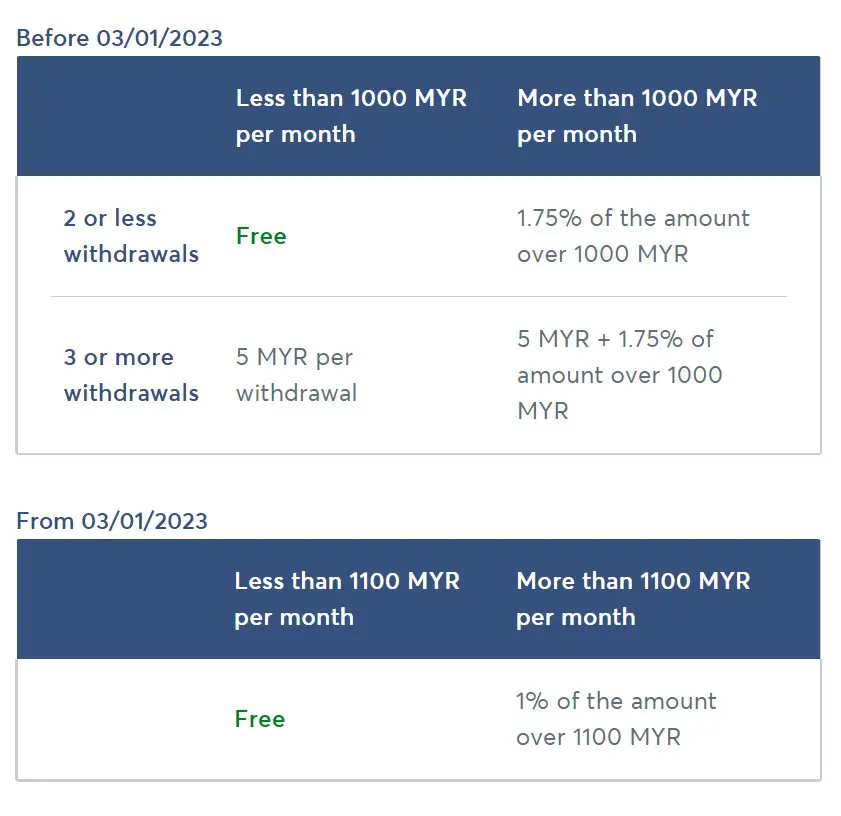

With regard to ATM and cash withdrawals, Wise said that it currently has a fee structure that is “overly complicated, and (that) varied depending on the amount and number of times you withdrew cash within a month”. Specifically, existing users can make two withdrawals of up to RM1,000 each month for free. After that, each withdrawal will have a fee of RM5. On top of that, there is also a 1.75% fee for any withdrawals that exceed RM1,000.

Come 3 January 2022, the current fee structure will be simplified for the convenience of users. “Now, you can withdraw up to RM1,100 cash per month for free, and we’ll simply charge 1% of the amount for additional withdrawals above this limit. This applies for ATM withdrawals, as well as withdrawing cash from a merchant or bank, money orders, foreign exchange, or bureau de change,” said Wise in a notice sent to its users.

Here’s a table to summarise the updated fee structure for ATM and cash withdrawals via the Wise card:

In addition to this revision of its withdrawal fees, Wise is also introducing a new fee of 2% for account funding transactions in selected currencies, such as when you use your Wise card to fund e-wallets and external accounts that may be converted to cash (including, but not limited to, casino chips, cryptocurrencies, and lottery tickets). This is because these transactions cost more money to process than others, said Wise.

Wise further explained in its Help page that depending on whether your Wise card is a Visa or Mastercard card, the 2% fee will be exempted for the following currencies:

| Card | Currencies exempted from 2% fee |

| Visa | – Australian dollar (AUD) – Brazilian real (BRL) – Canadian dollar (CAD) – Swiss franc (CHF) – Czech koruna (CZK) – Danish krone (DKK) – Euro (EUR) – British pound sterling (GBP) – Hong Kong dollar (HKD) – Japanese yen (JPY) – Mexican peso (MXN) – Malaysian ringgit (MYR) – Norwegian krone (NOK) – New Zealand dollar (NZD) – Poland zloty (PLN) – Swedish krona (SEK) – Singapore dollar (SGD) – United States dollar (USD) |

| Mastercard | – Australian dollar (AUD) – Canadian dollar (CAD) – Swiss franc (CHF) – Euro (EUR) – British pound sterling (GBP) – Hungarian forint (HUF) – Japanese yen (JPY) – New Zealand dollar (NZD) – Poland zloty (PLN) – United States dollar (USD) |

For context, Wise assigns Visa cards to its users in Malaysia, so local Wise cardholders will want to take note of all the currencies that may incur the 2% fee, especially if you are a frequent traveller who often use your card to top up foreign e-wallets or other relevant accounts.

The Wise card – which landed on Malaysian shores at the end of 2021 – is essentially a debit card that is tied to its multi-currency account, which was previously known as the borderless account. It allows you to spend money in more than 175 countries with low upfront conversion rates and no annual or card subscription fee. There is, however, a one-time fee of RM13.70 to get the Wise card.

(Source: Wise Malaysia [1, 2])

Comments (2)

What is an e-wallet , does this mean if I want to convert my AUD to Thai baht and hold that Thai baht in the a”Thai baht wallet” on my wise account I will be charged 2% for the conversion ?

No, it means when you use your Wise card to reload third-party e-wallet apps.