Alex Cheong Pui Yin

4th March 2022 - 4 min read

Following a sneak peek last week, BigPay has finally unveiled its first personal loan product as part of its launch of a wider suite of fully digital financial services and offerings. Rolled out via its wholly owned subsidiary, BigPay Later, the new product is dubbed BigPay Later Personal Loan, and aims to provide the public – especially the unserved and underserved groups – with convenience when applying for personal loans.

In a statement, BigPay said that the BigPay Later Personal Loan will offer competitive interest rates that are lower than standard credit card rates. The terms provided may, however, differ from user to user, depending on the customer’s spend history or tenure with BigPay. Long-time BigPay users with consistent payment history, for instance, may be allowed a higher loan amount with a lower interest rate.

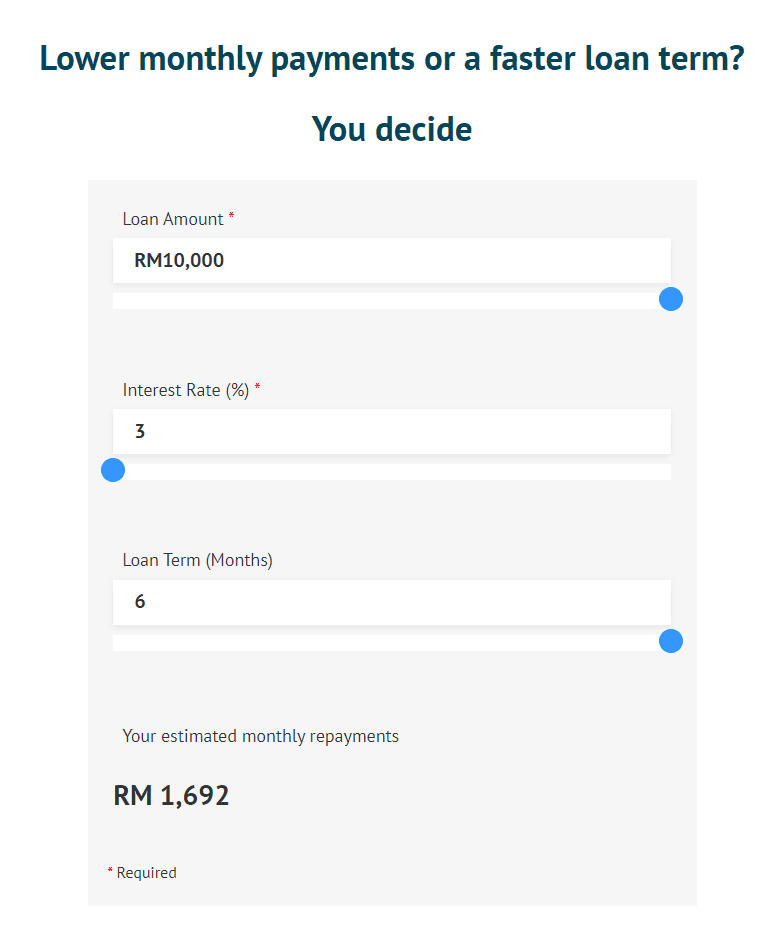

Based on BigPay’s Personal Loan Calculator on its website, it seems that the minimum loan amount allowed is RM1,000, and the maximum is RM10,000. Interest rate, meanwhile, ranges between 3% to 12% p.a., whereas loan terms go from one month to six months. The calculator does note, however, that the figures calculated on it is meant only for estimation, and that users should refer to the BigPay app for the final amounts.

Aside from the interest rate, users who take up the personal loan should also note that they will be charged a small stamping fee of 0.05%. This fee will be included in the first monthly repayment. Late interest, on the other hand, may go up to 8% p.a..

The BigPay Later Personal Loan service can be found within the BigPay app under the “Payments” section, and users who wish to apply are not required to provide any documents. As this is a fully digital financial service, the entire process can be done within the app, with BigPay striving to provide approval within minutes. In the event of a longer process, BigPay said it will try to get back to the affected customer within one working day. Customers can also communicate with BigPay via the live chat function within the app if they have questions.

The financial service provider further shared that the BigPay Later Personal Loan also emphasises transparency, as its dashboard will feature a repayment schedule with a breakdown of repayment installments and an auto-payment option to prevent users from falling behind on repayments. Details – such as the principal amount, interest, late interest, and stamping fee – will all be clearly listed so that users are always aware of what they are paying for.

According to the chief executive officer and co-founder of BigPay, Salim Dhanani, the BigPay Later Personal Loan will help to democratise financial services within the country. “The pandemic has highlighted how important it is that people have access to versatile, easy-to-use financial solutions. Many underserved demographics in Malaysia lack access to the credit they need because they do not have the typically ‘acceptable’ credit history which is required by traditional banks – this directly impacts the ability to build long-term financial standing,” he further commented.

The chief executive of BigPay’s parent company Capital A, Tony Fernandes also chimed in with a similar sentiment. “We are excited that we can disrupt once again and give the common man, from SMEs, small entrepreneurs to the mass public, the same accessibility to easy, simple loans, and other outstanding financial services,” he said, adding that the product is fully regulated by the Ministry of Housing and Local Government (KPKT).

That said, the BigPay Later Personal Loan is currently still in its beta phase, and has been rolled out only to selected users. It will be gradually made live to the public in the following six months, but you can register your interest in the product by putting your name on the waiting list here.

(Sources: BigPay [1, 2], SoyaCincau)

Comments (0)