Jasen Lee

21st August 2024 - 4 min read

Ever since the digital revolution took off, the demand for personalisation has never been higher. From customisable home screens on our smartphones to social media algorithms that curate content based on our interests, today’s consumers seek experiences that are tailored to their needs but are also highly convenient.

This shift is especially noticeable in the banking sector, where the need for a personalised banking experience is paramount. And that’s where the CIMB OCTO App comes into play, offering a suite of features designed to meet your individual preferences while enhancing convenience and security. Let’s explore how it works!

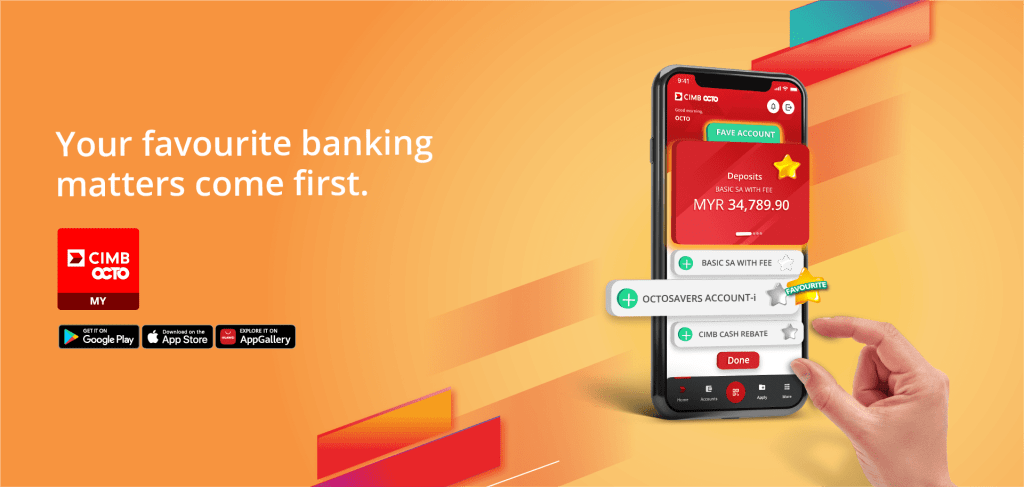

Customisable Home Screen & Quick Menu

One of the major highlights of the CIMB OCTO App is its customisable features, which allow you to not only customise your own Quick Menu for easy access to your most-used features but also rearrange how you would like to view your home screen. Whether you prefer your OCTO Transaction History to appear first on your home screen or wish to see “What’s New” for you after logging in to your app, the choice is yours to customise your banking experience that is most convenient for you according to your personal style.

Other than that, if you have multiple banking accounts with CIMB, you can also choose which account balance you wish to see on your home screen.

Cross-Border Convenience With DuitNow QR

Recognising the convenience of digital payments, the CIMB OCTO App includes the DuitNow QR feature, allowing you to scan and pay at any establishment that accepts the QR code payment method, thus eliminating the hassle of carrying a lot of cash in your wallet.

Moreover, DuitNow QR payment now extends beyond Malaysia to Singapore, Thailand, Indonesia, and China. This means you can now pay directly using your CIMB OCTO App in these countries, whereby the transaction amount is converted to Malaysia Ringgit according to CIMB conversion rates and is automatically deducted from your CIMB bank account balance.

With this, you no longer need to wait in long queues at money changers or carry large sums of foreign currencies when travelling to the said countries and come home with unused amounts.

Enhanced Security With Biometric Authentication

When it comes to digital banking, security has always been a top priority. Addressing this concern, the CIMB OCTO App has then introduced its users to cutting-edge biometric authentication capabilities, which allow transaction authorisations of up to RM500 using your Fingerprint, Touch ID, or Face ID.

But if your smartphone doesn’t support biometric authentication, don’t worry – you can still activate your 6-digit passcode as a means of transaction authorisation, making it just as secure and convenient.

One-Tap Approval For All Online Debit & Credit Card Transactions

To further enhance your convenience while maintaining the robust security standard, the CIMB OCTO App incorporates the SecureTAC feature to protect your online debit and credit card transactions with enhanced encryption.

All you need to do is tap the “SecureTAC” button on your app menu or tap the SecureTAC push notification you received from your CIMB OCTO App and press “Approve” to approve the transaction. That way, you don’t have to wait for SMS to send you a 6-digit OTP number and this also works while you’re abroad too!

***

The CIMB OCTO App is more than just a banking tool – it’s a comprehensive app that transforms your banking experience through its customisable and user-centric features, making it more personalised and convenient for you.

So, if you’re ready to seek a more personalised, simpler, yet secure banking experience, download the CIMB OCTO App today and embark on a personalised banking journey from here on out.

Comments (4)

Sya mohon pinjaman

Anda boleh ke laman web kami dan semak pinjaman peribadi yang bersesuaian dengan anda. Atau, anda boleh emel kami untuk bantuan selanjutnya.

Pls help pinjam bagi duit

You may visit RinggitPlus website and find the most suitable loan for you.