RinggitPlus

18th September 2020 - 4 min read

Oh, credit score.

There’s no escape from discussing your credit score, especially when applying for credit lines, be it a credit card or personal loan. However, according to the RinggitPlus Malaysian Financial Literacy Survey 2019, 67% of Malaysians don’t think about their credit score. For some, this is a dreaded conversation, while for others they might not quite get what the phrase “credit health” means. Meanwhile, 32% of Malaysians think it’s an essential part of planning for the future.

Understanding Your Credit Score

A credit score is a number that denotes how creditworthy an individual is. Simply put, it informs banks of how likely you are to pay back the credit received and whether it will be paid in a timely manner.

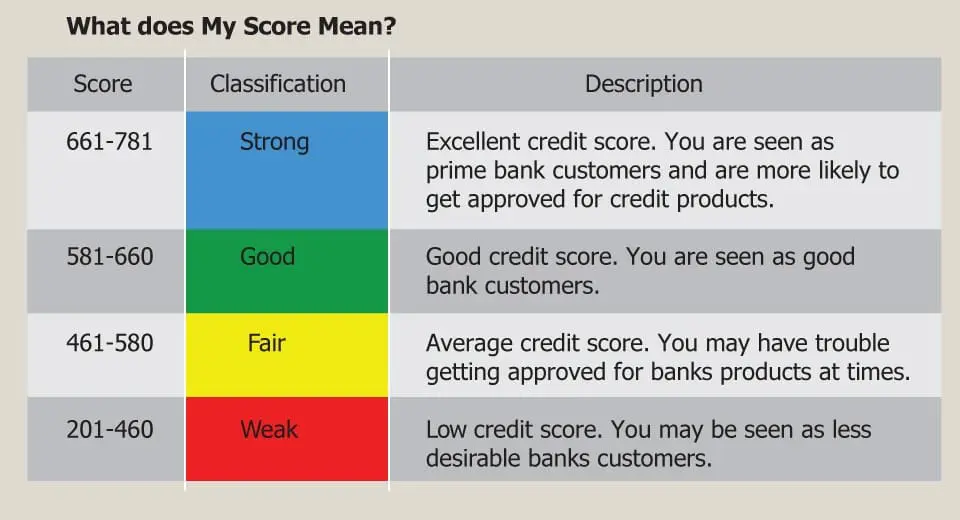

Meanwhile, your credit health refers to how good (or bad) your credit score is. A good credit score, which ranges between 781-581 indicates good credit health, while anything below that means that your credit health needs some care.

But how exactly is your credit score calculated?

Your credit score is calculated based on information collected about your credit history. This information is ethically obtained by credit reporting agencies such as Experian, who document credit information with your consent. The personal data collected can only be disclosed to third parties with your consent.

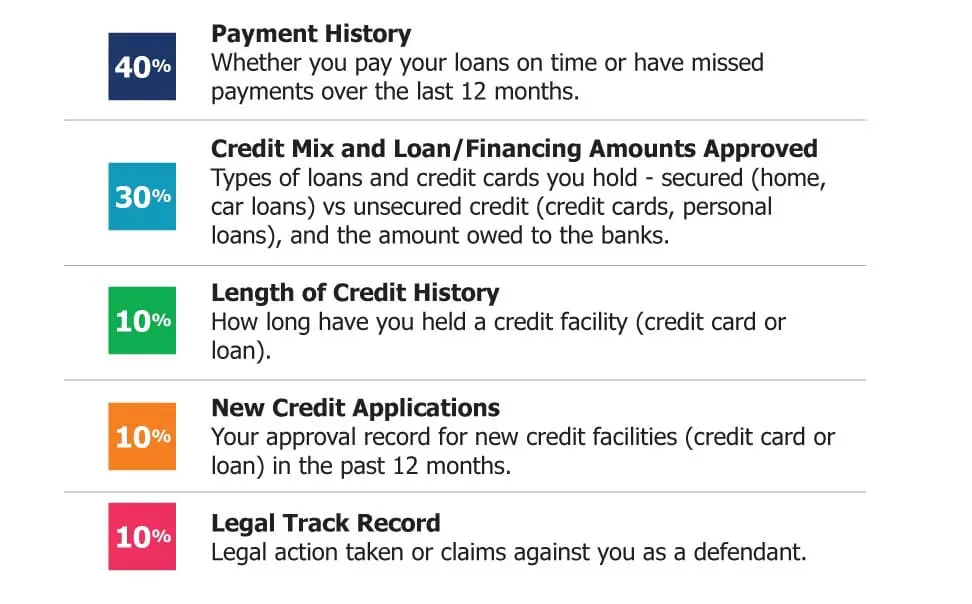

These credit reporting agencies then process your credit information and assign a point system based on the following factors to give you your credit score.

Benefits of a Healthy Credit Score

The benefits of a healthy credit score are numerous and widespread. Firstly, a good credit score tells banks and other financial institutions that you’re a “good risk” when it comes to managing credit facilities. These institutions will be more likely to process your credit applications quickly and with a higher chance of approval.

For example, if your credit card applications keep getting rejected, chances are that your low credit score is the cause. Alternatively, if you’re looking to buy a house and received a good interest rate on your loan, having a healthy credit score most likely boosted your approval chances.

A good credit score also gives you more negotiating power when it comes to asking for an increase in your credit line or negotiating for lower interest rates on loans.

It’s not difficult to achieve a good credit score but there are a few basic steps to achieving and maintaining good credit health. These include paying your bills in a timely manner, not maxing out your credit card, and not applying for too many credit facilities at one go. The beauty of a credit score is that it can be changed and if you’re not happy with your current credit score, you can aim for a better credit score by changing a few behaviours.

Here’s how you can improve your credit score: 6 common mistakes that lead to a low credit score and how to avoid them.

Credit Health and Planning for the Future, Financially

Now that you know how your credit score is calculated and the benefits of a healthy credit score, you can start to see why it’s important to your future plans. Knowing your credit score gives you a better understanding of your current debts, payment behaviour, and an indicator of how banks see you as a prospective borrower. This allows you to make early decisions – and changes if needed – to secure loans, credit cards, and other credit facilities in your financial future. After all, if you don’t know where you stand now financially, how can you set a goal for the future?

Fortunately, you don’t have to gather your financial information and calculate your credit score by yourself. Credit reporting agencies, such as Experian, offer a variety of credit reporting tools for individuals and businesses.

What’s more, in conjunction with Experian’s Credit Health Month, they’re offering 50% off all their products and services. Find out your credit score report with Experian’s ranging of credit reporting tools at a fraction of the price.

Comments (0)