Pang Tun Yau

7th November 2018 - 7 min read

As it turns out, Budget 2019 was not as austere and “sacrificial” as it was made out to be. The allocated amount is actually higher than last year’s Budget, and with plenty of new measures in place that will benefit the rakyat, especially those who need them.

With most of the incentives being targeted towards specific groups of the population, let’s take a look at what Malaysians can do to take advantage of the new benefits.

1. Get life insurance.

Beginning 2019, there will be a new tax relief structure for EPF and life insurance. Where it was previously combined with a total relief of up to RM6,000 a year, the new structure will split it into RM4,000 for EPF, and RM3,000 for life insurance. Based on our calculations, individuals earning more than a gross income of RM3,030 monthly and don’t currently have life insurance coverage, will see their EPF tax relief reduced.

What this means is clear: if you earn more than RM3,000 a month and are not currently covered any by life insurance policies, get one. The split in tax relief means those who are covered by life insurance policies can claim up to RM1,000 more than in previous years – this additional amount means you can increase the amount of coverage for your insurance plan if life takes a turn for the worse.

2. Pay off your remaining PTPTN loan before the end of 2018.

That’s right. Not only is it an obligation to pay what you owe, but the discounts for paying off your PTPTN loans will be removed from 1 January 2019. With some RM2.74 billion still owed by 373,975 borrowers, it’s clear that many are still not repaying their PTPTN loans.

Starting 2019, the Government will remove the three PTPTN discounts:

- 20% discount for those who repay their outstanding balance in full.

- 10% discount for those who repay at least 50% of their remaining debt in a single payment.

- 10% discount for those who set up scheduled salary deductions or direct debit.

These incentives will end on 31 December 2018, after which the PTPTN will put in place automatic salary deductions ranging from 2% to 15% from those who earn a minimum of RM1,000 a month.

Therefore, do yourself (and the country) a favour by paying off your PTPTN loan by the end of this year – and save thousands of Ringgit in the process.

3. Consider buying your first home in H1 2019.

In an effort to encourage home ownership, the Government has introduced a number of measures to get Malaysians to buy their first home. At the same time, it also looks like the Government is discouraging investors in buying homes to sell in the future.

First-time home buyers can look forward to the National Home Ownership Campaign, where unsold residential properties priced between RM300,001 and RM1 million will have their stamp duty charges waived by the Government, and the developers will offer a minimum price discount of 10%. This campaign kicks off on 1 January 2019 and will end on 30 June 2019.

For new projects, the SST waiver for construction and building materials will see developers offer a 10% discount off residential properties that are not price controlled. Meanwhile, the Government will waive stamp duty up to RM300,000 on sale and purchase agreements (SPA) as well as loan agreements until December 2020 for first-time home owners purchasing residential properties priced up to RM500,000.

Finally, the Government is also introducing a new RM1 billion home loan fund to help the lower-income group who earn less than RM2,300 a month to buy their first home priced up to RM150,000. This fund will be available starting 1 January 2019 from participating financial institutions (AmBank, BSN, CIMB Bank, Maybank, RHB Bank), offering a concessionary rate from as low as 3.5% per annum.

4. Take advantage of the increased tax relief for SSPN.

The National Education Savings Scheme (Skim Simpanan Pendidikan Nasional or SSPN) offers two savings funds for children’s future education. The savings plans not only offer high dividend rates (in 2017 the dividend yield was 4%), but there are also additional benefits such as income tax relief, PTPTN loan eligibility, Syariah-compliant savings that are guaranteed by the Government, and even Takaful protection for the children.

From 2019, the Government has increased the tax relief amount for SSPN deposits by parents from RM6,000 to RM8,000 a year. This is an additional RM2,000 that you can get back from the Government to offset your annual income tax from previous years, making it an extremely lucrative savings plan (provided your annual income tax is high enough to claim the full amount!) Hence, if you would rather not buy life insurance (since it would cost money) but would still want to recover the RM2,000 loss in EPF tax relief, depositing RM8,000 on SSPN would be an alternative.

5. Consider investing in an energy-efficient vehicle, or go all-in on public transportation.

With the targeted fuel subsidy coming into play from 2019, it looks like the affordable prices for petrol and diesel that Malaysians have been enjoying may come to an end for a large majority of the rakyat. The scheme will kick off in the second quarter of 2019, but Finance Minister Lim Guan Eng has said that the Government will need time to iron out the mechanism. The proposed subsidy is a minimum of 30 sen per liter for cars with engine capacity of 1,500cc and below, and motorcycles with engine capacity of 125cc andbelow. The subsidy will have a monthly cap of 100 liters for cars and 40 liters for motorcycles, and will not apply for owners with multiple vehicles.

When this is implemented, petrol prices will fluctuate every week based on the Automatic Price Mechanism (APM), which is determined by the global fuel prices. Therefore, regardless of whether you qualify for the subsidy or not, Malaysians are likely to be paying more for petrol come Q2 next year. Perhaps it may make sense to invest in an energy-efficient vehicle with high fuel efficiency?

This does not mean you should get a hybrid or even an electric vehicle, of course. Any vehicle that meets the specifications set by the Malaysian Automotive Institute can be classified as an energy-efficient vehicle. This includes models like the Perodua Myvi, Toyota Vios, Proton Ertiga, and of course, hybrid vehicles such as the Honda City Hybrid – these all not only are fuel efficient, but their engine capacities also qualify them for the fuel subsidy.

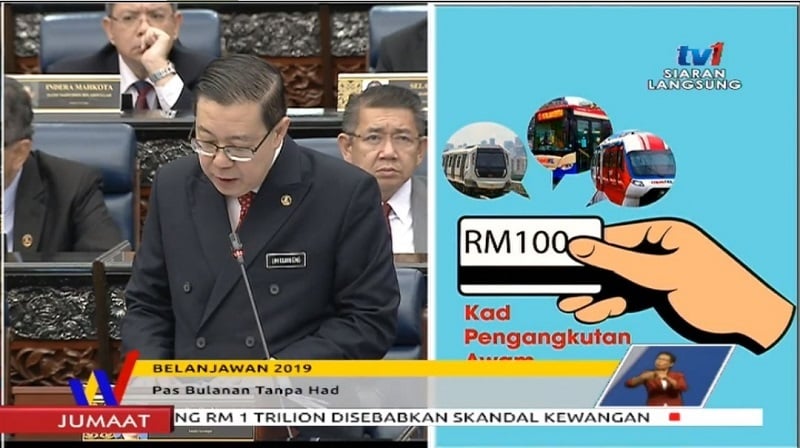

In the meantime, the Government has also announced that there will be new public transportation passes in the Klang Valley. At RM100 (bus and rail) and RM50 (bus only), these monthly passes are exceptionally affordable. With the new MRT and expanded LRT lines covering the greater Kuala Lumpur area, those working in the Klang Valley should seriously consider switching to public transportation and remove a huge chunk off their monthly expenditure.

Take charge of your finances

Budget 2019 may not be the austere budget the Government had previously hinted, but it sure looks like one where Malaysians need to be more prudent with their money. Other new measures such as the increased gambling-related duty charges, the new departure levy, and even the “soda tax” means Malaysians will be taxed on “non-essential” expenses.

Therefore, it literally pays for Malaysians to take charge of our finances and take a look at how Budget 2019’s new policies and incentives will affect us. Making changes today may save ourselves hundreds to even thousands of Ringgit.

Comments (0)