Alex Cheong Pui Yin

21st February 2023 - 2 min read

The public has been urged by Bank Negara Malaysia (BNM) to carefully study the terms and conditions of Shopee’s latest offering, SLoan, before deciding to tap into it. This comes following the recent rollout of the facility just last week.

“SLoan is a personal financing product offered by SeaMoney Capital Malaysia Sdn Bhd, which is licensed by the Local Government Development Ministry under the Moneylenders Act 1951,” the central bank shared, adding that individuals must make informed decisions if they are considering committing to financing products.

The bank also noted that members of the public can contact BNMTELELINK if they have enquiries or feedback regarding the service.

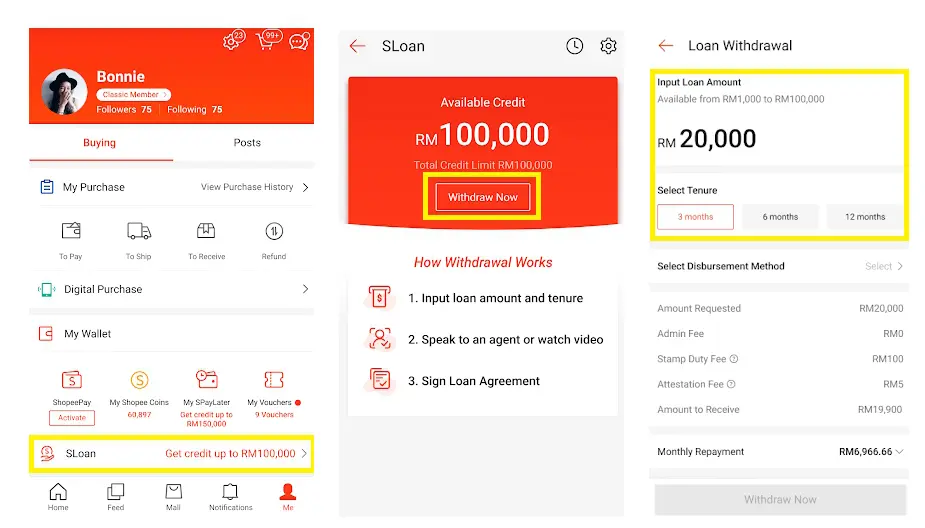

For context, Shopee’s SLoan is provided for both consumers and sellers, allowing them to obtain loans of up to either RM100,000 or RM120,000 within 24 hours, respectively. The interest rate charged for the facility, meanwhile, stands at 18% p.a., with a flexible repayment tenure of either three, six, or twelve months.

For buyers, Sloan is intended as a solution that gives them “more financial flexibility to meet their needs”, whereas for sellers, the loan is intended as a working capital loan service to help facilitate business growth.

(Sources: The Edge Markets, BusinessToday)

Comments (1)

you can get much cheaper interest rate personal loan from bank than from SLoan at whooping 18%