Alex Cheong Pui Yin

26th June 2020 - 2 min read

Just over a week after Facebook-owned WhatsApp launched its new in-app payments service in Brazil, the feature has been suspended by the country’s central bank.

According to Brazil’s financial regulator, this decision was made to maintain an adequate competitive environment in the payments system market, ensuring the availability of a payment system that’s interchangeable, fast, secure, transparent, open, and cheap. Additionally, the central bank will take this opportunity to evaluate potential risks to Brazil’s payment infrastructure and to assess WhatsApp’s compliance with its regulations.

In line with this decision, Visa and Mastercard – both of which supported WhatsApp’s payments service – were also directed to cease offering payments and transfers through WhatsApp’s service. Non-compliance will see them subjected to fines and administrative penalties.

In response to this suspension, a WhatsApp spokesperson said that the company’s goal is to provide digital payments to its users in Brazil using an open model. As such, it will continue to work with local partners and the central bank to make this possible.

“In addition, we support the Central Bank’s PIX project on digital payments and together with our partners are committed to work with the Central Bank to integrate our systems when PIX becomes available,” added the spokesperson. The PIX project is in reference to the central bank’s own payments service, which is slated to be launched in November 2020.

(Image: The NEWS Minute)

This suspension in WhatsApp’s second biggest market is the latest obstacle for Facebook’s fintech ambition. The tech giant had been testing a closed beta version of the service in its biggest market, India, since 2018, but was met with various regulatory setbacks. Facebook had also tested its payment service in Mexico.

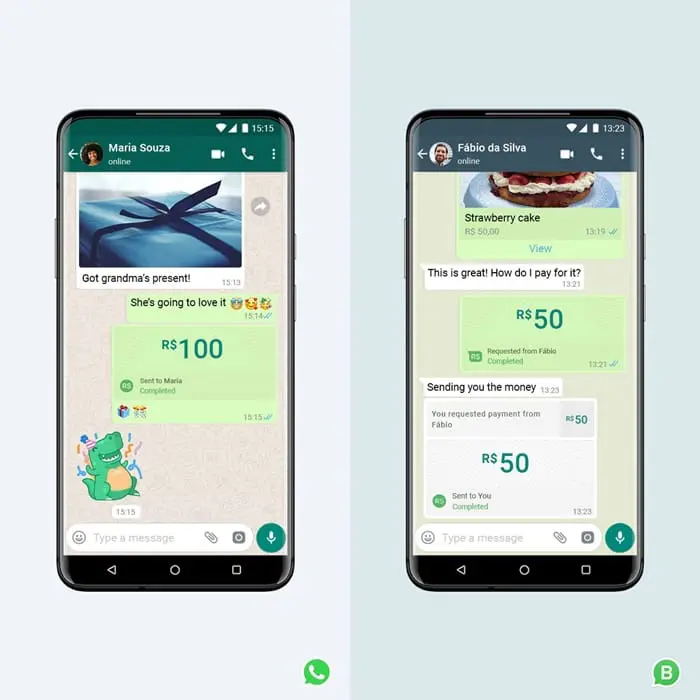

If allowed to proceed, WhatsApp’s free payments service would have enabled users to transfer money or pay for purchases from small businesses via the platform itself, offering more convenience. It would also support debit and credit cards from several Brazilian banks, including Banco do Brasil, Nubank, and Sicredi.

(Source: Bloomberg, TechCrunch)

Comments (0)